European airline winners and losers from the pandemic

How has COVID impacted the European competitive landscape?

When the pandemic hit the airline industry in early 2020, analysts were quick to form opinions on the likely “winners and losers”. Of course, there were never likely to be any absolute winners and the share prices of every airline plummeted as fleets were grounded and revenue disappeared. But the early share price falls for the big quoted European airlines varied quite a bit. In the chart below, I’ve shown the share price falls between the end of 2019 and the start of April 2020, with the low-cost airlines in red and the network airline groups in blue.

Source: OAG, GridPoint analysis

Part of the difference can be understood by looking at debt levels. All other things being equal, a company with higher debt levels will see a bigger percentage drop in its value for the same impact on operating profits and cashflows, the “leverage effect”. That is one of the reasons why the low-cost carriers were less impacted. Another factor which helped them was the widely shared view that domestic and short-haul traffic would be quicker to come back than long-haul. Finally, the highly outsourced business models of the low-cost carriers meant a higher percentage of their costs were variable with activity - a real benefit in containing losses in a reduced demand environment.

So it is not a surprise that the smallest valuation hits were seen at low-cost carriers Ryanair and Wizz. Harder to explain was why AF-KLM and Lufthansa Group’s share prices weren’t worse hit. Relatively higher exposure to the booming Cargo market might be part of the answer, but probably the real explanation is that investors assumed they would benefit disproportionately from government assistance.

The final puzzle is why easyJet was impacted so much more than its low-cost rivals. The main answer I think was unit costs. As I showed in this article, the pre-pandemic unit costs of easyJet were about 50% higher than at the other two carriers. Both Ryanair and Wizz were quick to say that they saw the pandemic as a great opportunity to grab market share from higher cost and financially weaker carriers and to argue that the lowest cost airlines would be structural winners in the new environment. Based on the share price reaction, it is clear that in April 2020, investors believed them.

How has this early verdict stood up to the test of time? Although the industry is not yet fully “out the other side” of the pandemic, overall traffic levels in Europe are getting back close to 2019 levels and the fog is beginning to clear and give us a better view on what long-lasting impact the pandemic has had on the competitive environment in Europe.

Market share gains by Ryanair and Wizz

In the following chart, I’ve plotted the intra-European seat capacity figures for Europe’s biggest airlines in Summer 2022 compared to the equivalent period in 2019. Carriers which are above the diagonal line are flying more capacity than they did in S19, whilst those that are below the line have reduced. Seats flown is not the same thing as passengers carried, but generally speaking the two metrics should follow each other closely.

Source: OAG, GridPoint analysis

The most striking thing about this chart is the sheer scale of Ryanair and how significantly it has extended its lead over the other carriers since 2019. It is now almost twice the size of number two player, easyJet. In percentage terms though, Wizz has done even more, with seat capacity up 35%, compared to “only” 18% at Ryanair.

The biggest share losses amongst the big carriers come from Norwegian, Alitalia/ITA and SAS. The first two have emerged from their bankruptcy processes as much smaller competitors. SAS avoided bankruptcy thanks to government assistance, but has downsized and continues to struggle due to uncompetitive unit costs.

Looking at overall statistics is interesting, but market share gains are made at a route, city and country level and drilling down is quite informative. There are some interesting stories, such as easyJet pulling back from the German market and exiting domestic flying completely. But unsurprisingly, the most dramatic changes have been triggered by the collapse of Alitalia.

Bloodbath in Italy

The next chart shows the seat capacity for intra-European flights which touch Italy and how it has changed since before the crisis (note: I’ve fixed a flight double-counting error I made in the original version of this post, which affected this chart and the related seat count figures - no change in message, but I like to get things right!). Ryanair has added 54,000 weekly seats to the market, a 39% increase from a carrier that was already the biggest player. That is more than enough to replace the lost capacity from Alitalia / ITA and the demise of three other now defunct Italian short-haul operators. Also striking is that the company only added just over 90,000 weekly seats to the intra European market in total. Italy is by far Ryanair’s biggest bet.

But Ryanair is not the only carrier trying to jump into the vacuum left by Alitalia and the other failed Italian carriers. Wizz has added 35,000 weekly seats to the Italian market, almost tripling their capacity. Like Ryanair, this is a big proportion of the 50,000 weekly seats they added in total. Barcelona based low-cost airline Volotea also fancies its chances and has increased capacity by 27%. And last but not least there is ITA, which is attempting to rebuild an Italian national carrier from the wreckage of Alitalia, with Lufthansa and partner MSC strongly tipped to become shareholders in the government-owned company. If they do go ahead with taking a stake, the word “brave” springs to mind.

After Ryanair and Alitalia, the third largest short-haul player in Italy before the crisis was easyJet. They are restoring their pre-pandemic capacity, but obviously lack the stomach to fight for an increased share of a market where Ryanair and Wizz are slugging it out and the Italian government is still trying to hang onto a national airline.

Source: OAG, GridPoint analysis

What about the network airline groups?

Amongst the network airlines, the only carrier which has increased intra-European capacity compared to 2019 is Turkish Airlines. It is fully state owned and, like many airlines, required government assistance to survive the crisis. Most European recipients of State Aid needed clearance from the European Commission and that generally came with strings attached, one of which was a requirement to shrink capacity in order to mitigate the distortion of competition. However, Turkey isn’t in the EU and so Turkish Airlines didn’t need Commission approval and didn’t face any restrictions on its capacity. The company has taken full advantage and the market share gains it has made as a consequence will I am sure be a source of frustration for the other carriers.

It is interesting to look at the competitive situation for intra-European flying, aggregating up the various airline brands into their ownership groups. Back in 2019, Lufthansa Group was the largest player in that market, measured by seat capacity. Looking only at the summer, the more seasonal Ryanair was already number one, as you can see from the following chart. That lead has been significantly extended in Summer 2022, with Ryanair increasing by 18% and Lufthansa Group shrinking by 13%. Further down the rankings, easyJet is closing in on IAG for the number three position.

Source: OAG, GridPoint analysis

The battle of the hubs

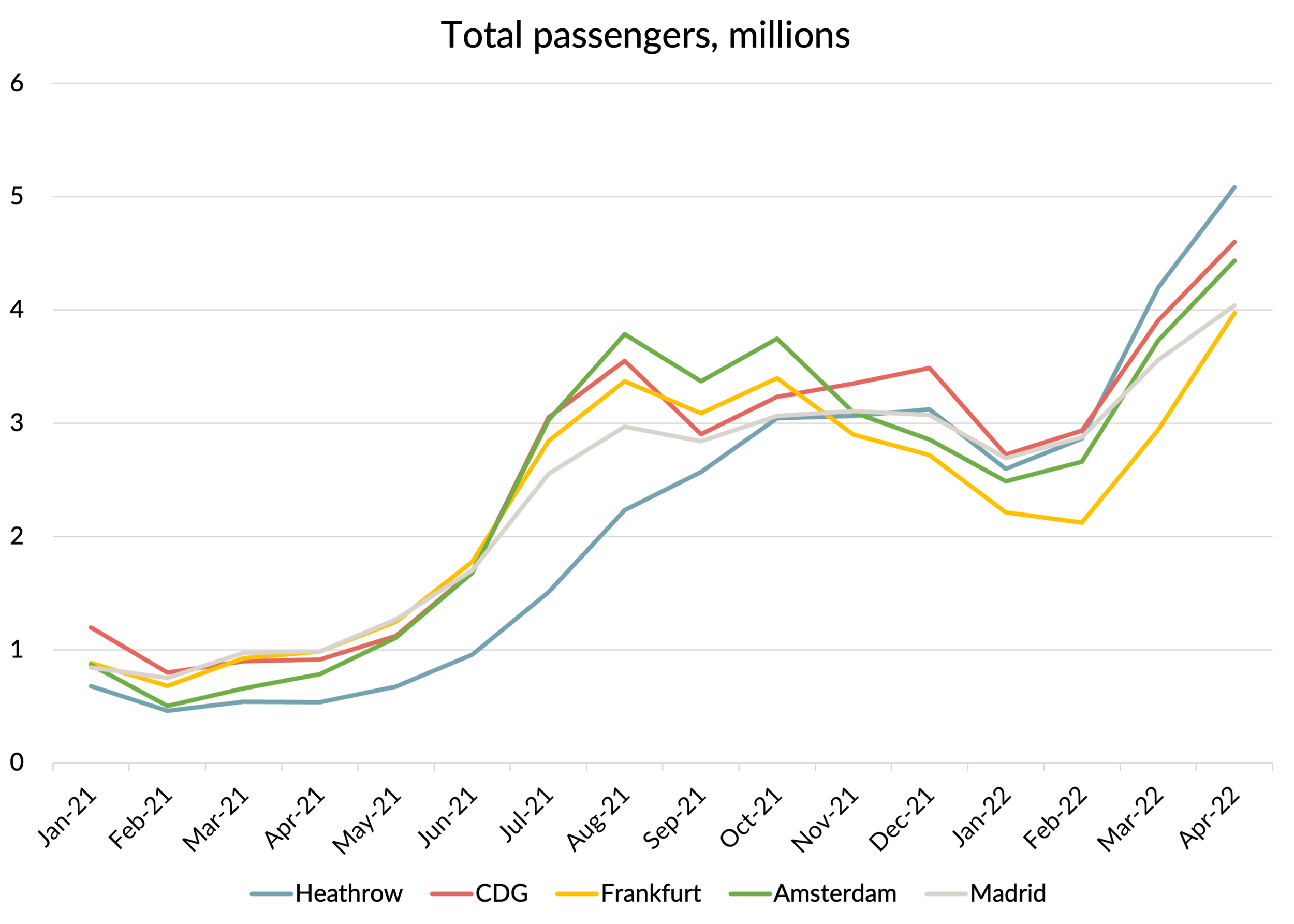

When the pandemic hit, some commentators were quick to predict that it would kill off the hubs. The argument was that passengers would be unwilling to make connections at busy hub airports due to health concerns. I never subscribed to that theory and we now have good evidence that traffic is recovering well at Europe’s biggest hubs. The following chart shows the passenger numbers at Europe’s five biggest hub airports, as a percentage of 2019 levels. The biggest challenge to the recovery at these airports is not demand at this point - it is a shortage of staff due to the strength of the recovery and long lead times to recruit and obtain security clearance for staff.

Source: Company reports, GridPoint analysis

For much of the pandemic, Heathrow’s recovery lagged significantly behind the other hubs due to more onerous travel restrictions in the UK. But this share loss doesn’t seem to represent a lasting structural shift. Now that restrictions have been removed, Heathrow has recovered its pre-pandemic position as Europe’s largest hub by passenger numbers and in April was closer to recovering its pre-pandemic traffic level than any of the major hubs except Madrid.

Investor returns since 2019

With the benefit of another two years to observe and evaluate the consequences of the pandemic, who do investors now believe are the winners and the losers? I’ve created a new version of the share price chart I shared at the start of this post, but brought things up to date on the basis of the latest share prices.

First a word about the numbers. All three of the network airline groups made discounted rights issues during the period, as did easyJet (Ryanair did raise a small amount of equity capital, but it wasn’t issued at much of a discount and was so small that I’ve ignored it). Those rights issues reduced their headline share prices significantly, but had less of an impact for shareholders who subscribed fully to the rights issue or sold their rights. So I’ve done a simple adjustment of the share prices to allow for that, making the assumption that most investors took up their rights. This gives me the following chart for the reduction in value experienced by shareholders since COVID hit.

Share prices adjusted for rights issues.

Source: Yahoo Finance, GridPoint analysis

You can see Ryanair shareholders have seen a tiny increase in the value of their shares. That doesn’t sound great, but it represents a big recovery from the 40% drop that was seen early on and is vastly superior to the other carriers. WIzz has also seen something of a recovery from its early losses, but nothing like as strong as Ryanair.

At the other end of the chart, IAG continues to show the biggest shareholder value destruction and is virtually unchanged from early on. Investors were initially less pessimistic about Air France-KLM, but the value destruction is now almost as bad as IAG. Lufthansa Group is still showing as the best of the network carriers. Clearly there is a lot more driving overall investor returns for the network carriers than just the short-haul growth story. Long-haul is a big part of their business. But there is not a lot to choose between the three big network airline groups when it comes to long-haul capacity and traffic recovery at this point. They are all bringing back capacity in Summer 2022 at similar levels compared to 2019. The divergent performance has been more driven by different amounts of help from governments and how badly impacted they were by travel restrictions during the crisis. That took a big toll on their balance sheets. I looked in more detail at how those factors had played out in this post from November if you are interested, as I don’t have the space to go back over what is quite a complicated story.

Investor scepticism about easyJet has continued. It has recovered some of the early value loss, but is still by far the worst of the low-cost companies when it comes to value destruction. With a much less aggressive approach to growth, perhaps it will be able to demonstrate superior unit revenue recovery to Ryanair and WIzz during the next few months. At the moment though, investors continue to double down on the belief that “lowest cost wins” and to reward the carriers that they believe fit that description.

Where next?

So far, the “winners” in the pandemic have been those that have done the best job of containing losses, limiting the balance sheet damage and presenting the most credible story about future growth as the industry comes out of the pandemic. There are three more phases to go through I think before we will know for sure who emerges as winners.

First there is the operational story, who can successfully get their operations back to full capacity without falling over? Several airlines and airports are currently failing that challenge badly. Second, there is the revenue side of the equation, something that has been largely absent as a performance differentiator during the pandemic. Which carriers will do the best job of rebuilding unit revenues? It is clear that unit revenues need to be higher than pre-crisis levels given cost inflation and high fuel prices. Finally, another big test will be the ability of companies to contain upward pressure on labour costs, as labour shortages and returning revenues trigger demands for increased wages.

In any case, it is clear that there are plenty more challenges ahead for Europe’s airline management teams, despite recent positive news on booming demand.