Heathrow passenger numbers rebound in April

Highest passenger numbers for more than two years

Heathrow airport reported its April passenger number figure yesterday, which reached 5.1m. That’s the highest monthly figure since February 2020, which was the last month unaffected by COVID.

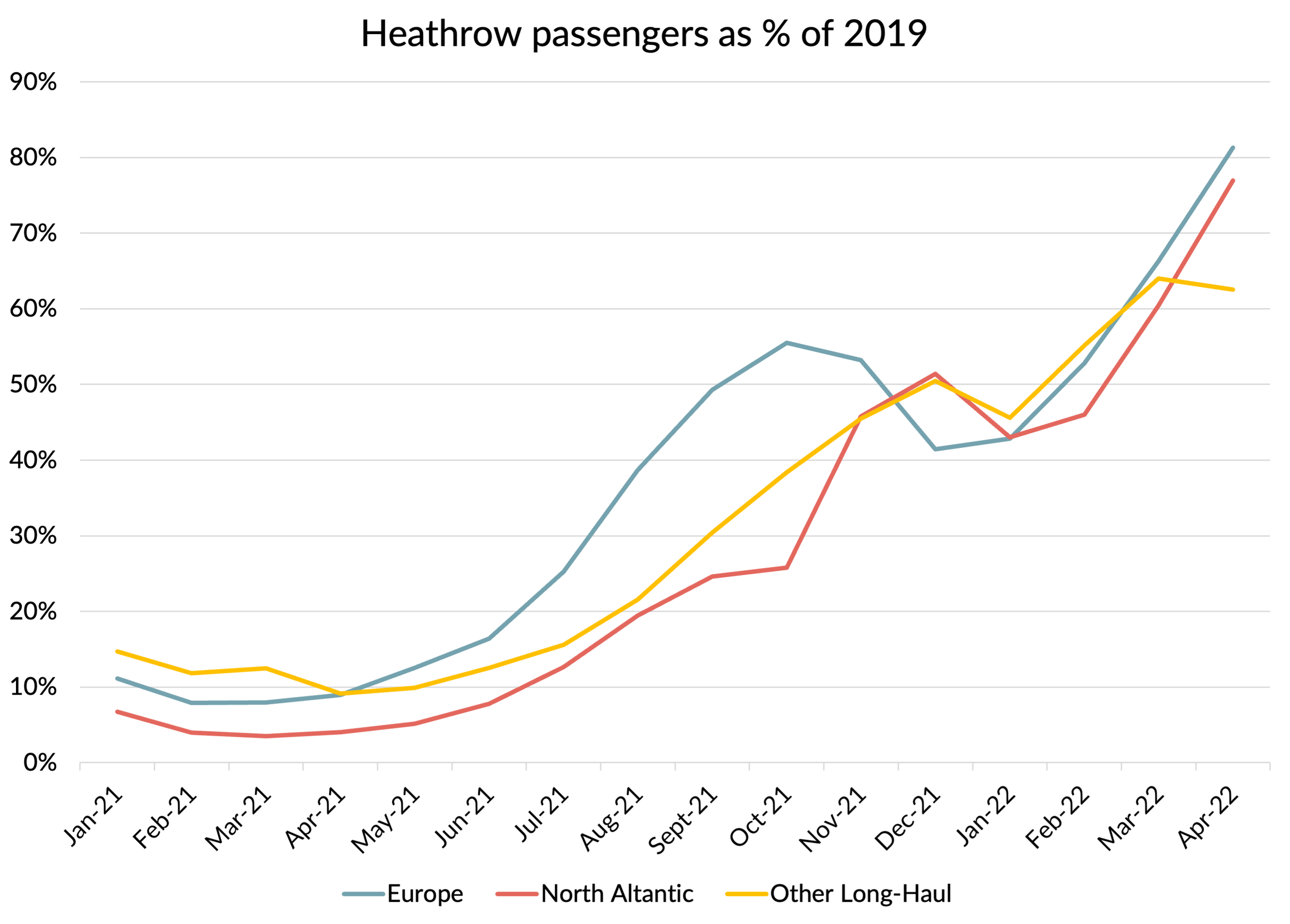

Passenger volumes were still down 25% on April 2019, but the recent trend has been improving fast since travel restrictions and testing requirements in the UK were relaxed. European traffic hit 81% of 2019 levels and North Atlantic volumes were almost as strong at 77%. The total was only dragged down by continued travel restrictions to Asia. That region, included in “other long-haul” in the chart below, managed only 37% of 2019 levels.

Gaming the regulatory system

The strong performance prompted the airport to update its “official forecast” for 2022 passenger numbers from 45.5 million to 52.8 million. The airport is trying to convince its regulator, the CAA, to allow it to increase the amount it can recover per passenger from airlines and passengers. This regulatory game gives it a massive incentive to low-ball the passenger number forecast, since allowed expenses get divided by forecast passenger numbers to determine the price cap.

How plausible are Heathrow’s latest forecasts? Let’s start by looking back at what I said in mid December, when I made some forecasts for the year ahead.

How well did I do on my forecasts?

When I did my last set of forecasts, we had just seen the UK reimposing travel restrictions due to the arrival of Omicron. Airlines had not yet adjusted their published capacity, so I made an allowance for that, as well as for the likely impact on demand. However, I was also pretty sure the restrictions would be short-lived and that travel would bounce back.

Here is the main chart from that post, showing my best guess for capacity and passenger numbers, expressed as a percentage of 2019 volumes for the same month.

I’ve produced a new version of the chart, showing how capacity and passenger numbers turned out for December to April, plus my current view for the remainder of 2022.

You can see that I underestimated how much Omicron would hit demand and capacity in the short-term. Capacity was about 10% lower in January and February and passenger numbers 17% lower in January. However, I was correct that passenger volumes would bounce back rapidly. February passenger volumes were just 6% below my forecast and March was marginally better. My April figure was 0.07% too optimistic. Clearly, that level of accuracy involves a significant dose of luck, but it is gratifying nonetheless.

It is worth noting that my April passenger number forecast was achieved despite reduced capacity due to well-publicised operational issues at Heathrow and also the war in Ukraine, something that nobody expected at the end of 2021.

Revised forecasts

For my new forecasts, I’ve not adjusted the published capacity. There have been some cancellations driven by manpower shortages, but I think they are pretty much all reflected in the published schedules now. You can see that those are about 5% lower than what was being published back in December.

We have had many reports of airlines seeing record booking volumes in recent weeks, with everyone seeing passenger volumes in line with and in many instances ahead of 2019. With capacity still constrained by resourcing issues, it seems likely that load factors will get back to 2019 levels very quickly now, even with big price increases being implemented by airlines as they pass on high fuel prices. So my passenger forecast sees passenger numbers as a percentage of 2019 beginning to run ahead of capacity by the end of the summer and hitting 100% of pre-pandemic levels by October.

If that performance is achieved and sustained into the last two months of the year, my calculations would see Heathrow passenger numbers hitting 64.4m for 2022 as a whole. That’s 22% above Heathrow’s forecast.

Of course, it is possible that I’m being over-optimistic. Operational challenges may be worse than expected. There could be Ukraine-driven negatives beyond what we’ve seen so far, or another COVID related set of issues. The “cost of living crisis” and high energy costs will hit incomes and even trigger a recession in the UK, impacting volumes.

But getting to Heathrow’s 52.8m number would require passengers to be 27% below my forecast for May to December.

Heathrow’s strategy

The airport argues that there is still massive uncertainty and they want to put in place a “risk sharing mechanism”. If the mechanism was genuinely symmetrical, maybe that would make sense. But they have demonstrated by their behaviour with the passenger forecast that what they have in mind is that the airlines should take the all the risk, whilst they are prepared to share some of the reward if volumes exceed a worst case scenario.

Not much chance of peace breaking out between the airlines and the airport, I suspect.