Heathrow: taking stock after the pandemic

The fog begins to clear

Whilst President Biden’s recent declaration that the pandemic is over in the USA might be felt by some to be premature, most would agree that travel is largely “back to normal”, at least outside Asia and leaving aside the direct impacts of the war in Ukraine. In any event, I think the fog has cleared sufficiently to be able to attempt an assessment of how the pandemic has changed the aviation industry and the position of the various industry players. These are big questions and it won’t be possible to tackle them in a single article. But we need to begin somewhere and I have decided to make a start by looking at Heathrow airport.

Before the crisis, it was the biggest airport in Europe in terms of passenger numbers with 80.9m passengers, 6% bigger than the second largest, Paris CDG.

Source: Company reports, GridPoint analysis

The finances of the airport and of its main base operator British Airways were in robust health. The airport recorded pre-tax profits of £546m in 2019 and British Airways made over £2 billion, before exceptional pension-related charges. The airport was working well for customers too, with 82% of the passengers passing through the airport in 2019 rating it as as “Excellent” or “Very Good”.

The main issues facing the airport and the airlines that used it were expansion and future airport charges, which of course are closely linked questions. Although Heathrow might still have been hanging on to the number one spot in Europe, CDG was catching up inexorably, growing at almost twice the rate over the previous five years. With four runways compared to Heathrow’s two, flight frequencies at peak times were less constrained and it had more headroom for growth.

Source: Company reports, GridPoint analysis

What has changed?

How do things look two and a half years later? Has Heathrow emerged in a stronger or a weaker position versus other European airports? Has the pandemic and the ever-growing focus on sustainability changed the outlook for expansion? And as Heathrow’s regulator, the CAA, finally gets back to the task of setting future airport charges after three years of kicking the can down the road, will they be going up or down?

Let us start with the first of these questions. Heathrow’s market position post pandemic.

Back to number one

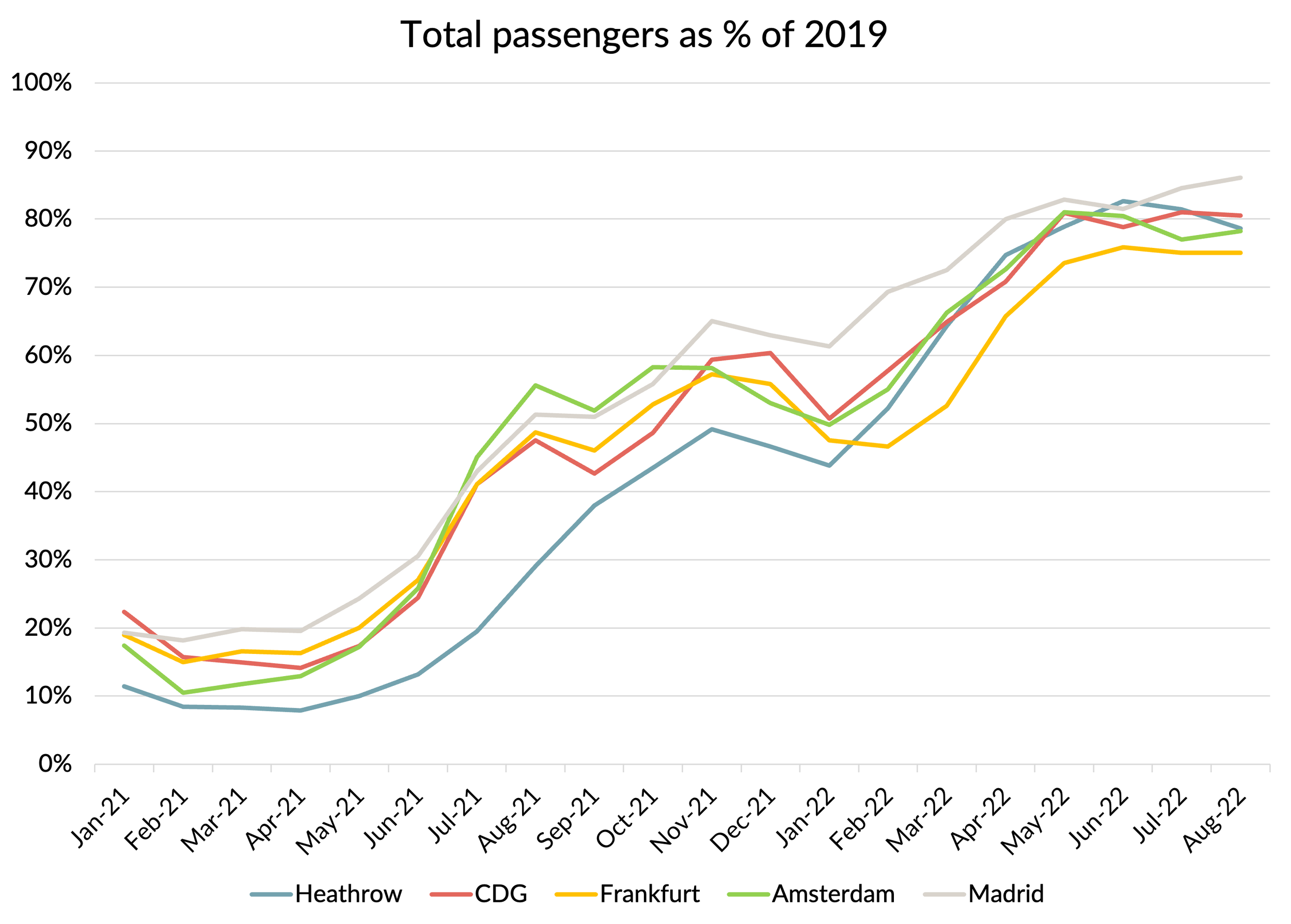

Heathrow’s recovery lagged behind the other European airports in 2021 and early 2022, but by March 2022 it had recovered its number one position, thanks to the UK government finally relaxing its travel restrictions and onerous testing requirements. The recovery stalled somewhat in mid July, after the airport was forced to impose a cap on passenger numbers, driven by ground handling resource constraints. Other European airports also had issues ramping up activity after two years of depressed volumes, notably Schiphol in Amsterdam. However, the passenger numbers for August suggest that Heathrow was more impacted. It almost lost the number one position again, with CDG coming within 0.3% in the month. Heathrow’s management estimated that passenger numbers would have been about 10% higher, without the cap. That’s about the margin that Heathrow had over CDG back in June. Heathrow has recently announced that the cap on passengers will be lifted from the start of the winter season in November. Assuming that issues don’t reemerge over Christmas or in peak periods next year, it looks like the volume downturn caused by the pandemic has helped Heathrow’s relative market position a bit, as you might expect.

Source: Company reports, GridPoint analysis

However, the most striking thing is how little the relative positions of the main European hub airports have changed. The next chart shows passenger numbers compared to 2019. Madrid has improved its position somewhat and Frankfurt is lagging, probably due to its higher dependency on Asia and Russian traffic.

I should explain that I’m not including Istanbul as a European hub. If I did, it would be a contender for the number one spot and it has already restored its pre-pandemic capacity. The city itself is famously in both Europe and Asia, although the airport is on the European side. But I’ve decided to leave it out in this comparison because, given its geographical position, the competitive overlap with Heathrow is relatively low.

Source: Company reports, GridPoint analysis

As well as competing with other European hubs for long-haul traffic, Heathrow also competes with other South Eastern airports for local traffic. The airport benefited relative to Gatwick during the pandemic from airlines consolidating their much reduced schedules at Heathrow. However, its greater dependency on long-haul and business traffic worked in the opposite direction. Heathrow’s volume cap has also impacted recent performance. After trailing Heathrow all the way through the pandemic, Gatwick matched Heathrow in July for passengers versus 2019 and then overtook it in August. Stansted continues to be the best performer, largely thanks to Ryanair, whilst volumes at business-focused London City continue to lag the other airports.

Source: CAA, GridPoint analysis

The case for expanding Heathrow

The pandemic may have delayed the urgency of runway expansion, but at least as far as the airport’s owners are concerned, the case for expansion remains. How realistic is that view? Whether to build a third runway at Heathrow has been a subject of heated public debate for decades. Let me start with a short recap on the “recent” history.

The long and sad tale of Heathrow runway expansion

In 2006, the airport put forward a proposal for a “short” runway, with the backing of British Airways and other airlines and it gained the support of the then Labour government. At 2,000 metres, it would have been significantly shorter than Heathrow’s two existing runways (3,660m and 3,902m) and therefore only suitable for short-haul operations. But that would have been fine for most European flights. Luton airport’s single runway is 2,162 m and London City’s is only 1,508 m. Flights to Malaga operate just fine from London City. Over half of Heathrow’s existing flights are shorter distance than that. The advantage of such a short runway is that it could have been built on largely empty land north of the airport, with significantly lower impact on local communities and reduced cost compared to building a “full length” runway. To this day, I still believe this would have been the better option for expansion.

When the Labour government lost the election in 2010 to a coalition of the Conservative Party under David Cameron and the Liberal Party under Nick Clegg, the Heathrow expansion was immediately cancelled. One of David Cameron’s election campaign promises had been that he would cancel the third runway. I remember going to a private dinner hosted by one of Cameron’s chief campaign advisors in the run up to the election. The other attendees were all representatives of the “great and the good” of British Industry (I guess I was invited by mistake). We were told that “During this campaign, David is going to promise many things that you won’t agree with. Many things that you want him to say and promise to do, he has to stay silent on. But you have to trust us. He needs to focus on getting elected, but once that’s achieved, all these things can and will change.” Cameron’s man then turned to me and said “Except of course the third runway at Heathrow. That’s a campaign pledge he intends to stick to, because he made a personal commitment to the member for Richmond to secure his support in becoming leader of the Party.”

You can perhaps understand why I have become rather cynical about politicians over the years.

The issue of runway expansion in the South East hadn’t gone away of course. In response to repeated questions about what the government’s plan was now the third runway project had been cancelled, an “Airport Commission” was set up to review the options. Setting up a Commission is a classic delaying tactic for politicians. After more delay and money spent, in July 2015 the Commission once again concluded that Heathrow was the best option. However, by this time the airport had decided that if it was going to go through the cost and challenge of getting a third runway approved at all, it might as well go for a “proper” full length runway (3,500m). This was of course a bigger, more disruptive and higher cost option, in part because the runway would now need to be built over the M25, one of the busiest motorways in Europe. On the map below, I’ve shown the proposed location of this runway in yellow, together with the 2006 “short runway” location for comparison in red.

The government adopted this third runway option as policy in 2016 and it was finally signed off by Parliament in 2018. Legal challenges by protestors were raised, but these were eventually overturned in late 2020, clearing the way for the planning application to proceed.

The problem of course was that by that time the aviation world had collapsed due to COVID. What had always been a contentious issue due to local environmental objections had also now become engulfed in the much bigger issue of climate change. Personally, I have never seen the logic of trying to reduce emissions by not building runways. Making aircraft stack for hours “queuing” for scarce runway slots, or forcing airlines to operate from airports further away from the centres of population does nothing for global emissions. If you want to limit travel, tax it and reduce the demand. Don’t try and manage it by restricting infrastructure investment.

In any event, even before the pandemic the airlines had changed their position on the third runway. The expected cost of the runway and related terminal infrastructure had spiralled to as much as £18.6 billion. The new car park alone was expected to cost £800m. I have no idea how you can spend that much money on a car park either. To put the total cost into context, the current Regulatory Asset Base (“RAB”) of Heathrow today is £18.4 billion. That’s the “value” of the existing infrastructure that the CAA allows Heathrow to earn a return on through airport charges. To a good approximation, the cash costs of running the airport are covered by the retail, car parking and other miscellaneous revenue streams of the airport. The user charges levied on airlines pay for new investment, financing costs on past investment and returns to the airport’s owners. Such a massive investment would roughly double the asset base, for an increase in capacity of less than 50%, which would have a big impact on airport charges. That was quite an unpalatable prospect for airlines, especially because Heathrow was already one of the most expensive airports in the world.

To be honest, when I left IAG in mid 2019, I thought the project was dead on purely economic grounds. And when COVID hit, I was convinced that was the final nail in the coffin. The rising cost of fuel and emissions further erodes an already difficult business case.

But apparently, Heathrow has not given up. Having already spent £500m preparing for the planning application, I guess it is difficult for them to reverse course. Quite how they have already managed to spend that much is hard to imagine. I thought £800m was expensive for a car park. I suppose part of the answer is that it is not their money they are putting at risk or wasting. The way they are regulated, that £500m is money that Heathrow’s shareholders expect to recover from airlines and passengers, whether the expansion goes forward or not. Plus a markup to ensure that they get a good return on their “investment” in fees for an army of consultants and lawyers.

As we’ve seen, the question of whether the expansion proceeds or not will make a huge difference to the level of airport charges for decades into the future. But charges in the near term are also up in the air. To understand the issues at stake here I’m afraid I need to go through some more details on the way Heathrow charges are set.

Heathrow airport charges

Because Heathrow has monopoly power, its airport charges are set by their regulator, the CAA. Technically, the CAA only sets the maximum that the airport can charge. But nobody will be surprised to hear that the airport has never failed to price up to the cap, even during the pandemic.

The normal process was to set the charges for five year periods, so-called “quinquennials”. The sixth such period (“Q6”), was due to finish in December 2018. The next regulated period, which should have been called Q7, got rebranded as “H7”. I think the “H” stands for Heathrow as it was envisaged that the regulatory periods for Heathrow might become misaligned with other airports, due to the difficulty of setting charges given the uncertainty over the expansion project. Q6 was initially extended by a year because of this and then further extended until the end of 2021 due to COVID. In theory, prices for the “H7” period (2022 - 2026) were supposed to have been set by now. But the CAA once again opted for an interim solution for 2022 (dubbed “iH7”), due to the uncertainties about demand.

All of these interim solutions for charges had to be based on estimates for passenger numbers. Because charges are set by forecasting airport costs, investments and non-regulated revenue and then “filling the gap” with revenue from regulated airport charges, the airport has an incentive to assume passenger numbers will be low (leading to higher required charges per passenger), whilst airlines have the opposite incentive. The room for disagreement on 2022 passenger numbers was of course particularly large.

Passenger forecasts

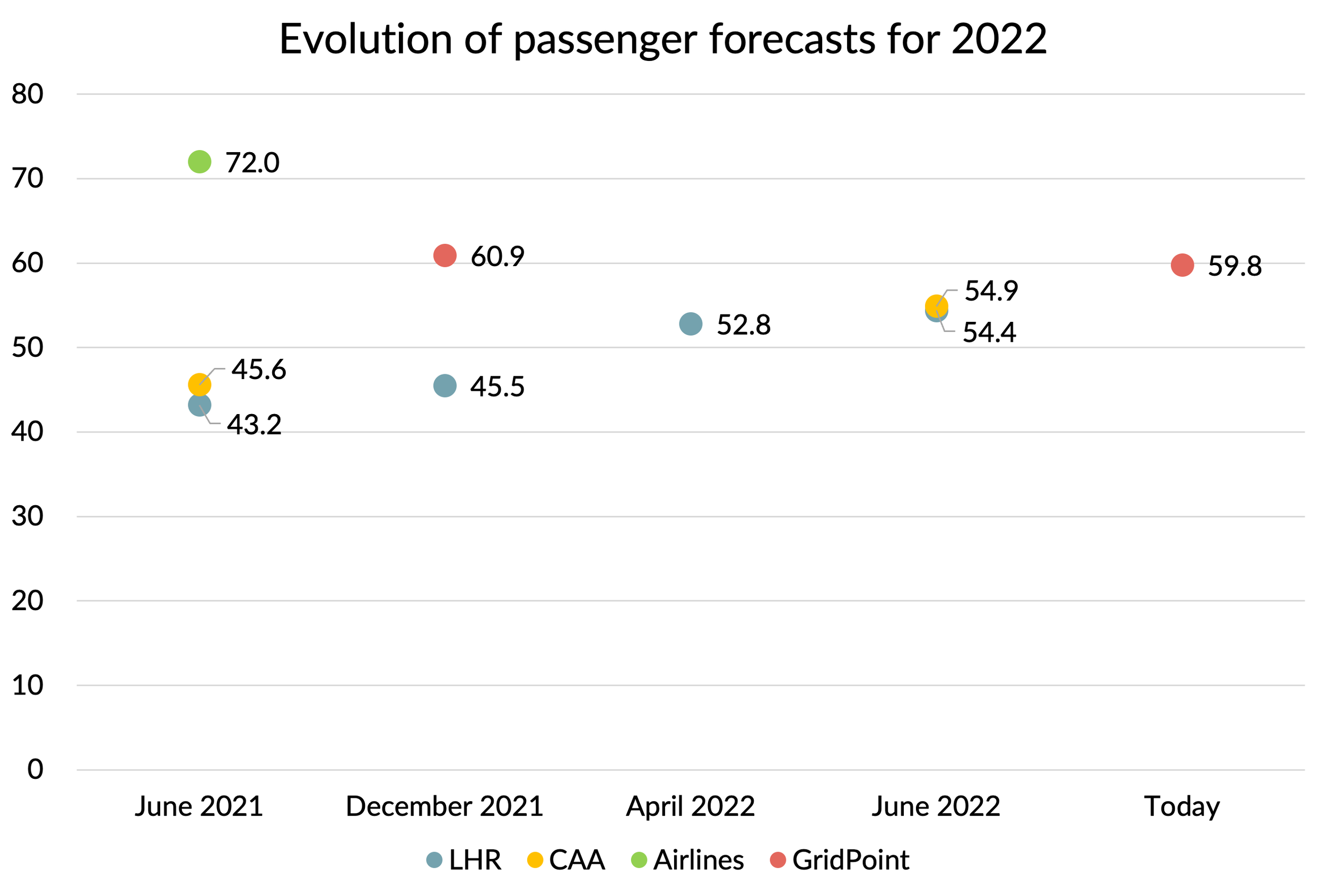

In mid 2021, Heathrow put forward three scenarios for 2022 passenger numbers. The low case was something of a “disaster” scenario with 15.2m passengers. Even the upside case of 52.8m passengers was still only 67% of the 80.9m passengers achieved in 2019. The mid-case scenario, which could be expected to be used by the CAA as the basis of the 2022 charges, was 43.2m, 53% of 2019.

Predictably, the airlines were much more optimistic, putting forward a forecast of 72.0m, 89% of 2019 levels. Their forecast was based on airline plans for bringing back capacity, with an assumption that travel restrictions would be lifted in time for 2022.

To some extent, the CAA split the difference, but for the most part it followed Heathrow’s forecasting methodology. They did tweak a few of the assumptions and ended up with a mid-case forecast of 45.6m, 5.5% higher than Heathrow’s figure. This was used as the basis for setting the interim charge for 2022 of £30.19 per passenger, 32% higher than the 2019 charge and 56% higher than the “specially discounted” rate set by the CAA in 2021 to promote passenger volume recovery.

Source: Heathrow

Those passenger forecasts always looked very pessimistic to me. When I took a look at the passenger forecasts for 2022 in December 2021, I described even the CAA’s high case scenario of 54.2m passengers as looking “ultra conservative”, forecasting passengers at only 65% of 2019 levels, compared to IATA’s forecast of intra-European passenger volumes recovering to 75%. I didn’t go as far as giving a specific prediction, but if you had adjusted the CAA’s upside scenario of 52.3m to reflect the IATA prediction (i.e. multiplying by 75%/65%), you’d get 60.9m passengers. Heathrow published a new forecast for 2022 at around the same time. It marginally improved its central forecast to 45.5m passengers, still way below what I thought was an unbiased forecast at the time, but conveniently very marginally lower than the figure the CAA had used to set the charges.

So what actually happened? Of course 2022 hasn’t finished yet and we don’t even have the September figures. But we do have a pretty good idea of how things will turn out. Heathrow broke their forecast down by quarter and Q1 proved to be every bit as dismal as their forecast predicted, due to the Omicron variant and the reintroduction of travel restrictions. Even so, passenger volumes still came out only 1.4% below Heathrow’s central forecast. By Q2, travel restrictions had been lifted and passenger volumes came out a whopping 48% higher than the Heathrow forecast. However, despite Q2 beating their forecast by 5.3m passengers, they only lifted their forecast for the year by 8.9m to 54.4m.

The CAA also reviewed their forecast in June 2022 and came up with a mid case of 54.9m and a high scenario of 62.8m.

We now have actuals for July and August and I’ve done my own forecast for September to December. For September, I’ve assumed that the published capacity is correct since it is now a historic figure. For October to December, I gave the published capacity a 6% “haircut” to allow for cancellations yet to take place. I then assumed load factor variances versus 2019 in line with what we saw in August (down about 3.5 percentage points). That should be a reasonably conservative forecast and gives me a figure of just below 60m for the year, pretty close to what I thought back in December. It is 9% above the CAA’s mid case forecast.

I’ve given you a lot of figures, so by way of summary, I’ve put them all on a chart to show how the various forecasts have evolved over the last 16 months.

Heathrow profitability

As the airport’s owners seek to pile the pressure on the CAA for a generous user charges settlement, low-balling the passenger forecasts is not their only tactic. The airport also likes to emphasise how much money it has lost during the pandemic and highlight that it continues to lose money even today.

You can see from the following chart of quarterly results that revenues for Q2 2022 came within a smidge of matching the equivalent quarter in 2019, just 2% below in fact. That was helped of course by significantly higher fees per passenger, as we’ve already seen. “Other regulated charges”, which are the cost plus fees levied on airlines for things like baggage systems are running at double normal levels, since the regulatory formula for those has allowed the airport to recover all of the revenue lost in 2020 due to lower passenger numbers through higher fees. Despite the airport making a lot of noise about having had to increase costs ahead of demand, operating profit was within 5% of Q2 2019.

Profit before tax in the latest reported quarter was £454m, but the company’s preferred profit metric is “adjusted profit / (loss) before tax” and on that measure it recorded a £98m loss. This figure excludes restructuring costs and volatile mark-to-market adjustments on the value of its investment properties and on its debt. We will come back to those adjustments later, but for the moment let’s go with the company’s preferred metric, which was almost £200m worse in the quarter compared to three years earlier. That was almost all driven by higher financing costs, as you can see from the widening gap between the blue and the red lines.

Source: Company reports - Heathrow (SP) Limited

Why are Heathrow’s reported interest costs going up? It is not because it has been affected by higher interest rates. Some of their debt is at variable rates linked to LIBOR or its replacement SONIA, but those rates had only just started to rise in the first half and much of the debt is at fixed rates.

Nor is much of the increase in interest costs due to rising debt resulting from operational cash outflows during the pandemic. Over the nine quarters starting in Q2 2020 up to the latest results in Q2 2022, the airport’s operating cashflow before interest payments has totalled a positive £118m, even after paying out £107m of severance payments. That was thanks to slashing capital expenditure to £780m, way below the depreciation charge of £1,792m.

The first reason for increasing debt is that the £118m of operating cash flow was insufficient to cover £915m of interest payments on its existing debt. This net shortfall of £800m would have pushed up net debt, but by less than 5%. But in fact net debt has gone up by £2.4 billion. To understand where the other £1.6 billion went, I’m afraid we need to go further down the Heathrow financial rabbit hole.

Inflation

A large part of Heathrow’s revenues are explicitly linked to UK inflation. The regulator sets the aeronautical fees relative to CPI, so if inflation goes up, that portion of the airport’s revenue automatically goes up too. In 2019 this “auto adjusting” part made up 60% of total revenues. The rest of the company’s revenues and cash costs are less explicitly inflation linked, but nevertheless would tend to rise in a higher inflationary environment. The Regulatory Asset Base, which determines allowed profit levels at each 5 year review, is fully inflation linked. So over the long-term, the cashflows of the business are fully inflation protected.

Recognising this, the company tries to match its inflationary risks by a policy where 50% of its debt is borrowed at rates linked to inflation. If inflation drops and the airport’s future revenue declines, it wants the amount it needs to repay on its financing to drop too. Of course, that works both ways and when inflation rises, some of that trading cashflow benefit is given up in higher debt servicing costs.

The company achieves the 50% inflation linkage on its financing in part by issuing RPI linked bonds, but a lot is achieved using swaps. It borrows at fixed rates and then “swaps” that exposure to inflation-linked rates in the market. The losses or gains on these inflation hedges are what gives rise to those volatile mark-to-market adjustments that we saw earlier. The company would like to be allowed to spread these volatile movements over time using what the accountants call “hedge accounting”, but so far they’ve not convinced their auditors that this is the appropriate treatment.

You may have noticed that there has been quite a lot going on recently in the bond markets, with rising inflation being top of the list of investor worries. So Heathrow has lost a lot of money on its inflation swaps and provisions for indexation on its RPI linked bonds, all of which needs to be provided for up front. That is the main reason why reported debt has increased.

Of course, the flip side of higher financing costs due to inflation hedges will be higher revenues and cashflows in the future. That’s the reason why they are doing this hedging after all. Airlines will automatically pay those increased costs through the CPI link on airport fees. In fact, as the CAA has pointed out, the 50% of Heathrow’s borrowings which are not inflation linked will be “inflated away”, lowering the company’s average cost of funding in real terms and boosting profits over time. So whilst inflation hurts the airport’s profits in the short term, over the long term it will be a benefit unless the CAA lowers inflation adjusted airport charges to compensate.

Inflation also helps Heathrow’s balance sheet metrics. Its banking covenants and its target gearing metrics are all linked to the Regulatory Asset Base. That automatically goes up with inflation and between the end of 2019 and June 2022 it went up by 11% or £1.8 billion, despite the the company slashing capital expenditure way below depreciation. £300m of that was courtesy of the CAA, who allowed an adjustment to compensate the airport for lost revenues during COVID. That will increase airport charges in future years and will therefore be paid for by airlines, plus an investment return of course. That sounds remarkably generous, although Heathrow wanted and is still lobbying for a much bigger adjustment of £2.4 billion. Since only half of Heathrow’s debt is linked to inflation, high inflation increases their RAB much more than their debt, improving all the financial ratios. At the half year, the company was able to boast that gearing was now better than before the crisis.

Didn't the shareholders support the business during the crisis?

That improvement in the balance sheet has been made despite not having raised any additional equity. In 2020, the company made quite a big song and dance about having raised £750m of "additional capital", of which £600m had been “injected” into the regulated business. All their public statements were designed to imply that the shareholders were doing their part in stumping up additional money. The reality of what happened was that in Q4 2020, ADI Finance 2 Limited (one of the nine1 holding company layers that sit between the shareholders and the regulated company) issued £750m of bonds paying LIBOR plus 7%. £600m of that made its way down into the regulated company in the form of an inter-company loan, at LIBOR plus 7.5%. The money, plus interest, was repayable in September 2027, but in fact £1 billion of inter-company loans were quietly repaid in Q2 2022. If you add up the changes in money owed to its holding companies during 2020, 2021 and the first half of 2022, the truth is that a net £47m was taken out of the business through inter-company loans. That’s in addition to the £107m of dividends paid out in February 2022, just before the crisis hit.

So no, the shareholders haven't put their hands in their pockets at all.

Are airport charges going up or down then?

It is at this point in the article that I somewhat regret having set out to answer this question, given all the complicated moving parts.

The charges proposed by the CAA in their “final proposal” published in June 2022 were for prices falling from the interim level of £30.19 to £21.75 in 2026, measured in 2020 prices. The CAA also showed their proposed price caps in nominal terms, using a forecast for inflation which starts out at 7.4% for 2022, before falling back to 4.0% in 2023 and then below 2% for the remaining years. I’ve show those nominal figures in blue on the next chart, along with the historical figures for reference.

Heathrow airport are still challenging the figures, calling them “un-investable” and issuing dark threats about deteriorating standards for customers and financing challenges. Their own submission was based on charges which were 74% higher. The CAA will make a final decision by the end of the year.

The recent turmoil in the UK bond market and rising interest rates may add some weight to Heathrow’s arguments about financing challenges and cost of capital. On the other hand, as we’ve seen, the passenger recovery seems to be much faster than assumed by the CAA. So it does look like charges will begin to fall from the currently inflated levels, although not all the way back to pre-crisis levels, due to inflation.

Paying for expansion

It should be noted that the CAA charges are based on a two runway airport. If Heathrow does manage to get the third runway proposal moving again, charges would need to be adjusted upwards from these levels.

With airlines still rebuilding their balance sheets after the pandemic and struggling to pass on higher fuel costs and other inflationary pressures, I can’t see that getting much support from the airlines any time soon.

1 The shareholders hold shares in FGP Topco Limited, which owns ADI Finance 2 Limited, which in turn owns Heathrow Airport Holdings Limited, which owns Heathrow Holdco Limited, which has a subsidiary LHR Airports Limited, which owns Heathrow (DSH) Limited, whose subsidiary Heathrow Finance PLC owns Heathrow (SP) Limited, which owns Heathrow (AH) Limited, which is the holding company for the regulated entity Heathrow Airport Limited.