Ryanair’s cash machine is firing on all cylinders

An impressive set of results from Ryanair for the first half

Ryanair’s CEO Michael O’Leary was in confident and combative mood as he announced the airline’s first half results this morning. For some reason he decided to appear in front of a background image of a tank. Quite who this subliminal message was aimed at wasn’t clear. He certainly fired off plenty of shots at a variety of targets, with airports, competitors, governments and the EU Commission all coming under heavy fire.

Media coverage focused on the 40% jump in pre-tax profits compared to the previous year. But in truth, that statistic said as much about the difficulties Ryanair had with revenue last year, due to a much publicised battle with online travel agents. With those issues now behind them, today’s results demonstrated a strong recovery.

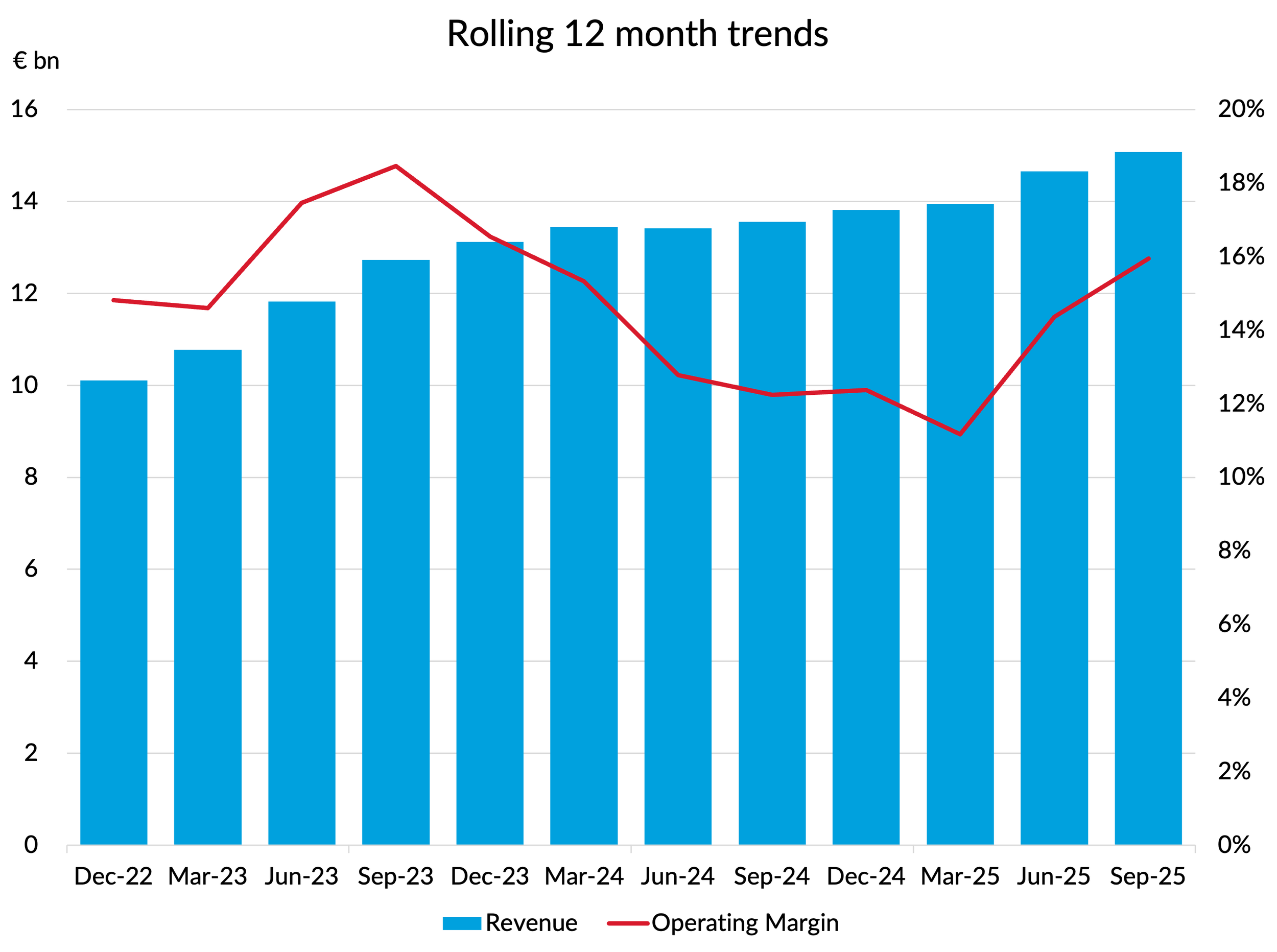

Ryanair’s business is very seasonal, so I like to look at trends on a 12 month rolling basis. The chart below shows the resumption of revenue growth and the recovery in profit margins to an industry-leading 15.9% at an operating level and 17.3% at a pre-tax level.

Source: Company reports, GridPoint analysis

The cash machine

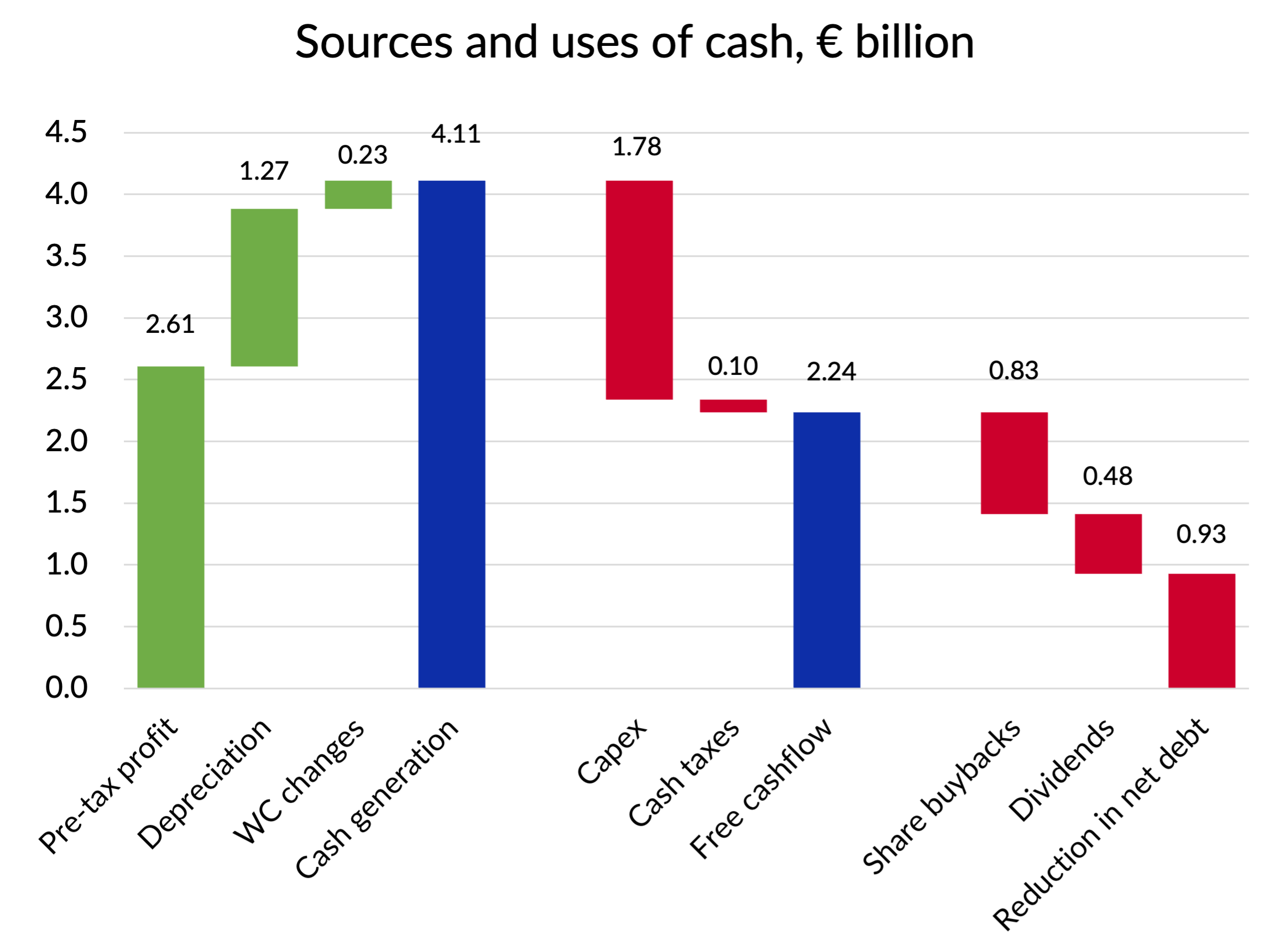

However, what impressed me even more was the demonstration of the company’s extraordinary cash generation ability.

Pre-tax profits over the last four quarters were €2.6 billion. Adding back €1.3 billion of non-cash depreciation and adjusting for working capital movements, that gave a pre-tax cash generation of €4.1 billion.

Capital expenditure of €1.8 billion was €500m greater than depreciation, equivalent to a fleet asset growth of about 4.5%, quite consistent with Ryanair's current capacity growth rate of about 4%. There is also tax to pay of course, but being based in Ireland with its famously low corporation tax rates, that doesn't add up to much. Only €250m was charged to the P&L account in the last four quarters, and only around €100m was actually paid.

This all added up to incredible cash conversion ratio, with €2.4 billion of post tax profits translating into surplus cashflow of €2.2 billion. That surplus was used to pay out €826m in share buy-backs and €481m in dividends. But that still left €930m available to be retained in the business and used to pay down debt.

Source: Company reports, GridPoint analysis

Ryanair’s vanishing debt

Ryanair is unusual in the airline business in purchasing rather than leasing its planes. Partly this is down to its sustained profitability over the years. It simply hasn’t needed to borrow money to finance its business. Perhaps the fact that it is based in Ireland means it can benefit directly from low Irish taxes, whereas other airlines based in higher tax environments need to use leasing to access those tax advantages.

At the end of September, Ryanair had net cash of €1.5 billion, with €1.5 billion of debt more than outweighed by €3 billion of cash. The surplus cashflows of the company are such that it plans to pay off its remaining €1.2 billion bond next May from cash, leaving the business debt free with substantial cash balances and an unencumbered Boeing fleet worth €13.4 billion.

Valuation thoughts

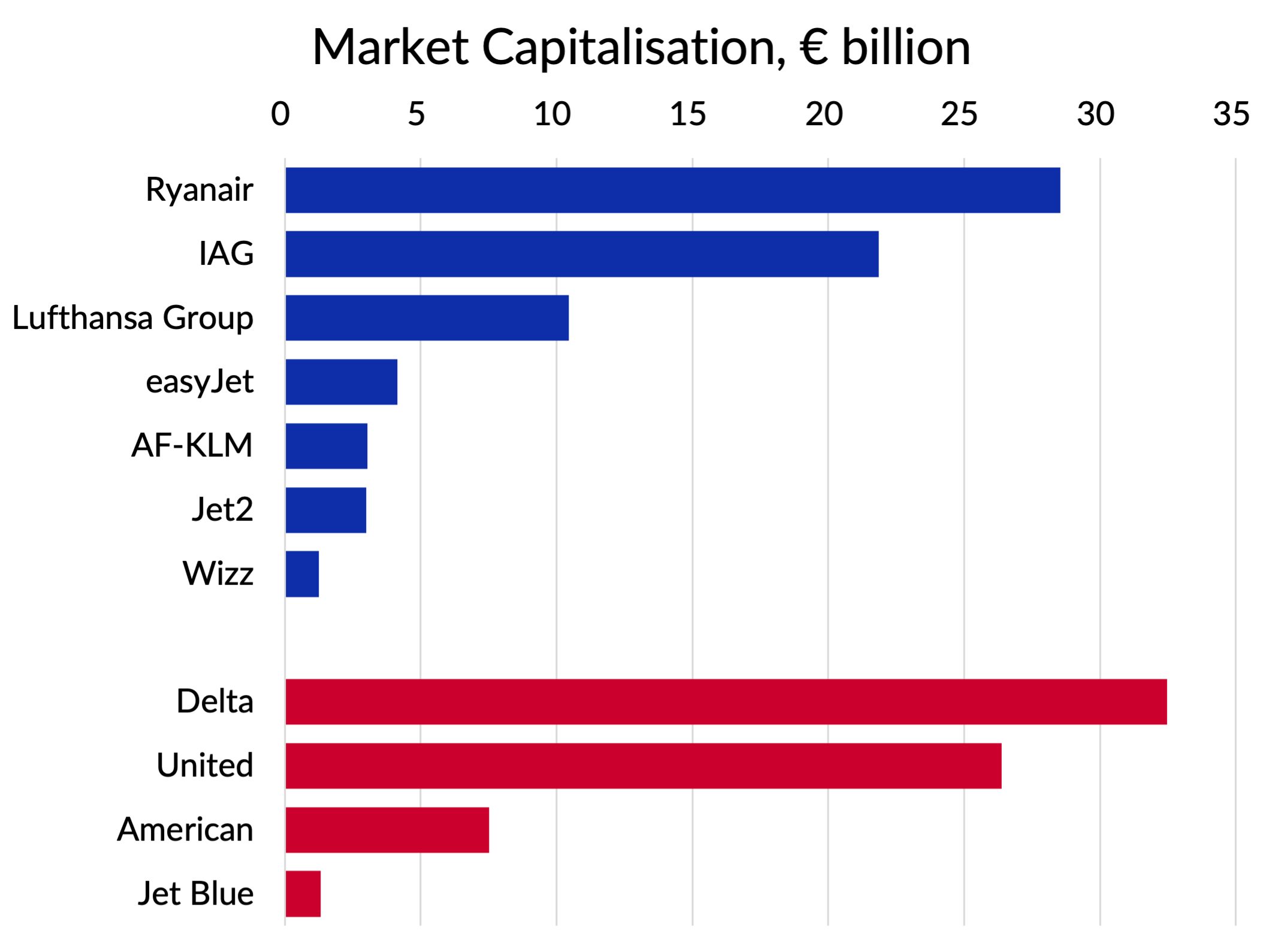

It won’t therefore come as any surprise to learn that investors have rewarded the company with one of the highest market valuations in the industry. I haven’t done a comprehensive analysis, but here is a chart of market capitalisation figures for a selection of European and US airlines. The only airline in this group that come close to beats* Ryanair is US giant Delta, which is 3.6 times the size of Ryanair in revenue terms and has a profit after tax which is 70% higher.

* Note in the original version of this post I had inadvertently overstated Ryanair’s market cap by 15% as I stupidly assumed that the figure given by Yahoo Finance would be in euro, because it is an Irish company. But no, it was actually based on the company’s Nasdaq listing and was therefore in US dollars. Although it doesn’t really change the story, I’ve corrected the chart below.

Source: Yahoo Finance 30th October 2025, GridPoint analysis

Whilst Ryanair’s valuation may look to be a lofty one for its size, in truth it is easy to argue that it is still too low.

The airline has plans to grow at 5% per annum over the next ten years and whilst that is faster than anybody’s expectation of market growth, it is far from outlandish and few would bet against the company’s ability to pull that off without impacting profit margins.

With free cashflow of over €2 billion a year, some simple maths will give you discounted valuation today of €47 billion. That assumes a growth rate in passengers of 5% p.a., a 1% a year growth in average fares (i.e. reducing in real terms), and constant margins. I’ve also made the conservative assumption that the company goes ex-growth beyond the ten years. I used a cost of equity of 7.15% (source: valueinvesting.io).

A €47 billion valuation would imply an upside of over 40% compared the current market cap. This is not an investment recommendation of course and for full disclosure I do have a chunk of Ryanair shares in my portfolio, for reasons that I think should be obvious. They’ve not quite delivered AI style returns, but an 80% gain since I bought them in 2022 is still more than respectable.

The company has recently been added to the MSCI Global and FTSE Russell indices, and off the back of that, the management team is about to embark on a road show with investors in Europe and the US.

I would certainly agree that they have quite a compelling story to tell.