A financial health check on the big three European network airline groups

The Q3 results are in

All three of the big Western European network airline groups have now reported their Q3 figures for 2025. Q3 is always an important quarter, encompassing as it does the peak summer season when airlines make most of their profits. I thought it would therefore be a good time to do a quick “financial health check” on how they are all shaping up, both in absolute terms and relative to each other.

I’m going to focus mainly on the “rolling annual” figures, aggregating the last four quarters. All airlines are seasonal and this is the best way to see the trends without the seasonal noise getting in the way of the signal. I will also mostly stick to absolute results, not ratios. That’s because in revenue terms, all three of these groups are about the same size. IAG (€33.3 billion) and AF-KLM (€32.7 billion) are virtually identical. Lufthansa is 17.5% bigger at €39.1 billion, so bear that in mind as you look at the numbers.

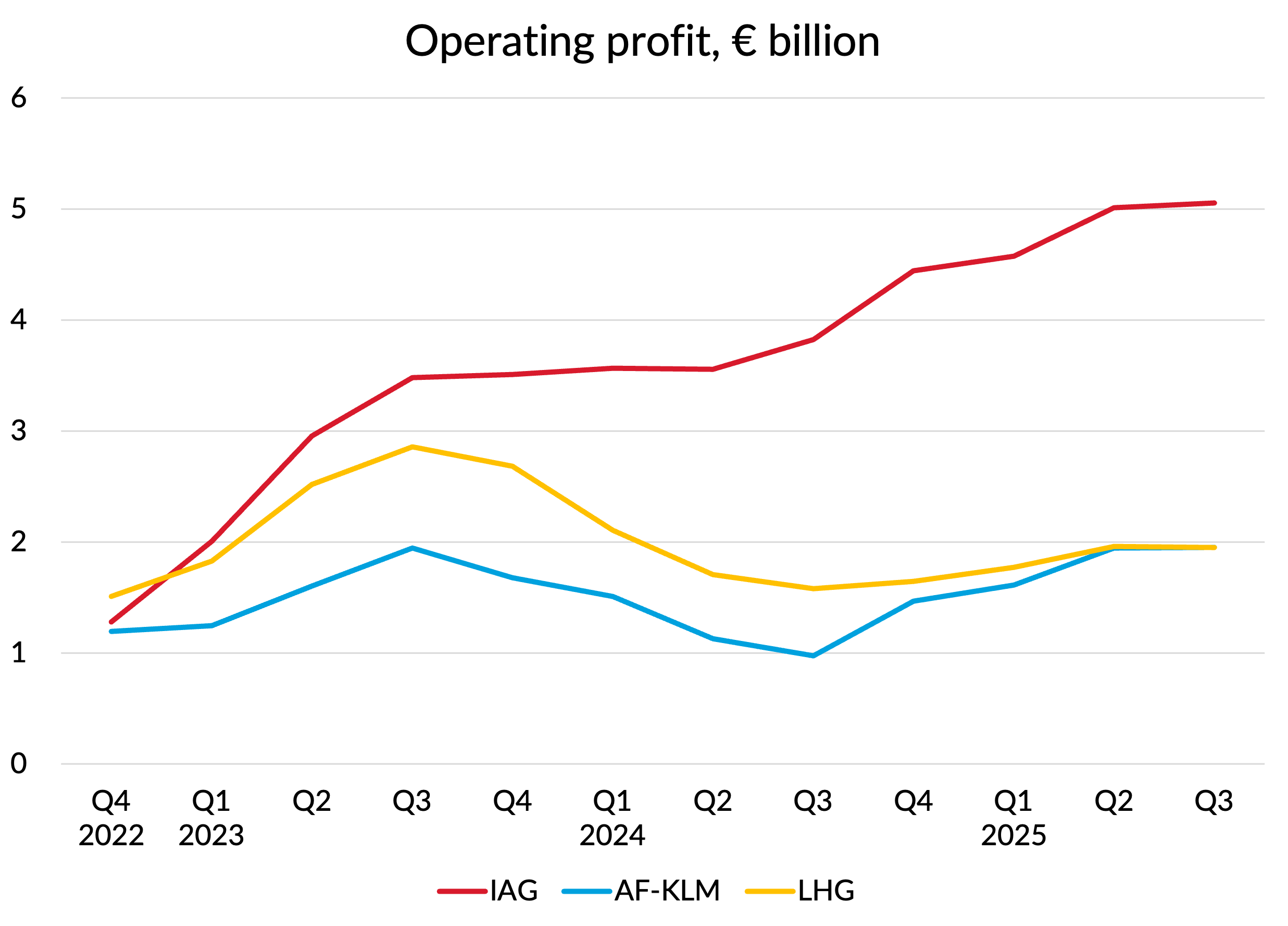

Profitability

Let’s start with operating profits, or earnings before financing costs and tax if you prefer. As the three groups came out of the post-COVID starting traps at the end of 2022, they were all much in the same place. But IAG has had a much better recovery, having already opened a clear performance gap by Q3 of 2023. Going into the final quarter of that year, profits at the other two groups had already started to falter, whilst IAG profits did no worse than plateau. Profits at all three groups started to climb again in the second half of last year, but once again the rate of ascent was stronger at IAG. On a rolling year basis, IAG’s profits are now over €3 billion higher than its two rivals. Operating margins of 15.2% dwarf the modest 6.0% at AF-KLM and 5.0% at Lufthansa Group.

Source: Company reports, GridPoint analysis

The final thing to note on the previous chart is the fact that operating profits hit a plateau in the latest quarter at all three groups. That means a decline in real terms (adjusting for inflation). You can see from the next chart that what looks like it could be a turning point in the profit cycle is even more evident in the pre-tax profit numbers, i.e. after deducting net financing costs. All three groups reported a small reduction in pre-tax profits compared to last year in Q3.

Source: Company reports, GridPoint analysis

Lufthansa’s profit performance compared to the other two looks a bit better after financing costs, because it has lower debt levels. But IAG’s pre-tax margin of 13.2% is still way higher than Lufthansa’s 5.2% and AF-KLM’s 4.7%.

Talking of debt levels, let’s look next at what the trends on that show.

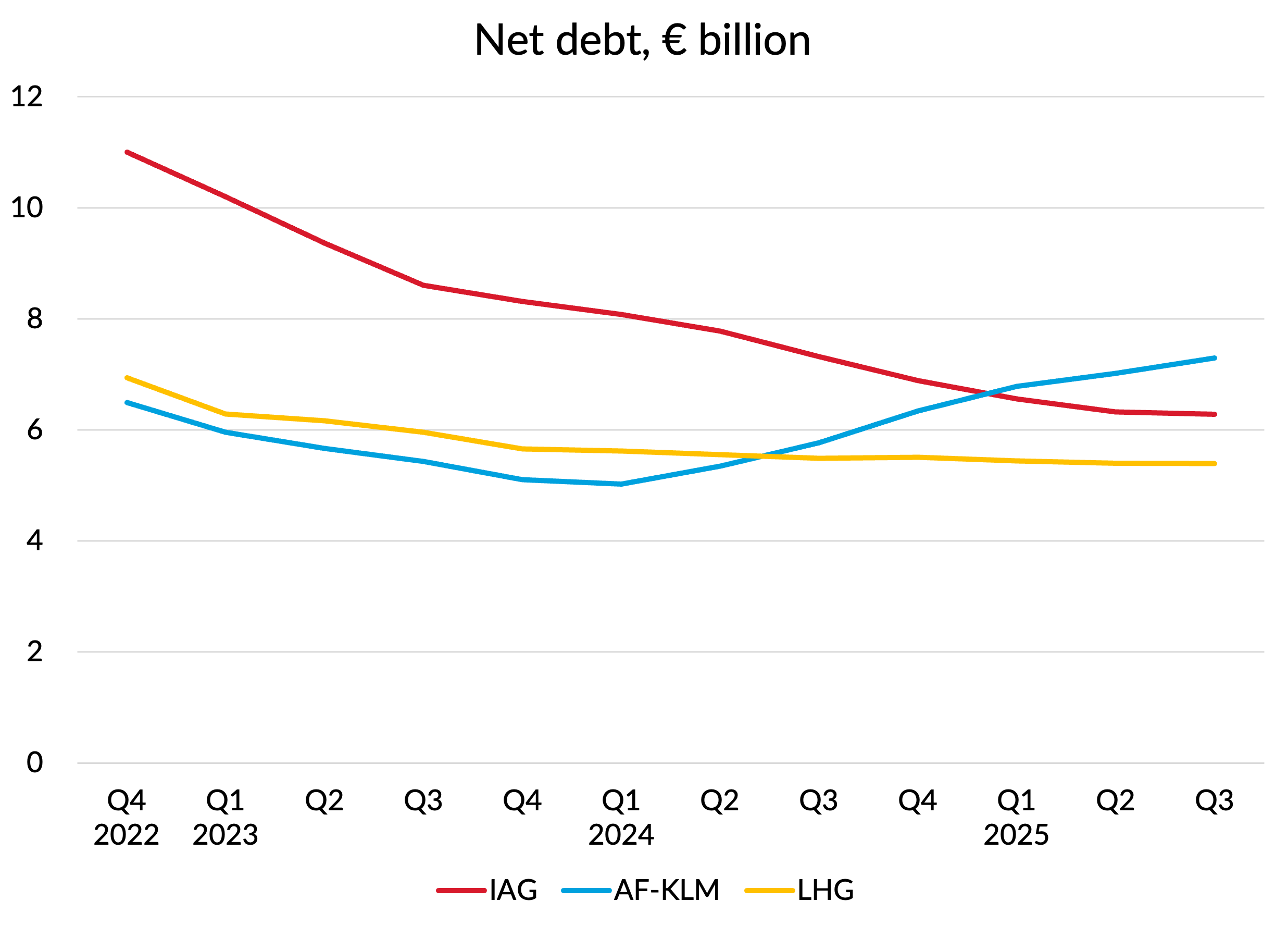

Net Debt

Net debt (debt less cash) was inflated at IAG coming out of COVID. Despite raising €2.6 billion of fresh capital through a rights issue in 2020, IAG’s net debt had increased from €7.6 billion in 2019 to €10.4 billion at the end of 2022 due to the losses incurred during the pandemic. Since then, due to strong profitability, the company has made steady progress in bringing down the debt levels. The chart below show the average net debt over the last four quarters, a metric which smooths out the quarterly seasonality. The rate of improvement at IAG has slowed recently, as the company has once again resumed paying dividends and buying back shares, with around €900m purchased by the end of Q3.

Source: Company reports, GridPoint analysis

In contrast to IAG, net debt levels at AF-KLM and Lufthansa were not in fact materially higher than pre-COVID levels at the end of 2022. The reason why is a bit different in each case.

Like IAG, AF-KLM raised €2.6 billion of fresh equity capital in 2021 and 2022. But it also got a lot of other cash support from the French and Dutch governments. For example they allowed the company to defer payments of taxes, including social security taxes. Between the end of 2019 and the end of 2022, the amount of unpaid taxes ballooned by close to €3 billion. If you are interested in the details, you can read more about it in one my blog posts from 2023. Since those unpaid bills don’t bear interest, they aren’t included in the definition of debt. Nevertheless, they do eventually need to be repaid and the company has been doing that during 2024 and 2025, contributing to the upward climb in net debt over that period. At the end of Q3, the employee liabilities balance was still about €600m higher than it was in 2019 and the company is still making catch-up payments of about €125m a quarter. More recently, AF-KLM has raised €2.5 billion of hybrid capital (“perpetuals”) which is classified as equity in its balance sheet by the accountants, but which has many of the characteristics of debt. €0.5 billion of this has now been repaid but there is still a large amount outstanding. Whether you view this as debt or equity (the ratings agencies I think treat it as 50/50), this has helped contain what would otherwise have been an even bigger rise in reported net debt.

Lufthansa Group also raised €2.2 billion of equity capital through a rights issue in 2021. I think they also did some deferred payment of taxes, but the details of that are not at all transparent in the accounts. However, the big reason that their reported net debt at the end of 2022 was no higher than before the crisis was a reduction of €4.6 billion in pension liabilities. That came from an increase in the interest rate used to discount future pension liabilities, from 1.3% in 2019 to 4.2% at the end of 2022 (it remains at 4.0% today). Like AF-KLM, Lufthansa’s profit levels haven’t been strong enough to materially bring down net debt or to buy back shares over the last three years. But it also hasn’t had the level of catch-up in unpaid taxes seen at AF - KLM, so net debt has remained fairly stable and has even slowly improved.

Future aircraft investment

So much for looking backwards, let’s have a quick look at one of the big drivers of future cashflow and net debt, which is fleet investment.

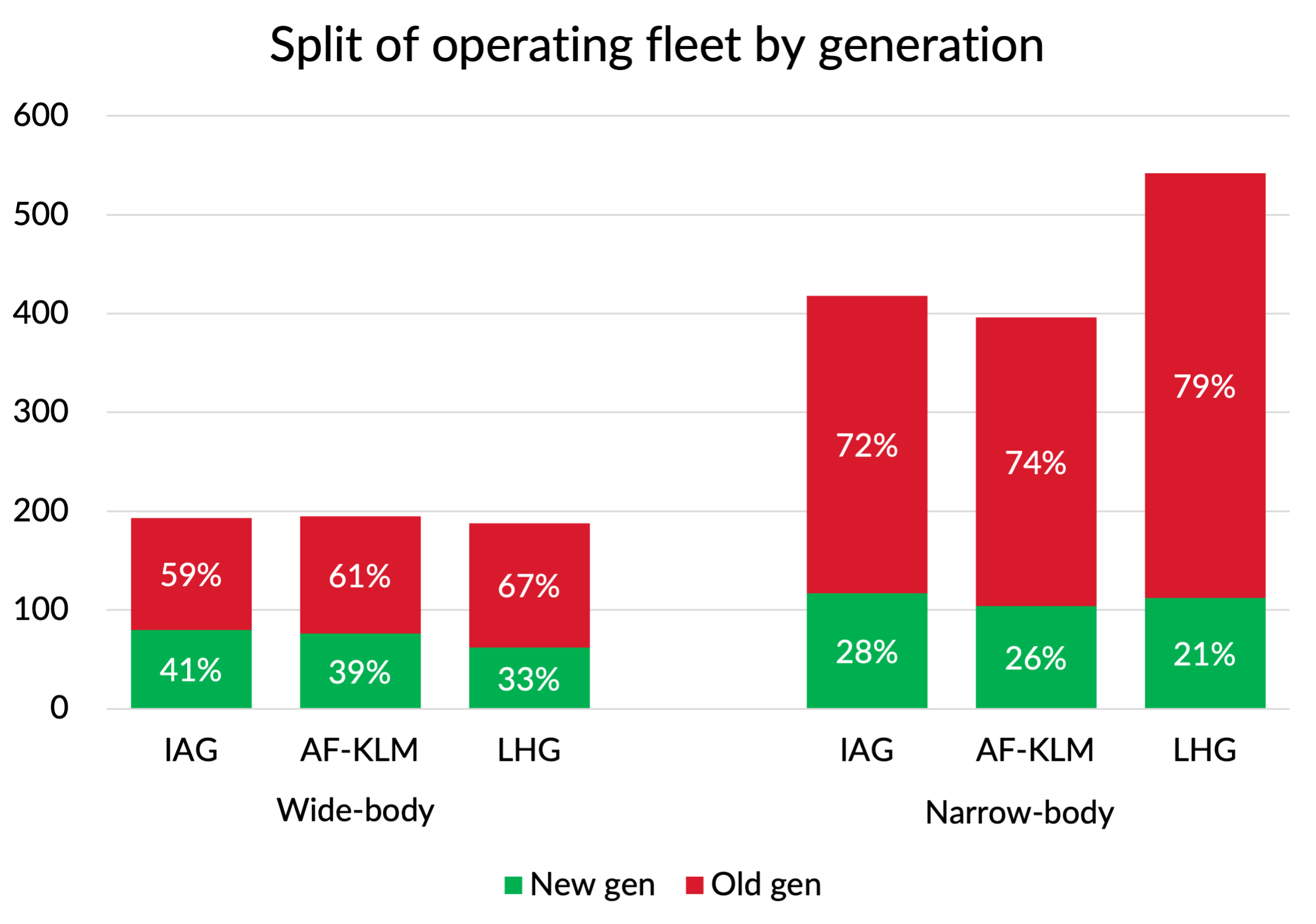

It is critical these days to have modern “new generation” aircraft in the fleet, like the re-engined A320/737 and the A350/787. With emissions costs rising, it has never been more important to have the benefit of highly fuel efficient aircraft. IAG is in a somewhat better place than its network rivals in terms of the current fleet mix, with 41% of its wide-body fleet and 28% of its narrow-bodies being “new generation”. Although the narrow-body percentage may look low, it is ahead of easyJet’s 26% and only just behind Ryanair’s 31%, although a long way behind Wizz’s 71% figure.

For both wide- and narrow-body aircraft, AF-KLM isn’t too far behind IAG, despite its balance sheet challenges.

Lufthansa Group has the most still to do, so it is fortunate that its current net debt levels are the lowest of the three. To get to the same levels of penetration of new generation aircraft as IAG has today would I estimate take about €1.7 billion of capital expenditure, which would take Lufthansa Group’s net debt up close to the same level as AF-KLM.

Source: GridPoint analysis. Fleet counts as at September 2025.

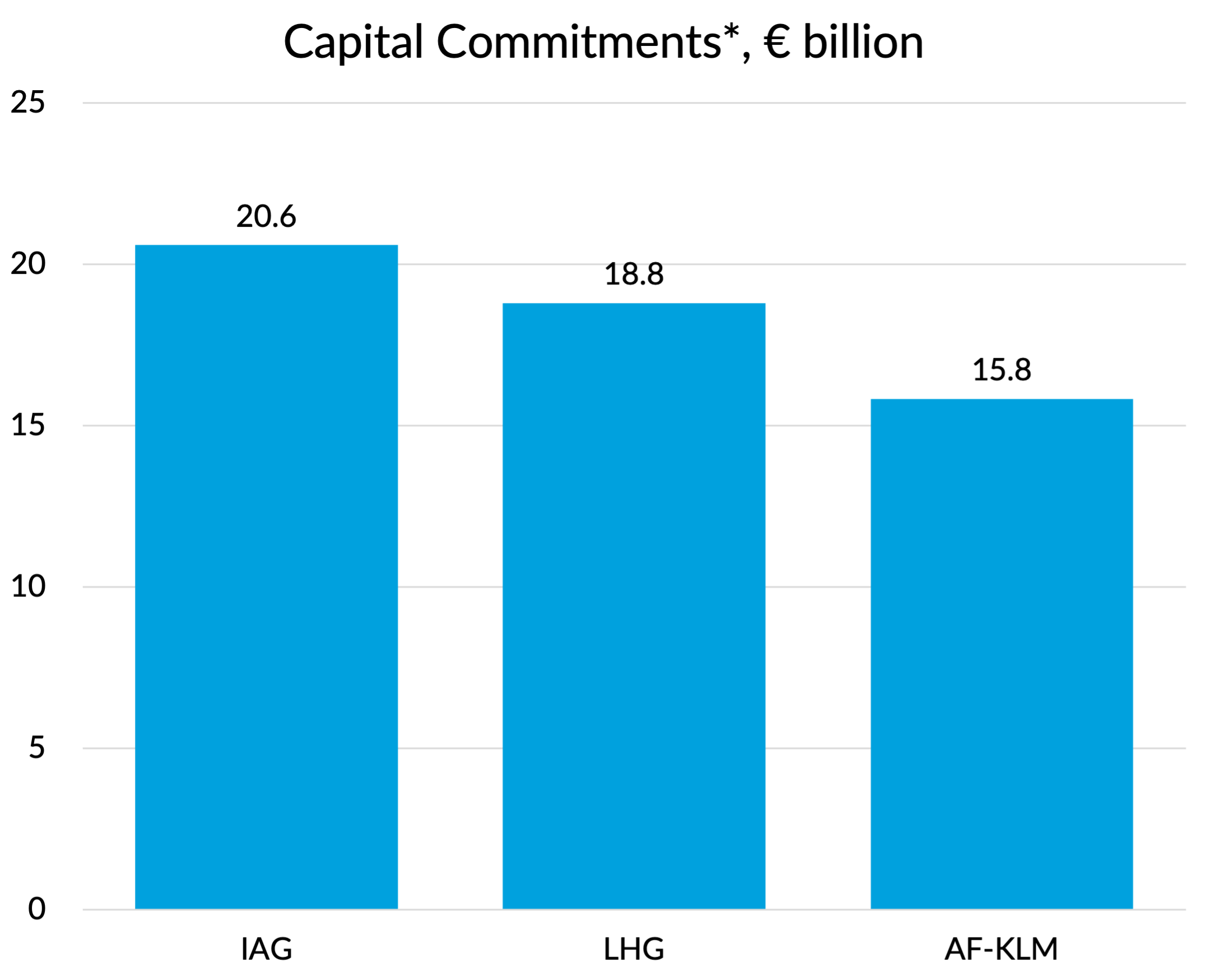

All three groups have significant commitments for future aircraft spend. Despite being arguably in a somewhat better place already, IAG has placed the biggest bet, with €20.6 billion of capital commitments at June 2025. That’s up substantially from the €12.6 billion of commitments at the end of 2024, after IAG placed orders for an additional 71 wide-body aircraft in the first half of 2025.

Lufthansa Group has slightly lower commitments of €18.8 billion (at September 2025), with Air France - KLM in third place. At the end of 2024, they had total capital commitments of €14.4m and in the chart below, I’ve included €180m of “other purchase commitments” and €1.3 billion of lease commitments for aircraft not yet in operation. AF-KLM is the only one of the three to make significant use of “pre-financed” aircraft from lessors. The other two prefer to arrange finance only on delivery and in many cases now plan to leave the aircraft unencumbered.

* includes lease commitments for undelivered aircraft for AF-KLM.

As at Jun 2025 (IAG), Sep 2025 (LHG) and Dec 2024 (AF-KLM).

Source: Company reports, GridPoint analysis

These differences may be purely a matter of timing, with IAG having just placed a major wide-body order. The other two groups may be just about to make additional commitments. But I do think one could argue that now that IAG has got its balance sheet back into shape, it is taking advantage of its superior profit performance and cash generation to get even further ahead of the game on securing new generation equipment.

Mind the gap

The message from the leadership of Lufthansa and Air France - KLM is that they are not even attempting to match IAG’s 15% profit margins. Air France - KLM is targeting an 8% operating margin by 2026 - 2028. Lufthansa has set a goal of 8-10% margins in the 2028 - 2030 period.

We don’t know whether they are not trying to match IAG because they believe IAG’s margins are unsustainable, or whether it is just that they don’t believe they are achievable for them. What is striking though is that even if they hit their own margin targets, that will only reduce the current €3 billion annual profit gap to around €2 billion, if IAG can in fact sustain its current margins.

One could perhaps argue that the gap doesn’t really matter from a strategic and competitive perspective. 8-10% margins are probably enough to afford to service debts and afford the capital expenditure to meet reinvestment and modest growth needs. If IAG is achieving its superior margin by underinvesting in its business or sacrificing long-term performance or growth, then setting a lower margin target may help deliver stronger competitive outcomes in the long-term.

However, if the performance gap is being driven by better efficiency or structural factors like network advantages, the competitive gap may actually widen over the long-term, as IAG attracts lower cost capital and can afford to bring in new generation aircraft faster, invest more in products and services and pursue faster growth, whether organically or through M&A.

What’s rather more clear cut is what this divergent performance has meant for shareholders. Since the end of 2022, Lufthansa Group’s share price is basically unchanged (down 1%). Air France - KLM’s is down 23%. Meanwhile IAG’s share price has more than tripled in euro terms and its market capitalisation is now over 80% bigger than the other two combined.

I guess the market at least is betting on the outperformance continuing.