End of year round up

Looking backwards and forwards

Another year is almost over and a bright shiny new one is about to be freshly minted. It is therefore time to take stock of how 2025 went for aviation, and to look ahead to the new year. Let’s start by looking in the rear view mirror.

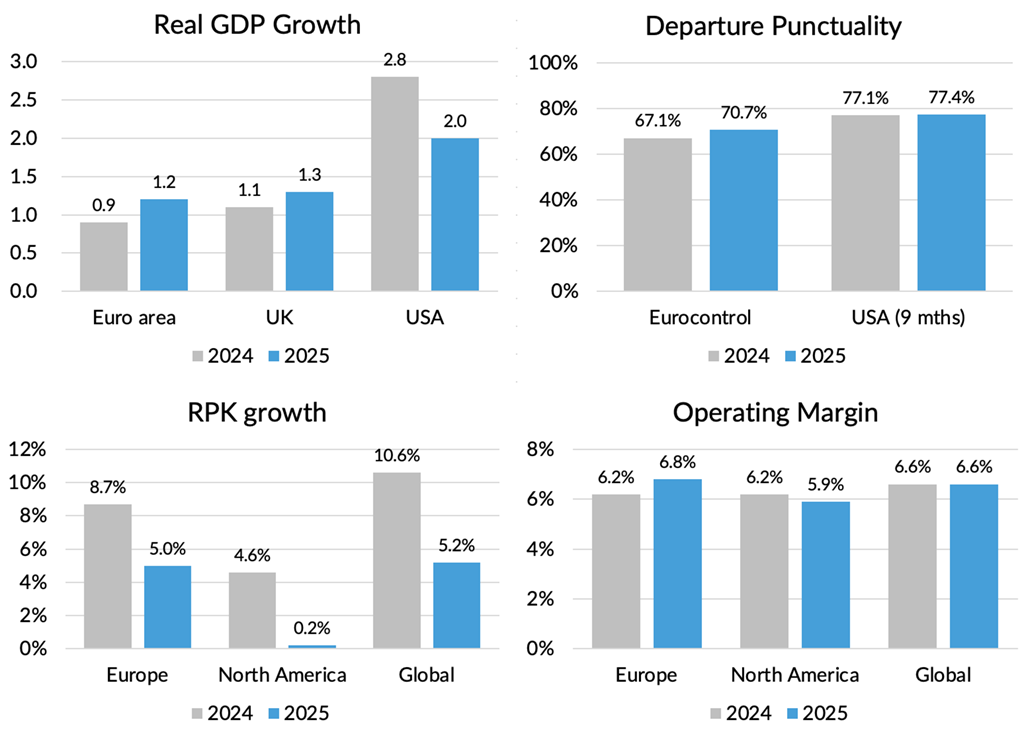

I put together a quick dashboard below of some of the key metrics for the aviation industry in 2025 and how they compared to the prior year. I’ve focused on Europe and the USA, because that’s where more than 80% of my readership is based.

Sources: IMF, IATA, Eurocontrol, Bureau of Transportation Statistics

In terms of the economy, 2025 was a better year in Europe than 2024. Growth slowed in the USA, but a 2% increase was still much better than the Euro area’s 1.2% and the UK’s 1.3%.

Traffic growth slowed worldwide as the COVID recovery phase drew to an end, but growth at North American carriers stalled completely, driven by trade wars and government shutdowns. That contributed to profitability at North American carriers slipping below the global industry average for the first time in years.

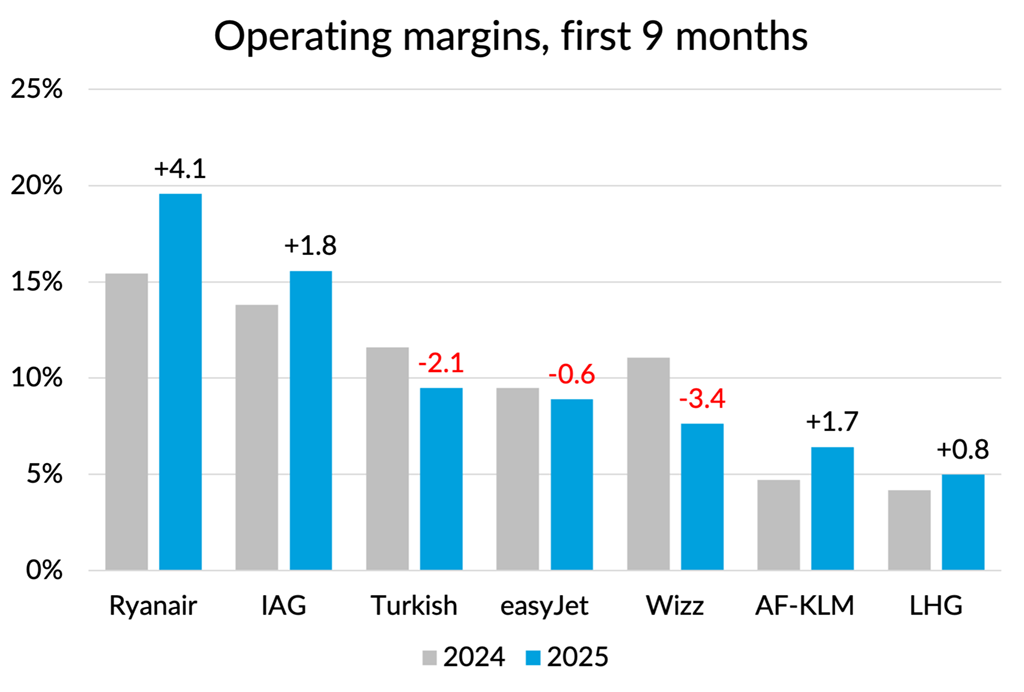

We don’t yet have full year profit results for European carriers, but IATA forecasts that operating margins will in aggregate be up by 0.6 percentage points, no doubt helped by slightly better economic growth, lower fuel costs, a stronger euro versus the dollar and fewer air traffic control delays. In truth performance by carrier was a bit more varied, with some airlines seeing declining margins whilst others did much better. I’ve shown the results for the first nine months of the largest European operators below. The numbers on the top of the bars show the change in operating margins compared to last year.

Overall then, 2025 was not exactly a boom year, but pretty reasonable by recent standards. What are the prospects for 2026?

Outlook for 2026

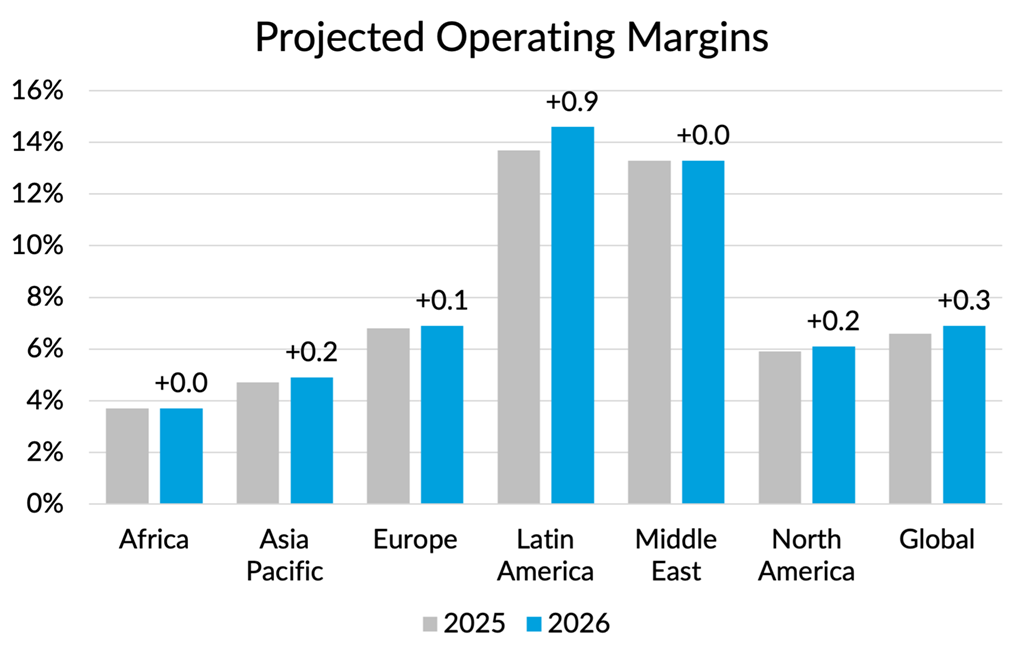

IATA recently published its Global Outlook for Air Transport report. It is forecasting that the growth in traffic (RPKs) will slow marginally to 4.9% at a global level, with a small recovery for North American carriers (1.5% compared to flat in 2025) and growth for European carriers falling back to 3.8% from 5.0% in 2025.

IATA thinks global operating margins will be up slightly in 2026, with small improvements expected in all regions except for Africa.

Source: IATA

If IATA’s outlook turns out to be correct, it all looks remarkably stable for a notoriously volatile industry.

Do airlines agree with this sentiment? I recently attended CAPA’s Airline Leaders conference in Lisbon. I was keen to hear what airlines from around the world were thinking and saying about prospects for next year. I would summarise the general sentiment as “cautiously optimistic”, although I think it is fair to say that nobody had a strong opinion and people remain nervous. Current trading and forward bookings are fine and fuel prices look relatively benign, but it is hard for anyone to have much confidence, given the current geopolitical environment.

The main topics of conversation at the conference were aircraft and engine supply issues, geopolitics, sustainability, and of course AI. Let’s address each of those in turn.

Aircraft and engine supply issues

Constraints on new aircraft supply have led to the order backlog climbing to almost 60% of the active fleet, according to IATA. That compares to around 40% before the pandemic and 30% back when I was buying aircraft for BA.

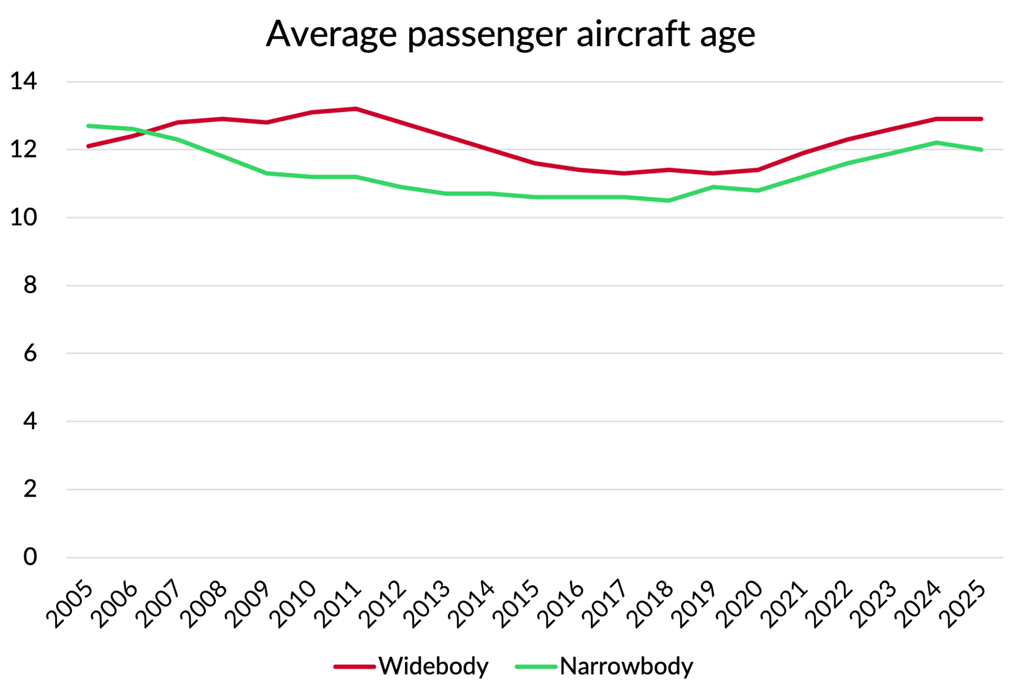

Airlines are holding on to older aircraft as a result, with the average age of the active aircraft fleet climbing by around two years since 2019.

Using some “rules of thumb” for the fuel efficiency gain of a new aircraft compared to a previous generation one, I estimate that this two year ageing is worth around 2% in lost fuel efficiency for the industry. That is of course significant, with a direct fuel cost impact of around $5 billion. However, that’s worth only about 0.5% of industry revenues. There are maintenance cost implications of course, but also savings in aircraft ownership costs and airlines will have received compensation for their delayed aircraft. Add in the fact that aircraft supply issues will have constrained capacity growth, supporting load factors and yields, and my guess is that airline margins were actually higher than they would have been without the supply issues.

I think the continuing issues with engines are causing more headaches, especially for carriers with high exposure to affected types. As well as contributing to the aircraft delivery shortfalls, record numbers of aircraft have been grounded awaiting checks and fixes for their engines. Regardless of the financial compensation received from engine suppliers, the inability of airlines to plan with any confidence destroys efficiency.

Issues with aircraft and engine availability are unlikely to be fully resolved, even by the end of 2026. However, there do seem to be reasonable prospects for the situation to improve, which should be helpful for efficiency. Meanwhile the ongoing supply constraints will keep the supply/demand balance tight, supporting load factors and pricing. Obviously this situation could change if demand starts to falter. What are the risks there?

Geopolitics and macroeconomics

I think we’d all like to believe that 2026 will be a more peaceful and stable year than 2025 was. Many people seem to believe that the Ukraine war may come to an end in 2026, or at least see a pause in fighting. Personally, I am quite skeptical about this, but of course we all hope for an end to the killing and destruction. It is easy to come up with scenarios where things get worse rather than better - escalation of the conflict with Russia, a breakdown in the Middle East peace process, an attack on/blockade of Taiwan by China are obvious examples.

Likewise, the macroeconomic environment seems impossible to predict. So much seems to depend these days on the actions of individual leaders, with the financial markets seemingly driven by greed and fear in equal measure. I am not predicting a financial market crash next year, but it is not hard to see how a bursting of the AI bubble (if there is one) could trigger a global financial crisis. That didn’t go well for the airline industry last time that happened.

There is not a lot that airline managements can do to plan for such unpredictable risks, except to focus on maintaining flexibility. Whether it is opportunity or risk that has the upper hand in 2026, it will be the most nimble and adaptable airlines that do best.

Sustainability

2025 wasn’t a good year for those of us who want to see the world successfully tackle climate change. I asked ChatGPT for a summary and it gave me the following verdict, which is hard to argue with.

| Dimension | 2025 outcome |

|---|---|

| Climate impacts | ❌ Bad |

| Emissions trajectory | ❌ Bad |

| Clean energy transition | ✅ Good |

| Global coordination | ❌ Bad |

| Corporate sustainability | ⚠️ Mixed |

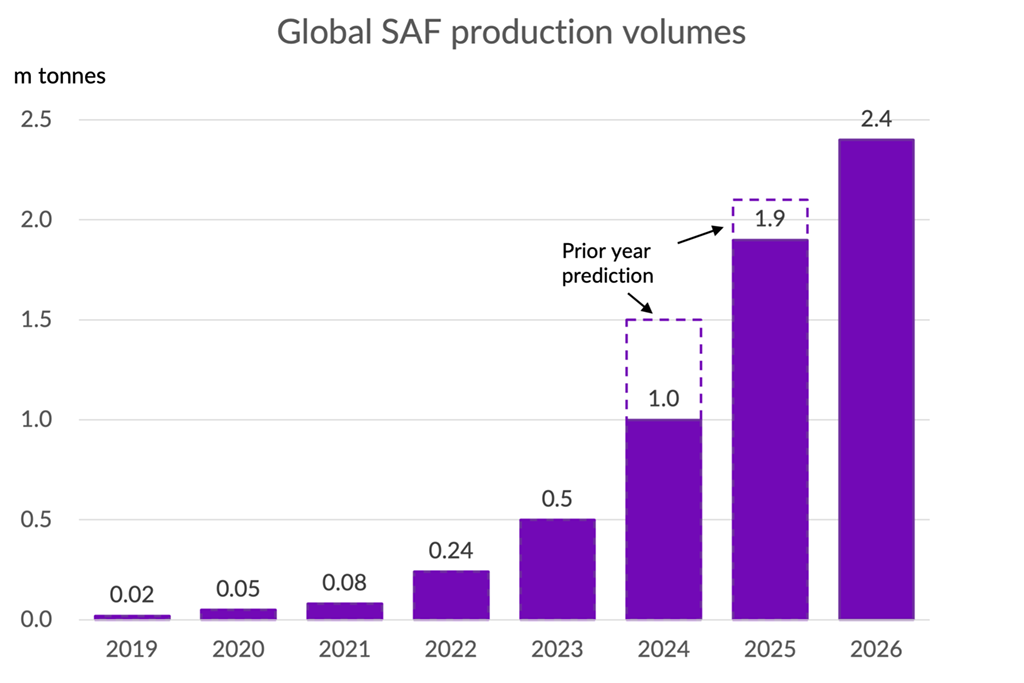

For the airline industry specifically, the only areas where things seem to be “going to plan” are the introduction of new taxes, emissions charges and mandates for Sustainable Aviation Fuel (SAF). So far, the efforts of some airlines to see targets softened seem to be making little headway with politicians. Meanwhile, not much progress was made in addressing shortfalls in the ramp up of SAF, with global production volumes once again falling short of IATA forecasts (see following chart). IATA seem to be taking a more cautious approach this year to their prediction for next year’s SAF volumes. But even if that forecast gets delivered, that will still only amount to 0.7% of overall fuel volumes.

There is no shortage of projects from companies trying to build plants to make SAF. But too many are getting stuck at the pre-FID (Final Investment Decision) stage, due to a lack of funding. They typically need $30-50m of equity finance to do the detailed design and engineering work to get themselves into a position to raise the $500m+ of project finance that is required to build a commercial scale facility. That’s too big for early stage venture capital investors, but the projects are not yet mature enough for risk averse institutional investors. I’m trying to do my bit to help bridge that gap through my work with SkiesFifty. What is clear is that 2026 will be a critical year to get projects to FID to give any chance of hitting the production volumes envisaged by the industry’s sustainability roadmap for the early 2030s.

2026 will also be a crunch year for the CORSIA emissions offsetting scheme. Airlines have been quite slow in sourcing credits and in fact, very few are available even now. But with the first credits relating to the 2024-26 emissions period needing to be retired by January 2028, time is running out and I think 2026 will be the year that airlines start getting really serious about CORSIA.

AI implications for aviation

Many of you will I am sure be thoroughly sick of hearing about AI. At times this year, it has seemed that nobody could talk about anything else. Nevertheless, a post that purports to review the key events of 2025 and the prospects for the future has to address what I think is the single biggest issue of our time.

I have a long history with AI in fact. I had a place to do a Masters degree in AI at Edinburgh University back in 1987, after finishing my Maths degree at Cambridge. In the end I didn’t take up the place and went into Strategy Consulting instead. Probably a good decision as 1987 to 1993 was officially the “second AI winter”. In any case, I continued to maintain an interest in developments and got myself properly back up to speed with the mathematics and technology in 2017 by taking a number of online courses. I became convinced that the technology was going to be revolutionary and we started working with some AI startups on applications in IAG at around that time. One of my favourites initiative was applying AI to cargo pricing - from memory we demonstrated a 1.5% uplift in yields from the initial version.

I mention all this history just to say that I’m not just jumping on the AI band-wagon, I’ve been thinking about this since long before it became topical. “So why didn’t you buy Nvidia stock 8 years ago then?”, I hear you ask. Well, in fact I did. The shares did basically nothing for the following four years, but the last three years have been quite extraordinary. Despite being a believer, I’m genuinely in two minds about whether the current valuations for AI companies are fully justified or represent a bubble that is going to burst. For what it is worth, I’ve taken profits on my AI investments and de-risked, but I am still overweight. Make of that what you will.

I’m much more sure of the revolutionary impact that AI will have on the world in general and on aviation in particular. Ask any head of revenue management what would be the value of being able to clone his or her best employees and you get a lower bound on the potential in just one area. The applications in operations and customer service are also transformative. The best airlines won’t just focus on automation of existing processes, they will take the opportunity to reinvent things.

The last great technology disruption, the internet, contributed to the commoditisation of aviation, with customers seeing options primarily ranked by headline price. That also led to the inexorable rise of “unbundling” - if an airline continued to try and sell on an “all inclusive” basis, their flight literally wouldn’t be seen by most customers. That paradigm is going to be disrupted again by AI. People are not going to be doing their own searches for holidays and flights, they will increasingly entrust that to their AI agents, which will be much more sophisticated buyers of travel than their human clients ever were. The optimist in me hopes that this means that airlines will once more be able to compete on the basis of value, not just price, and that “dark patterns” which exploit human psychological biases will become a thing of the past.

Wrapping up

One of the benefits of leaving my end of year review to literally the last possible day is that I have a non-moveable deadline, which is fast approaching. This post is already more than long enough and although I could go on all day about the potential of AI, I’m going to leave things here.

As we move into the new year, there are many things to worry about, but also many reasons to be hopeful. For myself, I’m going to choose to remain optimistic, and I wish you all an exciting and prosperous New Year.