Changes in the UK - China air travel market

Recovery in total passenger volumes on UK - China flights

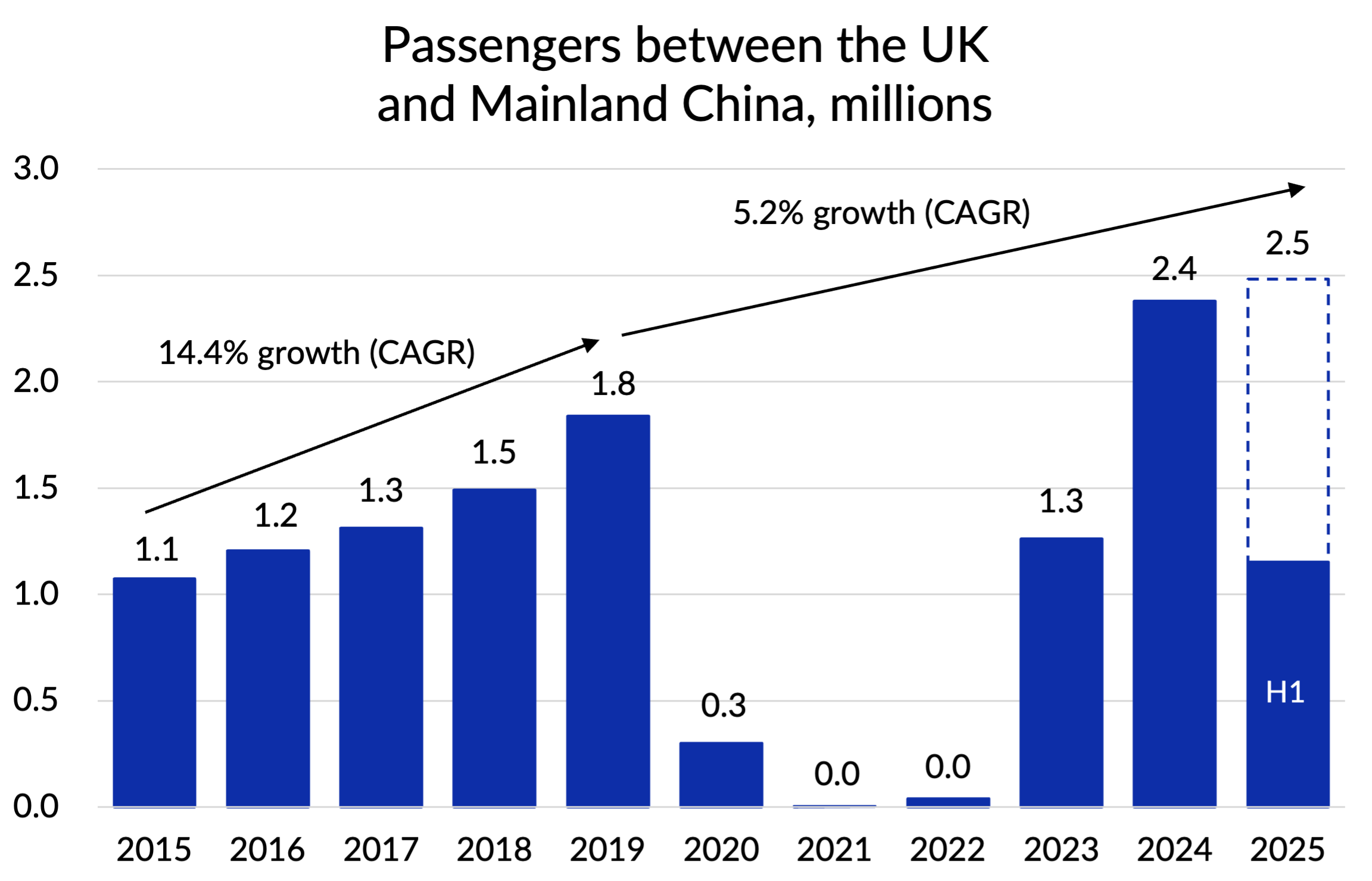

The Chinese aviation market was one of the last to recover from the pandemic, but the recovery finally kicked off in the second half of 2023. For 2024 as a whole, passenger numbers between the UK and Mainland China were almost 30% higher than in 2019. The first half of 2025 saw further growth of 8% compared to the previous year. Using published capacity for the second half and assuming load factors remain in line with the previous year, passenger numbers are likely to hit 2.5 million for the full year. That’s 35% higher than 2019.

It is fair to say that 35% growth over six years is less impressive than it sounds, representing a compound annual growth rate of 5.2%. That’s quite a bit lower than the 14.4% per annum growth recorded between 2015 and 2019.

Source: CAA passenger data, GridPoint analysis

The truth is murkier than the headline statistics suggest

However, these airport statistics show the number of passengers on flights between the UK and China. Some of those will be making connections to other countries, and some passengers between the two countries will be travelling via third countries.

To get another view on the market, I’ve used figures from the UK government’s statistical body, the Office for National Statistics (ONS). They publish statistics for both the number of trips to China made by UK residents and the number of Chinese residents visiting the UK. I’ve put those figures on the following chart (assuming two flights per trip) and for reference I’ve also marked a dot for the total passenger numbers on UK-China flights that we’ve just been looking at.

You will see that far from showing a story of recovery and growth, the total “O&D” market (passengers travelling between the UK and China ignoring routing) is down from 3.3 million in 2019 to only 2.3 million in 2024, a decline of 30%. The UK outbound market has pretty much recovered (96% of 2019) and grew in 2024, but the inbound market from China has halved and didn’t show much sign of further recovery in 2024, at least according to these statistics.

Source: ONS, GridPoint analysis

Changing travel patterns

From the previous chart, you can see that the mismatch between passengers on UK - China direct flights (the bars) and the true size of the O&D market (the dots) has changed hugely since 2019. Back then, a large number of UK-China passengers were travelling via third-country hubs in Europe. Comparing the O&D figures with the statistics on direct flight volumes suggests it was around half the market.

By contrast, in 2024 it looks like there were more passengers on direct flights than could be accounted for by O&D demand. That’s possible of course if travel to or from third countries was taking place via hubs in the UK or in China.

The massive shift in travel patterns has been driven by the war in Ukraine and the inability of European airlines to overfly Russia, which has destroyed their competitiveness relative to Chinese airlines, who continue to overfly Russia as normal. The longer journey time is an issue for passengers by itself of course, but it also adds considerably to costs. We’ll come back to this topic later, but before we do let’s drill down into the collapse of the inbound Chinese market.

What’s happened to the inbound Chinese market?

Visit Britain publish figures for the composition of inbound travel from China. The total figures don’t quite line up with the ONS ones for some reason, despite being partly based on them, but they tell the same story of a halving of demand since 2019. You can see from the following chart that the big driver of the decline was the drop in holiday visits to the UK, which have fallen by 62%. The student and business markets have also declined, down by 40% and 42% respectively.

Whilst total Chinese outbound tourist travel is reported to have largely recovered, hitting 82% of 2019 in the first three quarters of 2024 according to Travel China Guide, the recovery has been focused on nearer destinations, with long-haul markets such as the UK lagging due to cost and visa issues.

Source: Visit Britain, Gridpoint analysis

Rising immigration from China

The only segment of the inbound Chinese travel market to see growth between 2019 and 2024 was the “Visiting Friends and Relatives” (VFR) segment, where trips have actually grown by 18%. That’s about 20,000 extra annual visits. Estimates by the ONS put net migration to the UK from China during the 12 months to June 2023 at 89,000 people. It’s quite easy to see how this kind of annual influx is driving additional VFR trips from China.

New services to non-London airports

Within the overall UK to China passenger numbers, growth has been strongest at non-London airports. Back in 2015, there weren’t any direct flights at all. This summer, there are daily flights between Manchester and both Beijing and Shanghai and even 4 flights a week between Edinburgh and Beijing. As a result, passengers on direct flights to China from non-London airports have tripled since 2019.

This development may also be partially linked to the Russian overflight issue as the European hubs such as Amsterdam and Helsinki used to be particularly competitive for non-London O&Ds.

Source: CAA passenger data, GridPoint analysis

Chinese airlines increasingly dominant

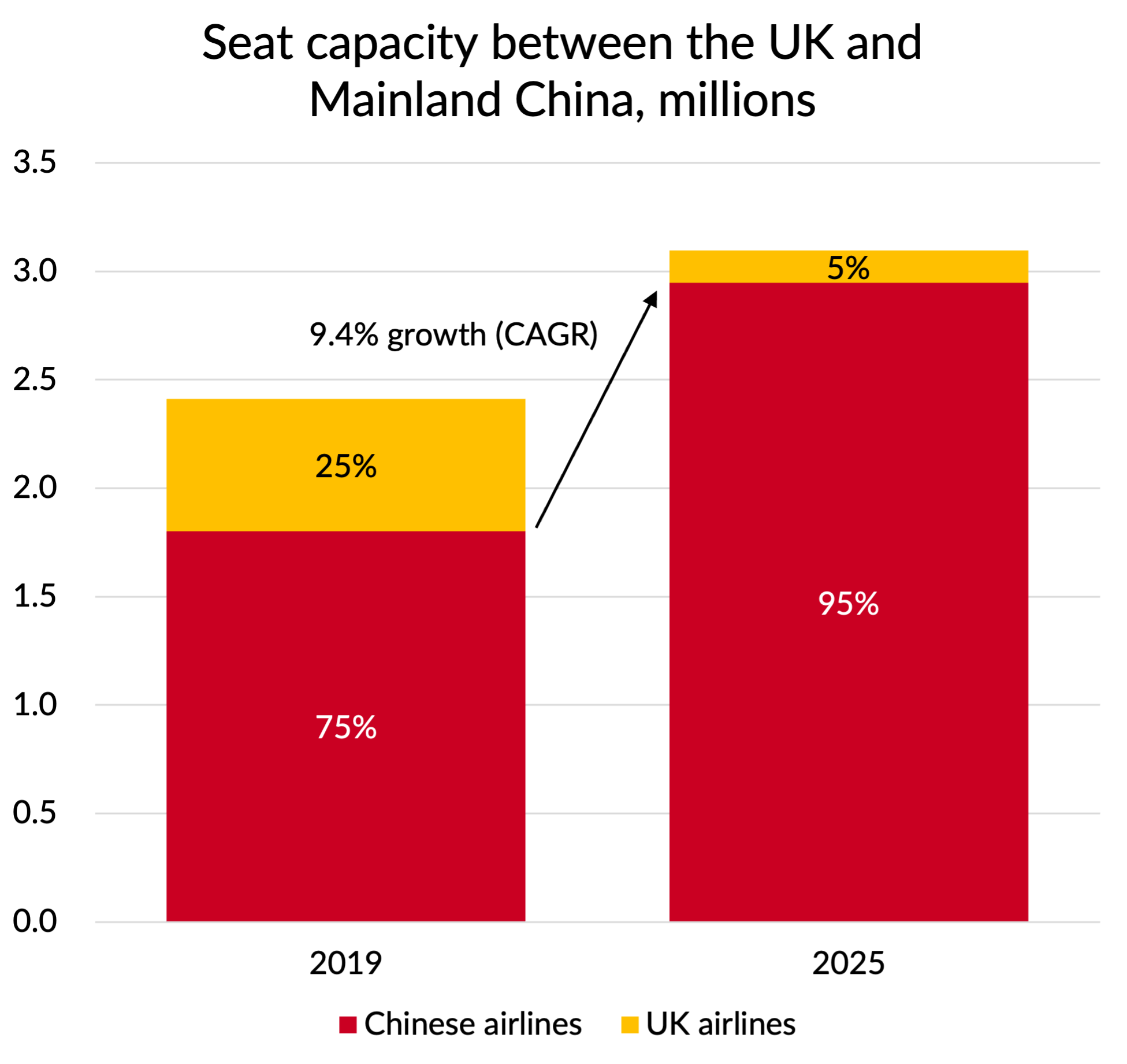

All of the new services to the UK regions are operated by Chinese airlines and they are increasingly dominant even to London. Even back in 2019, Chinese airlines accounted for 75% of total seats operated to the UK. But the issues with Russian overflights have driven Virgin Atlantic to withdraw completely from the market and British Airways has withdrawn from Beijing, leaving BA’s daily Heathrow to Shanghai service as the sole UK operated flight. That contrasts with the 16 daily services operated by Chinese airlines in the summer peak, giving them a seat share of 95% in 2025.

Source: published schedule data, GridPoint analysis

The story of Chinese dominance is not confined to the UK of course, as all European airlines have been affected by the overflight issue. The number of flights operated in 2025 between Western Europe and Mainland China is essentially unchanged from 2019. But the split between those operated by the Chinese airlines and those operated by Western European ones has shifted markedly.

Source: published schedule data, GridPoint analysis

The only European airline that has not significantly cut back its flights to China is Turkish Airlines. In fact they have increased slightly, benefiting from the geographical position of their Istanbul hub which is sufficiently far south and east not to need to overfly Russia on a great circle routing.

The USA takes a more protectionist line

US airlines have also been affected by the inability to overfly Russia, and have suspended their China flights from their east and central USA hubs. They continue to serve the market from their hubs in the south and west of the USA, which are much less affected.

In contrast to their counterparts in Europe, the US government has taken a much more protectionist line. Chinese airlines have been heavily restricted on the number of flights they are permitted to operate, due to their “unfair advantage”. In some cases, flights have been permitted, but only where Chinese airlines agree to avoid Russian airspace too.

The result of this policy is that in relative terms, US airlines have actually slightly strengthened their position in the market compared to their Chinese competitors. However the protectionist policy has contributed to the total market capacity remaining significantly down compared to 2019.

Source: published flight schedules, GridPoint analysis

Closing thoughts

I’d like to end this piece on a positive note, but it is hard to find anything other than bad news for the UK and European airlines and economies here.

Despite apparently positive headline passenger number figures for the UK, inbound tourism and business travel are both still considerably down on 2019. What travel is happening is doing so on Chinese airlines, not European ones. If the overflight issue is ever resolved, it will be tough for European airlines to rebuild their positions against entrenched Chinese airlines.

The main bright spot I think is for businesses and travellers in the Manchester and Edinburgh catchment areas, who finally have some non-stop flight options to cities in China and no longer need to make connections in London or at other European hubs.

As long as they don’t mind flying on Chinese airlines, of course.