Record second quarter results at IAG

Pre-tax profits of €1.2 billion for the quarter

Three months ago, when IAG reported its Q1 results, I expressed some puzzlement about the company's "low-balled" outlook statements for the full 2023 year. IAG’s original guidance, published on February 24th, was for operating profits in the range €1.8 - 2.3 billion, and after reporting Q1 they updated this to "above the top end of previous guidance". So “more than €2.3 billion” in plain speak. In the article linked to above, I explained why I thought a figure of around €3.5 billion would be a more reasonable number, given performance in Q1, together with the company's own guidance on unit revenues, unit costs and the outlook for fuel costs.

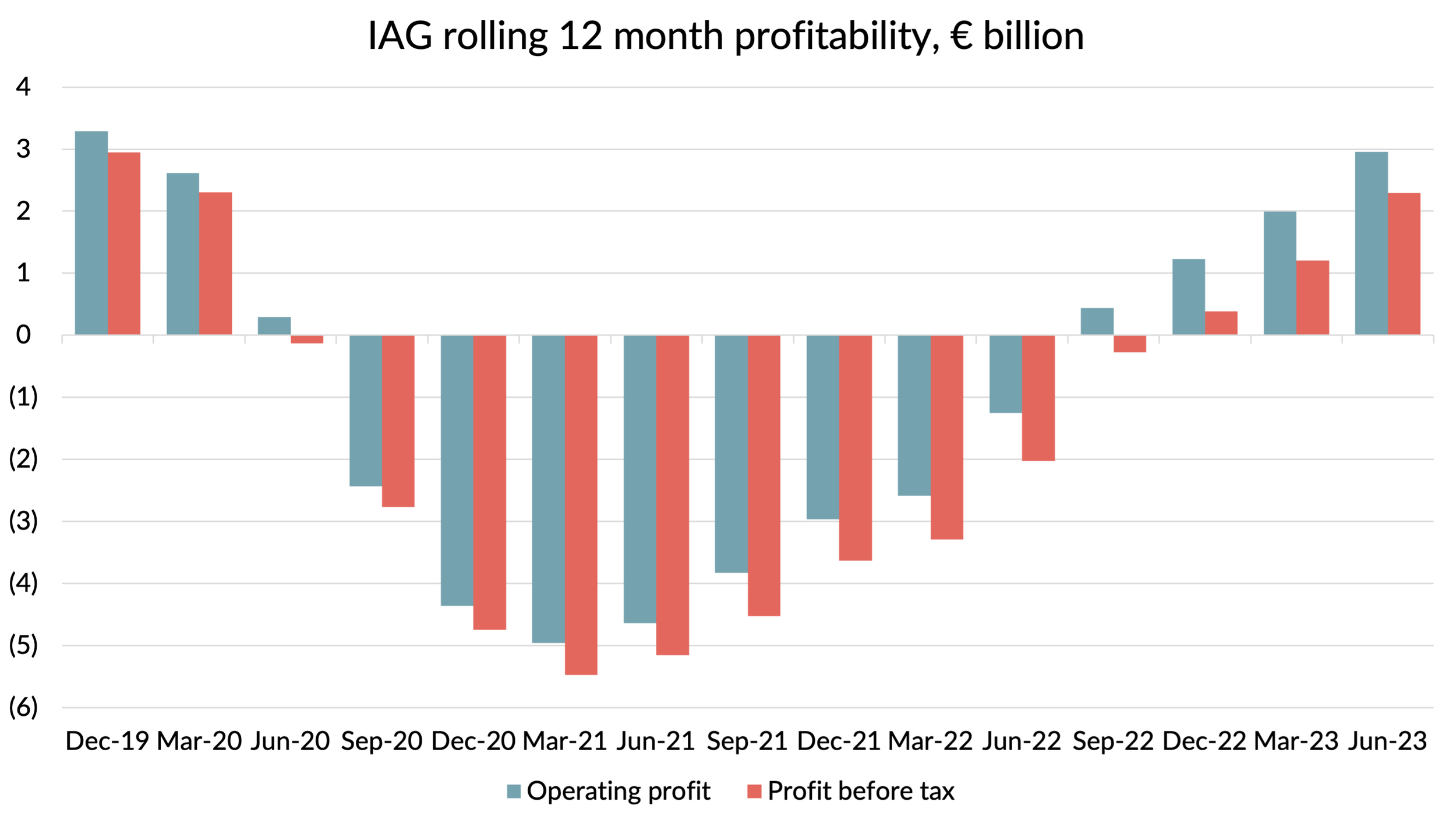

So we now have Q2 results and boy did they confirm what I said three months ago. Operating profits for the quarter came in at €1.25 billion. Q2 is normally a slightly better than averagely profitable quarter for IAG, for example back in 2019 it accounted for about 30% of annual profits. The cumulative figure for the first half now stands at €1.26 billion. With the company's most profitable quarter (Q3) still to come, even my €3.5 billion figure now looks very conservative. In 2019, H1 made up almost exactly a third of full year profits, so by this crude yardstick a full year profit of €3.8 billion might be expected, unless there is a collapse in profitability in the second half.

The results confirm the continued strong recovery in profits from the depths reached during the pandemic.

Where the improvement came from

My own spreadsheet, which gave me the €3.5 billion full year figure, had a Q2 operating profit of just under €1 billion. So the actual performance was 30% higher. That outperformance was more than fully accounted for by better passenger revenues. Three months ago, the company said that Q1's 14% yield performance versus 2019 was "holding up quite well" into Q2. The outturn was quite a bit better than this suggested, with an 18% increase in yields compared to 2019. Load factors were also 1.4 points higher than 2019.

I expected Cargo revenues to be much weaker, but they were a bit worse than I thought. With wide-body capacity back to pre-pandemic levels, cargo yields are quickly reverting too. They were still 28% higher than the same quarter in 2019, but that’s a far cry from the doubling that happened during the pandemic.

Non-fuel unit costs were also a little disappointing, decreasing by 2.7% compared to last year. With the company sticking to its guidance for a full year decrease of 6-10%, and a cumulative H1 decline of 7.6%, they'll need to do better than they did in Q2 in the second half if they are to hit their guidance on costs.

Outlook for H2 and the full year

What operating profit do I now think they'll hit for the full year? Well, with the usual caveats on not being legally qualified to provide investment advice and none of this representing an investment recommendation, I will say that my spreadsheet now has a figure of €3.7 billion pencilled in for the full year. Despite the strong Q2 out-turn, I'm slightly more cautious than I was about the second half.

My increased caution about H2 profits is mainly down to fuel costs, with forward fuel prices for the second half about 20% higher than they were three months ago. IAG apparently mostly missed the opportunity to hedge when prices were lower. Q3 is still only 69% covered, up just 6 points on three months ago. This seems unusually low to me, given that 80% of Q3 passenger revenue is already sold. For comparison, this time last year, IAG was 81% hedged for Q3. Might be time to ask a few pointed questions of the hedging team.

Fuel hedging questions notwithstanding, IAG should be congratulated on a great set of results. An operating margin of 16.3% was a record, beating the 14.6% delivered back in 2018. It also handily outperformed the 9.6% reported on the same day by Air France - KLM.

The company did not update its full year profit guidance, which officially therefore remains at "more than €2.3 billion". They say that they "continue to be mindful of wider uncertainties that might affect the full year".

I guess the negotiations with labour unions have still not been concluded.