Pandemic winners and losers in Latin America

A profile of Latin American aviation

Boutique executive search firm Venari Partners has asked me to profile the aviation industry of some of the regions that get less coverage than Europe, North America and Asia.

I’ve already taken a look at Africa and the Middle East, so the final piece in this series of posts will be all about Latin America.

Before I get going, I need to clarify what definition I am using for the Latin America region. For the purposes of this article, Mexico is in Latin America, not North America. I also decided to exclude the Caribbean from my definition, except as a destination from the rest of Latin America. As an aviation market, the Caribbean is pretty much a pure leisure market and is dominated by the North American and European carriers, bringing tourists from their home regions.

With that out of the way, I will start with an overview of the industry in 2019.

The big markets

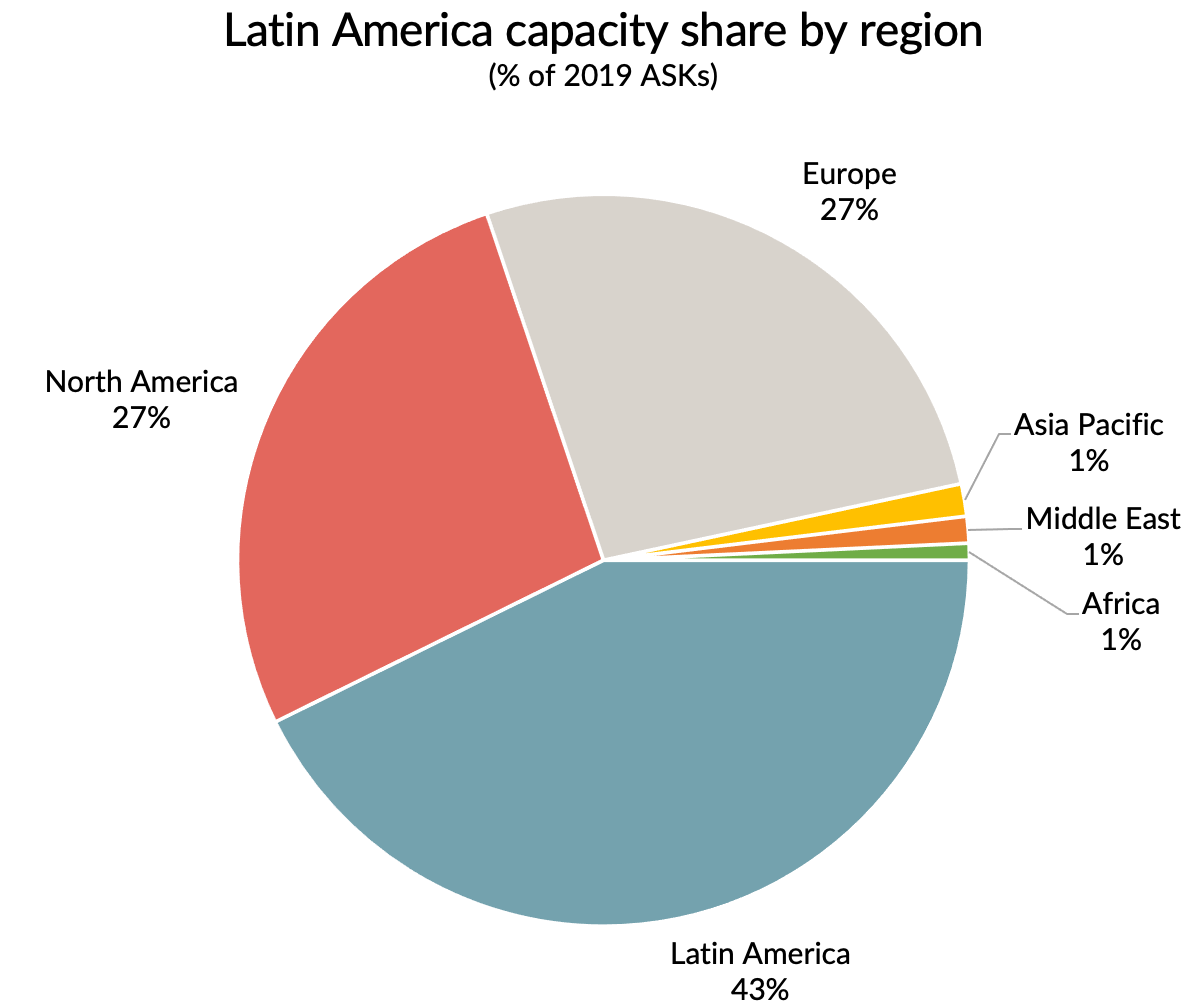

As is usual, the biggest part of the market was made up of intra-regional flows, which in 2019 accounted for 43% of capacity measured by ASKs. Intra-regional flows were even more important for airlines based in the region, making up 70% of their capacity. That is because the other two big markets, North America and Europe, are biased towards non-Latin American carriers, who account for 58% of North American and 77% of Europe capacity.

Source: OAG, GridPoint analysis

Within the region, there are two big domestic markets, Brazil and Mexico. Between them, they made up almost half of intra-regional capacity in 2019. That has risen to over 70% in Q4 2020 as domestic demand and capacity has returned much faster than international.

The big airlines

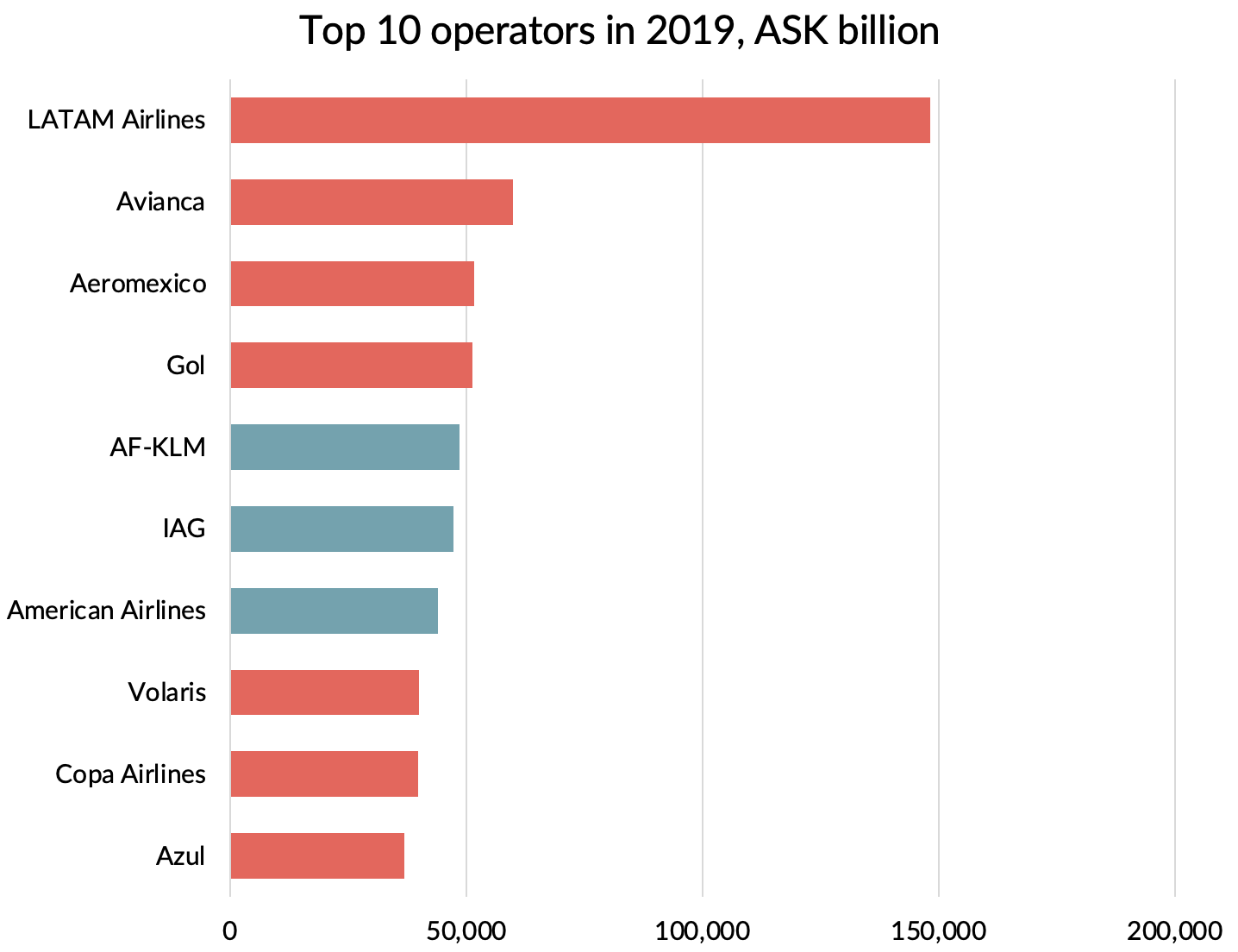

The top 10 airlines in terms of ASKs operated to, from or within the region are mostly based in Latin America, with LATAM by some margin the biggest operator.

Three big foreign operators also feature due to their size on routes to Europe and North America. I’ve coloured them blue in the chart below.

Source: OAG, GridPoint analysis

Looking only at the carriers based in the region, LATAM was unsurprisingly the number one player by revenue in 2019. The carrier was more than twice the size of the next biggest, Avianca.

In the chart which follows, I’ve coloured the low-cost airlines in red, of which GOL was the biggest by revenue last year.

Source: Company reports, GridPoint analysis. Interjet figures are for 2018.

The largest airlines reflect the weight of Brazil and Mexico in the region. GOL and Azul are both based in Brazil. Aeromexico, Volaris, Interjet and Viva Aerobus are all Mexican.

LATAM was formed from the merger in 2011 of Chile-based LAN with Brazilian network carrier, TAM. Prior to the merger, LAN had leading positions in Chile and Peru but lacked a strong position in any of the bigger markets. It also lacked a hub capable of supporting its ambitions to grow its position on routes to Europe and the USA. Despite the size of the Brazilian market, Sao Paolo is far from an ideal hub for this. Although it is Latin America’s second busiest airport after Mexico City, it is too far south and highly slot constrained. After the merger, LATAM talked about developing a new hub in the north of Brazil, but that plan had to be put on hold when Brazil went into recession in 2015. Nevertheless, prior to the crisis LATAM was the leading Latin American carrier to both North America and to Europe.

The only three of the top 10 airlines which don’t count Brazil or Mexico as a home market are Colombian-based Avianca, Aerolineas Argentinas and the Panamanian carrier COPA.

COPA focuses on connections between North, Central and South America through its hub in Panama, with an emphasis on connecting small markets that are too small to be served direct.

Avianca connects the same regions through its hubs in Bogota and San Salvador, which are also well located for serving these flows. Unlike Panama, Colombia has a domestic market, in which Avianca has a strong position. However, the market is relatively small, only 14% the size of the Brazilian domestic market in ASK terms. In 2019, Avianca was the second biggest Latin American operator to North America and to Europe, after LATAM. Prior to the crisis, it had a hub in Peru, but that has been shut down now.

Financial performance in 2019

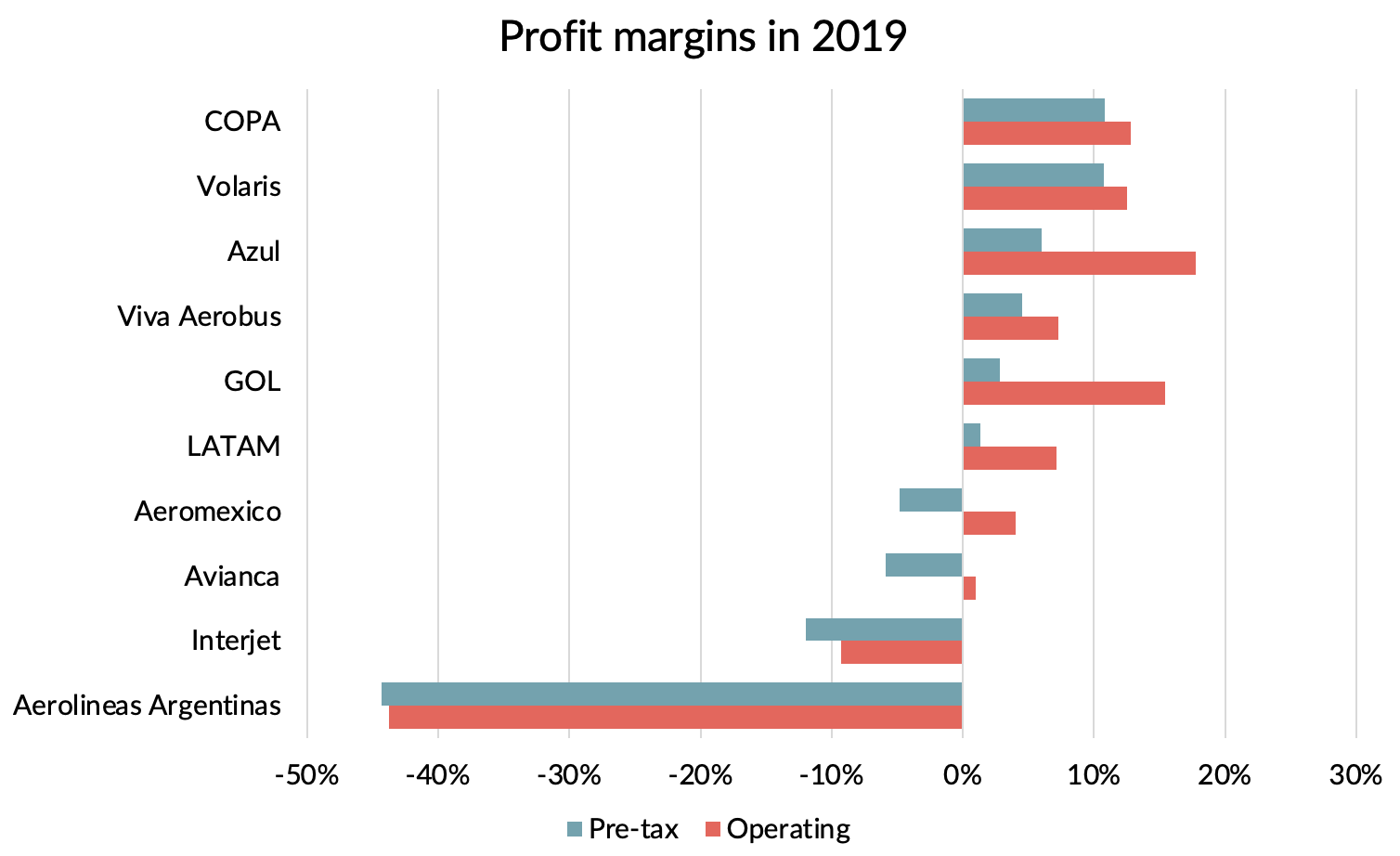

LATAM may have been the biggest airline, but they were middle of the pack when it came to profit margins. The award for highest operating margins went to the Brazilian low-cost carriers, Azul and GOL and the prize for best pre-tax margins went to COPA and Volaris.

Source: Company reports, GridPoint analysis. Interjet figures are for 2018.

COPA’s niche connecting smaller markets between North, Central and South America has been a profitable one. The airline doesn’t have the highest operating margins, but its low debt levels meant it topped the table for pre-tax margins in 2019.

Aeromexico and Avianca were both profitable at an operating level, but with such small margins that once financing costs are taken into account, both were loss-making at the pre-tax level.

The most recent figures I have for Mexican point to point airline Interjet are for 2018. They were making a thumping loss back then and I’m fairly sure that 2019 figures were even worse.

But the prize for value destruction must go to state owned Aerolineas Argentinas. I’m pretty sure I have interpreted their Spanish language accounts correctly, although the size of their loss seems hard to believe. When I was checking my rather imperfect understanding of Spanish accounting terms, I was amused by Google Translate’s rendering of “Pérdida bruta” (gross loss) as “stupid loss”. Hard to argue with that.

Cost competitiveness

It is not straightforward to compare unit costs due to differences in business model and geographical mix. For example, GOL estimate that their unit costs are 15% higher than international benchmark, Ryanair, due to Brazil specific issues such as taxes and infrastructure limitations. International flying incurs additional costs compared to domestic operations.

What does seem clear to me is that the Mexican airlines Viva Aerobus and Volaris live up to their “ultra-low-cost” positioning. At the other extreme, Avianca, Aeromexico and especially Aerolineas Argentinas look high cost.

COPA’s highly successful business model also seems to come with quite high unit costs given the stage length. However, its focus on connecting small markets that cannot be served direct has consistently delivered high enough unit revenues to make good money, despite this.

LATAM sits right on the line of average costs, adjusted for stage length.

Source: Company reports, GridPoint analysis

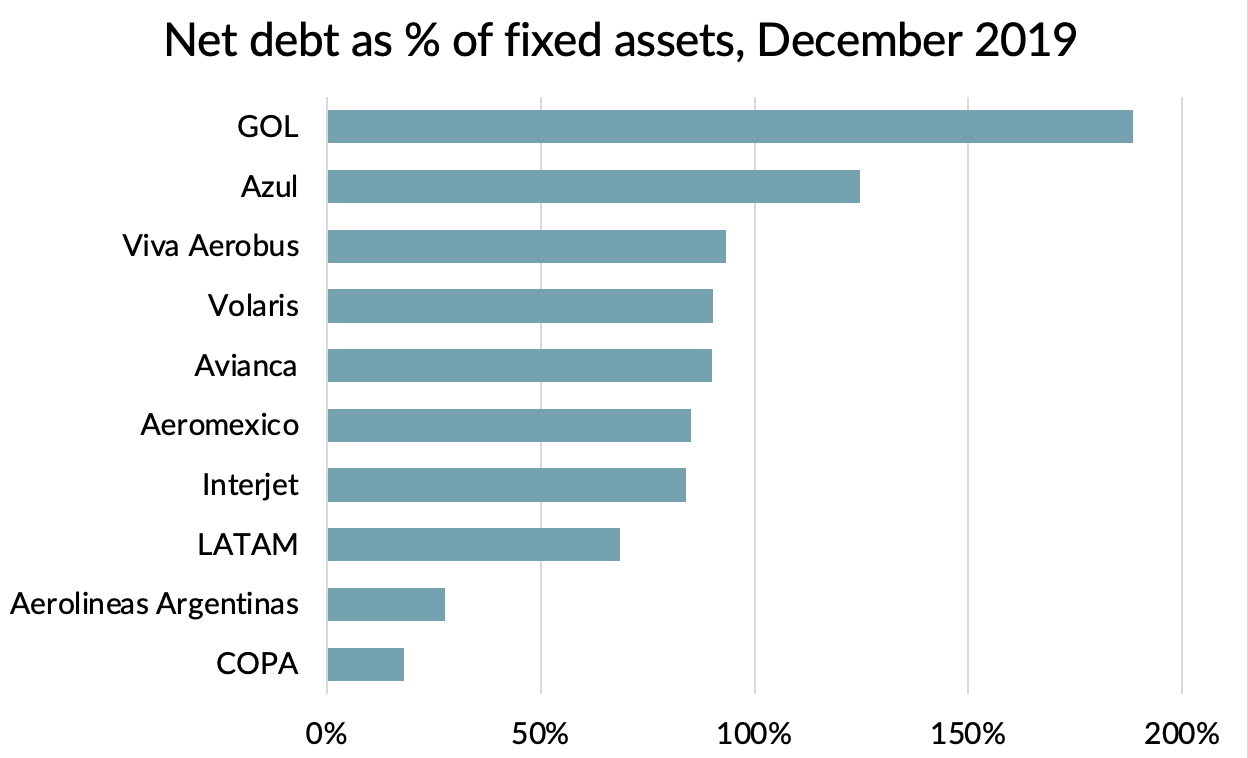

Many airlines in the region were unprepared for a downturn

Debt levels at airlines across the region were generally high before the crisis. Whilst GOL and Azul had strong operating margins in 2019, they also had very high debt levels. That is the legacy of earlier years when they made big losses. Even before the pandemic struck, both carriers had debts which exceeded the value of their aircraft and other fixed assets.

State owned Aerolineas Argentinas appeared to have low debt levels, despite a history of heavy losses. I assume that the Argentinian government has been funding the airline with equity.

LATAM’s balance sheet has been helped in recent years by a $600m equity injection from Qatar Airways, followed by $1.9 billion more from Delta Airlines. The company has exploited its strong market position in Latin America to extract cash from foreign carriers as a price for entering into alliance relationships.

COPA stood out in terms of balance sheet strength, benefiting from a strong track record of profitability over many years.

Source: Company reports, GridPoint analysis. Interjet figures are for 2018.

Whilst debt levels are important, even more critical for withstanding the pandemic was a strong cash and liquidity position. Many airlines in the region failed that test and immediately fell into bankruptcy when the pandemic hit.

I’ve coloured the carriers that have gone bust in red on the following chart which shows cash levels as a percentage of revenue going into the crisis. With the exception of state-owned Aerolineas Argentinas, every carrier which had cash below 20% of revenue has filed for bankruptcy protection.

Source: Company reports, GridPoint analysis. Interjet figures are for 2018.

Latin America stands out from other regions in that for the most part governments have not come to the aid of the industry. Instead, the weaker carriers have been forced into immediate restructuring. LATAM, Aeromexico and Avianca are using the US Chapter 11 bankruptcy process, which sees them continuing to operate, whilst renegotiating their debts and other contracts.

When these carriers emerge from Chapter 11, they will be smaller and lower cost airlines than before. Avianca are planning to emerge with only 70% of the capacity they had in 2019. LATAM’s capacity reductions seem smaller, maybe in the 10-15% range. Aeromexico are said to be shedding over 35% of their aircraft, although biased towards their regional jets so the capacity impact will be more likely in the 15-20% range.

As far as I can tell, Interjet has not formally declared bankruptcy, but it stopped paying its bills some time ago and almost all of its aircraft have been repossessed. Sounds like bankruptcy to me and, unlike the others, one that is virtually certain to be terminal.

Recovery in demand and capacity very different across the region

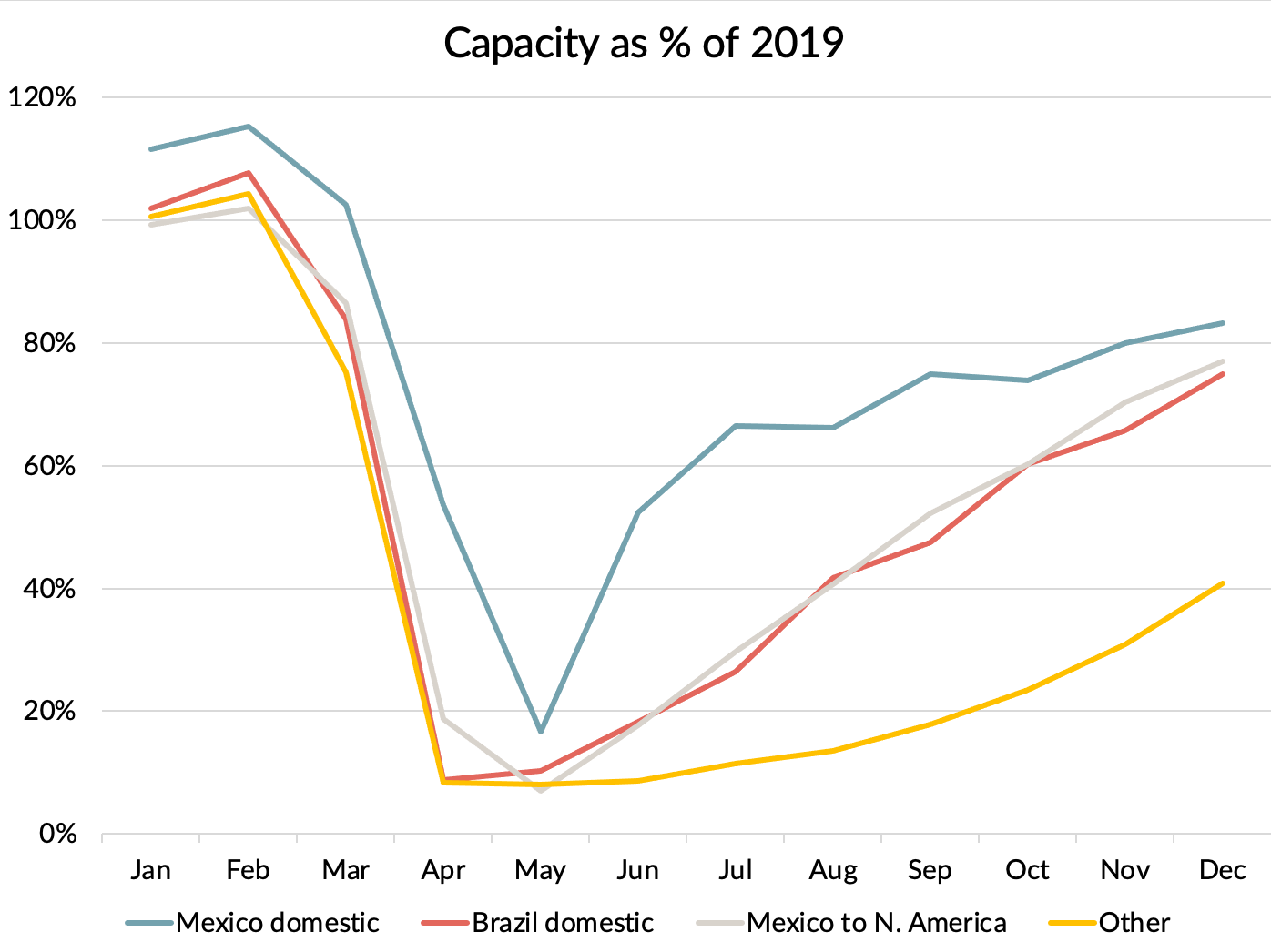

The experience of Latin American airlines in the pandemic has been heavily driven by travel restrictions. Like elsewhere in the world, domestic markets have fared better and recovered faster. Travel to the USA from Brazil is still not permitted, but the border has remained open for air travel from Mexico. Those differences have been reflected in the pace at which airline capacity has been added back.

Source: OAG, GridPoint analysis.

Between carriers, there have been very divergent experiences according to business model, customer mix and competitive strength, on top of the differences in geographical exposure.

The most striking example of this is in the Mexican domestic market. The demise of Interjet and shrinkage of Aeromexico have opened an opportunity for Volaris and Viva Aerobus to move into new markets and more aggressively rebuild their capacity. They have both got back to 2019 capacity levels with good load factors already, despite the overall reduction in market volumes. Volaris reported a domestic load factor of 84% in November, pretty much in line with last year. Whilst both carriers have benefited competitively, to me it is Volaris that stands out as the winner, having cemented their leadership position in Mexico.

In Brazil, LATAM has been squeezed by the low-cost players, although it remains a three way fight, with no clear leader. How effectively LATAM uses Chapter 11 to reduce its costs will be a big driver of how well it can fight back against its low-cost competitors as demand returns.

Source: OAG, GridPoint analysis.

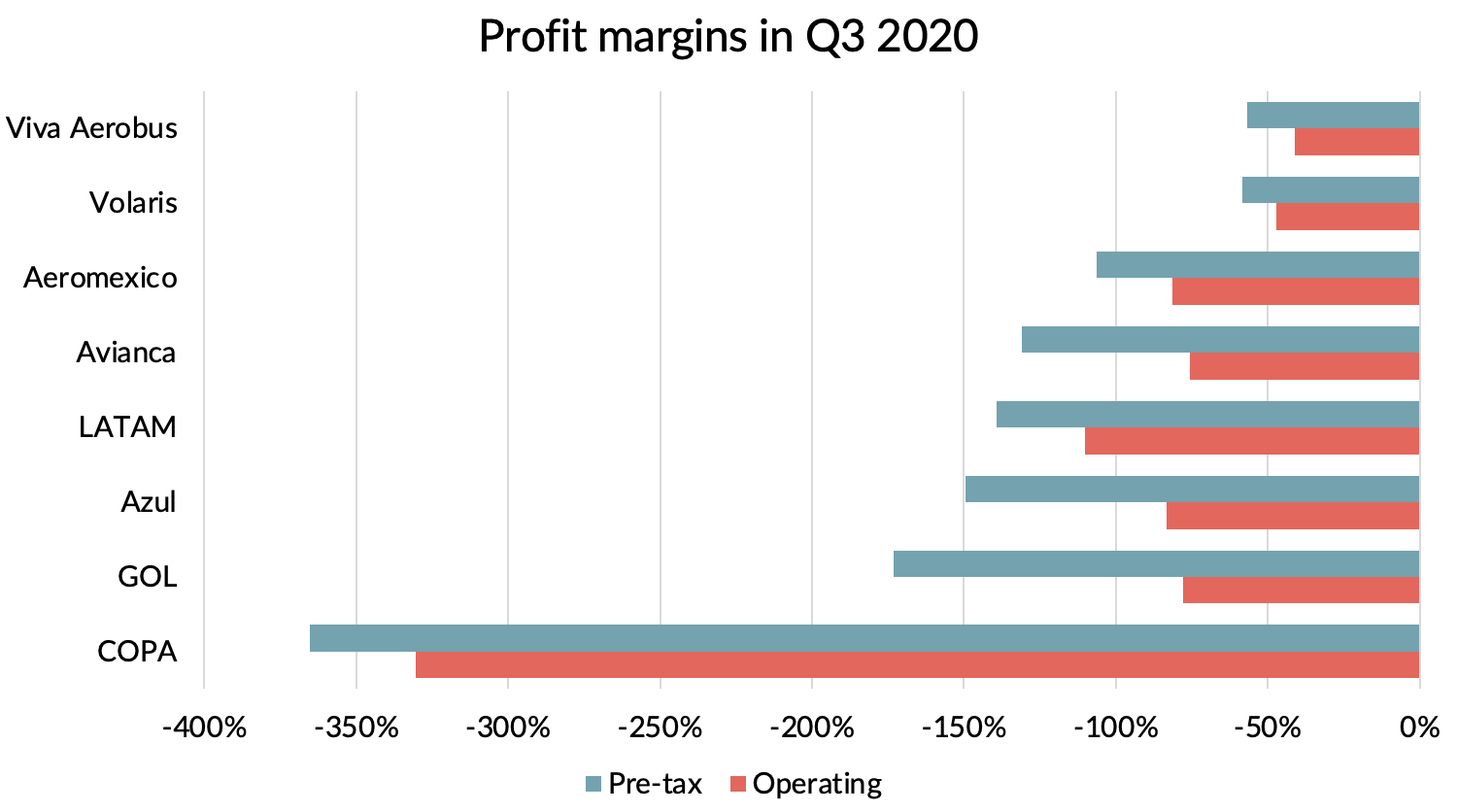

Profitability still a long way away

Although in some markets there are encouraging signs of a recovery in capacity and passenger volumes, there is still a long way to go to rebuild profitability.

As one of the airlines leading the way on recovery, it is instructive to look at performance at Volaris. In the September 2020 quarter, Volaris reported capacity down 25%, passenger volumes down 35% and revenue down 50%. Unit costs were worse by 21%, partly due to adverse exchange rates. That led to a negative operating margin of 47%. Horrible as that sounds, that was actually one of the best performances in the region (see chart below).

Source: Company reports, GridPoint analysis

I don’t have 2020 figures for the three biggest loss-makers before the crisis, but I am sure they are ghastly.

Amongst the rest, the worst performer was COPA. That is not surprising as they were effectively grounded for the entire period due to government restrictions.

The Brazilian low-cost carriers are the next worst, with their high debt levels continuing to be a drag on profitability at the pre-tax level. GOL provided some guidance on their outlook for Q4 and Q1 of 2021, forecasting that liquidity would be on a slightly rising trend through the period. The shares of GOL and Azul have both doubled in price since the end of October, so the market is clearly buying the story of impending recovery.

Will the virus spoil the recovery story?

Whilst vaccines are expected to come to the rescue in 2021, in the near term there is plenty of scope for rising cases in the region to choke off the demand recovery, as has been seen in Europe.

Cases in the United States continue to rise, which is a concern given the importance of that market for carriers in the region. It is hard to know whether the reported figures for COVID cases in Latin America are reliable or comparable between the different countries. However, it seems clear that infections have been rising in Mexico and Brazil in recent weeks. The following chart shows figures for the case rate, which is the number of new cases in the last 7 days per 100,000 people.

Source: GridPoint analysis of data from the European Centre for Disease Prevention and Control

Place your bets

As we head into 2021, investors will be placing their bets on the speed of recovery and trying to pick out winners and losers as the world’s travel industry gets back to some semblance of normality.

I think the Latin American story provides some interesting clues as to how things may pan out across the rest of the world, with the weakest shrinking or disappearing completely, creating new opportunities for the strongest and most agile competitors.

But don’t forget to buckle your seat belts, there will some bumps ahead before the industry reaches clear air.