Lufthansa’s Italian Adventure

Lufthansa Group agrees to buy Alitalia successor, ITA

On May 25th, Lufthansa Group (LHG) finally confirmed they had reached agreement with the Italian government to acquire a 41% stake in ITA Airways, the new “Italian flag carrier”, formed from wreckage of Alitalia’s latest bankruptcy using a big pile of cash from the Italian government.

The agreement provides for LHG to acquire full ownership in the future, but it can only be forced to do so if ITA’s financial results go to plan. This phased approach is designed to reduce downside risk for LHG and protect it from having to consolidate 100% of the losses during the period before the business can be made profitable. In the meantime, it looks like LHG will have a large amount of control, but it won’t be complete. To avoid consolidating the business into its accounts, LHG will have to keep the accountants satisfied of that fact.

The company released a presentation outlining the main terms of the deal and its plan for ITA, and also responded to questions from analysts on a briefing call. They remained coy on some of the details, but I thought I’d have a go at summarising what they did say and filling in some of the details with my own best guesses.

As is usual for airline consolidation, how the networks fit together and the revenue synergies that can be delivered are at the heart of the deal rationale, so I think that is the right place to start examining the deal.

Network plans and revenue synergies

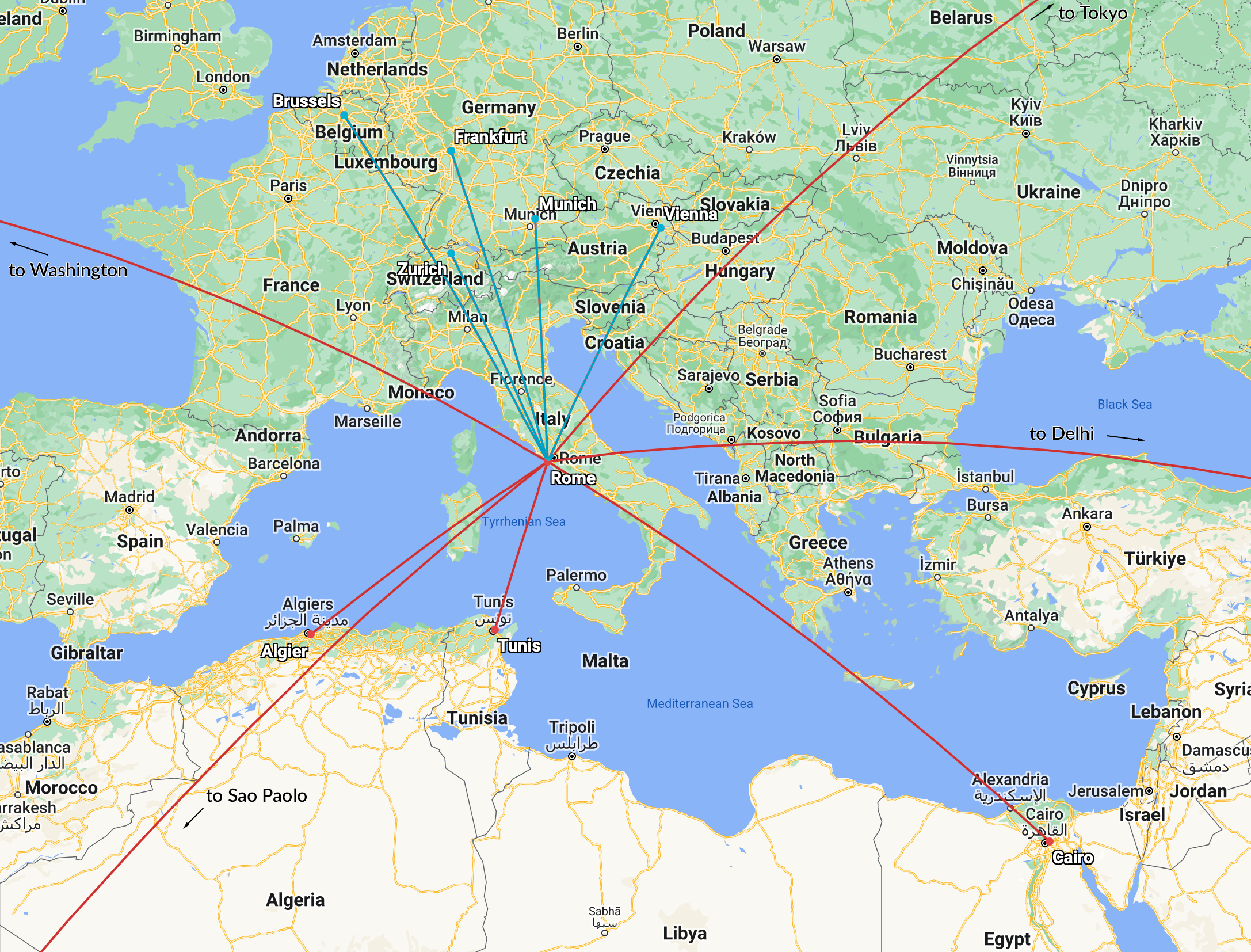

There is a single slide in their investor presentation which covers network synergies, which I’ve reproduced below.

Source: Lufthansa Group investor presentation

The left most panel focuses on connecting ITA’s network into LHG’s hub system. In addition to the dot for Rome, the other dots are LHG’s existing hubs in Brussels, Zurich, Frankfurt, Munich and Vienna.

The centre panel doesn’t add much, if anything. Given that the Middle East wouldn’t even count as long-haul from Rome, I’m not sure what part of the world they won’t be focusing on. I guess all it really says is that their plans for Asia flying are very limited.

It is undoubtedly the case that LHG will be able to substantially strengthen ITA’s schedule on the new “hub to hub” routes. Currently ITA is flying single daily or at most double daily services on these, whilst LHG offers a much higher frequency schedule. The new joint schedule will be slightly better for feeding LHG’s hubs, but offer big improvements in connectivity for ITA’s Rome hub to those points. How much will that help ITA?

“Enhance the short-haul network for the feeding of the hub in Rome”

LHG’s ability to feed the Rome hub from its home markets is strongly influenced by geography. I’ve shown this on the chart below. The blue lines are the feeder services that LHG says it wants to strengthen. In red, I’ve given examples of ITA’s existing non-European services.

I think it is obvious that such enhanced feed services are not going to do much if anything to support ITA’s growth into North America or North Asia, given the amount of back-tracking involved. The detour involved for connections to India and other South East Asia points is much less, but those markets face heavy competition from direct services and much bigger hubs in Turkey and the Middle East.

The geographical logic is stronger for Africa and the Middle East. However, both the Middle East and ITA’s existing African markets are all short-haul sectors, ranging from 1 hour 15 to Tunis to 3 hours 15 to Cairo. That’s not going to be high revenue business for ITA.

I suspect that LHG is planning to launch new long-haul services to sub-Saharan Africa. For example Alitalia used to fly to Johannesburg before the pandemic. LHG has daily services there from Frankfurt and Zurich, but a more southerly hub would be a better connect point for many flows, including from Vienna and Munich. Rome is also well located for targeting Air France’s lucrative traffic flows between France and East Africa.

Finally, we come to South America. ITA currently flies to Sao Paolo, Rio and Buenos Aires and there are some big local markets from Italy to those places. LHG already serves these destinations from its existing hubs - Sao Paolo from Frankfurt, Munich and Zurich, and both Rio and Buenos Aires from Frankfurt and Munich. But Rome would be a better connect point for traffic from points south and east of LHG’s existing hubs. Before the pandemic, Alitalia used to fly to Chile and ten years ago it flew to Venezuela. With LHG’s support, could more points in South America become viable?

Probably. But the truth is that Rome is far from ideal as a location for a hub serving Europe to Latin America. It is only really Southeast Europe that works without back-tracking. In particular, Rome is not a good place to connect traffic from the big Latin American markets of Spain, Portugal, France and the UK. Those are well served by better located hubs, notably Madrid, Lisbon and Paris. Even from Germany, connecting via Rome would be an 800km detour.

In summary, I think stronger feed to Rome from LHG’s hubs and home markets will help support ITA’s existing services to Africa, the Middle East, India and Latin America and may also enable some new services to be launched to those regions. However, I don’t see this as the biggest driver of network and revenue synergies. For that we need to move to the right-most panel in LHG’s presentation, Milan.

The Milan prize

When LHG talk about the deal, it is the value of the catchment area around Milan that clearly gets them most excited. The biggest value that ITA brings to them will be in incremental feed traffic from Italy, especially from the Milan catchment area.

Part of that will come from strengthening LHG’s “network proposition” to customers in Italy. With the addition of a home carrier, LHG’s proposition to corporate customers and frequent fliers will be strengthened. Its ability to market cost-effectively to leisure customers will also be enhanced by more scale and having a broader range of destinations to offer. LHG’s comment about developing the “touristic network” from Milan at the weekend is undoubtedly partly aimed at giving their frequent fliers in the region somewhere to use their points.

The other part of the plan to boost feed to LHG’s hubs will come from ITA’s highly prized slots at Linate airport. Linate is by far the most conveniently located airport in Milan, but operations are artificially restricted by the government to support Malpensa. A maximum of 18 flights per hour are permitted and no flights further than 1,500 km can be operated. When ITA took over assets from Alitalia, backed by money from the Italian government, the European Commission only permitted the transfer of 85% of Alitalia’s slots at Linate. However, that still leaves ITA as by far the biggest holder of slots at the airport. Currently, most of those slots are used on domestic Italian services. Redirecting some of the slots to improve feeder services to LHG’s hubs will boost market share on connecting flows and take traffic away from competing hubs.

North Atlantic

The last big part of the revenue synergy story will be on the North Atlantic.

We’ve already seen that geography means that LHG is unlikely to be able to provide much direct support to ITA’s North Atlantic services with feed from its home markets. But one thing that it can do is to stop undercutting ITA’s prices out of Italy. I haven’t done a scientific review of pricing, but a quick look on Expedia showed LHG undercutting ITA’s direct flights by as much as 30% via its hubs.

A much more important contributor will be the feed and selling support in the USA and Canada that will come from ITA joining A++ and getting the support of the North American partners. Whilst the benefit to ITA of teaming up with strong carriers in those regions is self-evident, I think the situation is a bit more complicated than it appears, due to the way these transatlantic joint ventures work.

Within these joint ventures, incremental unit revenues compared a “base year” are shared amongst the participants, in proportion to their share of capacity. The first problem the partners are going to have is how to agree a sensible base year for ITA. Normally, that would be based on unit revenues for the year prior to joining. But that’s unlikely to work for ITA which is still in “startup mode”, as LHG puts it. The parties will need to agree a base year which represents a sensible “mature year” level of performance, but which also excludes the benefit of joining the alliance, since that benefit is supposed to be shared. Even if a sensible base year can be agreed, perhaps based on old numbers from Alitalia, there is another problem for ITA. Based on its July 2023 capacity, ITA would represent less than 5% of the A++ capacity, so in theory 95% of the benefit of joining the alliance will not accrue to them. 63% will go to United and Air Canada and 32% will go to the rest of the Lufthansa Group.

ITA of course has significant growth plans on the Transatlantic, so their share of the upside will increase a bit from 5% over time. But those growth plans will also represent another tricky negotiating point with LHG’s A++ partners. Capacity levels need to be agreed in these ventures and normally partners take a dim view of one airline pursing aggressive growth plans which are out of line with those of the other partners.

Given the number of terms that need to be agreed, the final division of revenue synergies on the North Atlantic will be a matter of negotiation. Undoubtedly, having LHG’s negotiating clout on their side should get ITA much better terms from United and Air Canada than they could hope to get on their own. But it still seems likely to me that most of the benefit of ITA joining A++ won’t end up in the profit and loss account of the company itself. A significant part will end up elsewhere in the Lufthansa Group and a lot will end up with LHG’s A++ partners.

Cost synergies

ITA will get benefits on the cost side from joining a larger group. Much of that will be on the procurement side, with aircraft and leasing costs being two of the highest profile items. However, these are notoriously complex areas, often with little transparency on deal terms. During the period when the Italian government still owns part of ITA, it will be difficult for them to know whether LHG’s negotiating leverage is being used to get better terms for ITA, or if new aircraft orders for ITA are being used to give benefits somewhere else in LHG’s business.

The same is true on the maintenance, cargo and IT side. LHG will become a supplier of services to ITA on those items. Where the benefit ends up will depend on the transfer price that gets set.

If the deal involved LHG taking full ownership from day one, these questions about where synergies will accrue wouldn’t matter, or at least they would matter less. Even after it ceases to be a shareholder, the Italian government might still care about where the profits end up, whether for reasons of tax collection or caring about the financial health of its “flag carrier”.

Enough about the benefits of the deal. How much are LHG paying?

Deal structure and financial terms

As we’ve already seen, initially LHG will take a 41% stake, with the remainder owned by the Italian State. For that, they are paying €325m. This money will go into ITA as fresh equity, with the Italian government also putting in the final €250m of the €1.35 billion aid package approved by the EU Commission.

There is also an option agreement, which gives LHG a right to fully buy out the government over time, and the government the right to sell its stake to LHG, but only if ITA’s financial results are in line with the business plan.

LHG has not disclosed the precise terms of these option arrangements. In response to an analyst question, they did say that any synergies which accrued to ITA during the period where they owned less than 100% would ultimately be fully captured by LHG, once they took full ownership. That would be the case only if the price for the remaining 59% has already been fixed. As long as no dividends are paid out, any extra cash earned by ITA before LHG buys out the government will be cash that ends up in LHG’s pocket.

We did get some more details from Antonino Turicchi, the Executive President of ITA, in an interview published in Corriere Della Sera. He said that the next 49% would be priced at €325m, exercisable between 2025 and 2027. If ITA has achieved the objectives of the plan, there would be another €100m to pay as an “earn out”. The final 10% is scheduled for 2028-2029, priced at €79m. If those figures are correct, LHG will end up paying somewhere between €729m and €829m.

The fact that there is a variable “earn-out” element of the deal means that what LHG said about it not mattering where synergies fall, during the period where they own less than 100%, isn’t quite right. I would have thought they would have every incentive to “just miss” the targets that would trigger payment of all or part of the €100m earn-out, instead diverting benefits towards other parts of the group. But maybe the Italian government’s advisors have found a way to address that somehow.

Antonino Turicchi pitched the deal as a good one for government, highlighting the €829m upper end of the price range. He compared that with the €1.35 billion put in by the government and implied that the €521m difference represented ITA’s pre-deal losses, saying:

“The state cannot ask Lufthansa to pay for the losses accumulated by ITA between 2021 and 2023 when the German group was not controlling the company.”

Although the cost to LHG could be as high as €829m, €325m of that is going into the company, not to the Italian government. So in fact, even in a best case scenario, the government will only be getting €504m of their money back, leaving them between €846m and €946m out of pocket. That does seem to match the likely cumulative losses between 2021 and 2023. At the end of 2022, ITA had negative equity of €524 million and if the net loss in 2023 is similar to the €486m racked up in 2022, you can easily get to a figure of around €1 billion. It seems that the Italian state has agreed to swallow that.

In September 2021, the European Commission cleared the €1.35 billion cash injection for ITA, saying:

“The Commission found that the investment in ITA would give the Italian State a return that a private investor would also accept”

If you know who those private investors are who will give me €1.35 billion and be happy to receive only €0.4-0.5 billion of that back four years later, please let me know, as I have several exciting proposals to put to them.

LHG’s plan for ITA

Whatever the price and the synergies that will accrue to LHG, the ultimate determinant of whether the deal will be judged a success or a failure hinges on whether ITA can be made profitable under Lufthansa ownership. As long as ITA survives for a few years, the initial cost of the deal will undoubtedly be paid back through synergies accruing at other Lufthansa Group companies. But if ITA is a perennial loss-maker, the acquisition will become either a strategic dead end where LHG ends up having to walk away, or it will be a money pit into which LHG will have to continue to throw money if it wants to maintain the benefit of those synergies. Even walking away would likely incur substantial costs in such circumstances.

So there is a lot hanging on whether the business plan can be delivered. LHG haven’t given a lot of detail on that plan, but I will lay out my understanding based on what has been said publicly, together with a bit of educated guesswork on my part.

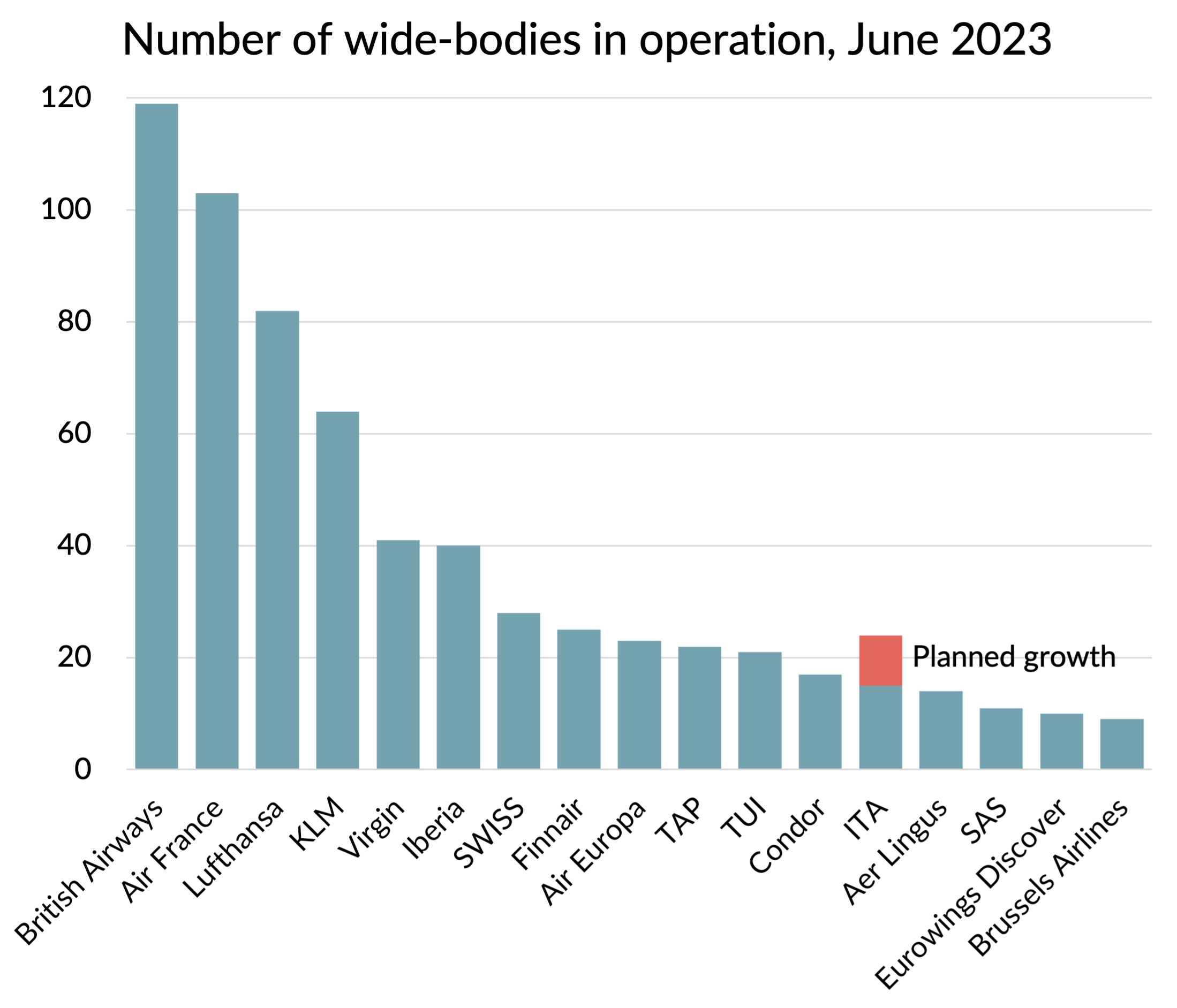

The plan envisages a lot of growth and a lot of investment in new aircraft. LHG shared a chart, reproduced below, showing the planned 2027 fleet of 94 aircraft, up from 66 today.

Taking the fleet growth and the planned replacements together, the plan involves 68 new aircraft entering the fleet over the next four years.

Let us look in more detail at these fleet plans and the likely network plans that will go with them, starting first with the narrow-body part.

Short- and medium-haul fleet and network plans

Based on LHG’s fleet chart, it looks like all 18 of their current A319 aircraft will be retired. Those aircraft are 17 years old on average, so that makes sense. 15 of the current fleet of 26 A320-CEOs will also be retired. 7 of these are 23+ years old and will I assume will exit quickly. The next oldest A320-CEOs are currently 15 years old, but by 2027 they would be 19, so I guess they will retire toward the back end of the period as leases expire and new deliveries arrive.

These 33 aircraft will be replaced with a mixture of 12x A220-100s (130 seats), 15x A220-300s (150 seats) and 6x A320-NEOs (180 seats). Compared to the A319/A320 aircraft that they replace, this represents a very small increase in average gauge (1.4%). But the unit costs of the new aircraft will be substantially lower than the old generation aircraft that they replace.

That leaves another 17 A320-NEO/A321-NEO “growth aircraft”, taking the narrow-body fleet from 53 today to 70 by 2027.

Where will these additional narrow-bodies be deployed? ITA’s operation at Linate is of course heavily constrained by slots, and they may have to give some of them up to secure clearance of the deal from the European Commission. As we saw earlier, LHG plans to switch some Linate slots from domestic Italian routes to operating feeder services for their hubs. But looking at the stage lengths, I don’t think that is going to use more aircraft, since LHG’s hubs are mostly very close to Milan.

It therefore seems that the extra narrow-bodies will all have to be at Rome. Network plans will be designed around building up feed services to support the planned long-haul growth there. I think that ITA currently only operates about 22 narrow-body aircraft from Rome, even if you include all the flights from Rome to Linate as “Rome aircraft”. Adding an additional 17 aircraft would take the fleet size to 39, supporting a planned wide-body fleet of 24. That is quite similar to SWISS at Zurich, where around 40 narrow-body aircraft support 27 wide-bodies. But SWISS also have quite a bit of regional jet feed at Zurich from partners. So unless LHG plans to do something similar at Rome, the wide-body fleet at Rome might be a bit light on feed compared to Zurich.

On the European feed front, there are some obvious gaps that I’m sure LHG will be looking to fill with the extra narrow-bodies. ITA currently only has seven daily flights from Rome into LHG’s home markets. I’m sure they are planning to grow that substantially. With ITA said to have 30% lower crew costs than LHG’s other airlines, taking over some of LHG’s existing 17 daily flights to Rome may also be part of the plan, if they can get that past their unions.

I would also think that ITA would want to reinstate a feeder service from Europe’s biggest market, London. ITA is only flying a single daily flight currently to London (to Heathrow). It can’t increase that by itself, since Alitalia sold off its Heathrow slots to raise cash. However, LHG has 46 daily flights from Heathrow, with 10 of them flown by Eurowings to non-hub destinations. Some of those could be redeployed to build a more competitive LHR-FCO schedule.

This will still leave quite a few growth aircraft needing to be deployed on other European routes, where ITA will face heavy competition from low-cost carriers. In the chart below I’ve shown the current share of seats from Rome to European destinations. ITA has only 28.4% of the capacity, with LHG adding another 6.2%. Less than 35% is a very low for a home/hub carrier. Based on the narrow-body growth plan, they seem to be planning to grow their share by more than 10 percentage points, which is going to be expensive.

Long-haul fleet and network plans

Turning to the long-haul side of the story, ITA currently has 13 wide-body aircraft, split 7x A330-200 and 6x A350-900. The A330-200s are only 12 years old, but it appears that LHG intends to replace them all before 2027 with A330-900s, which have new generation engines. They will also take another 11 A330-900s as growth aircraft, bringing the wide-body fleet to 24 aircraft.

Whilst that is a huge growth compared to today, it will still leave ITA with a wide-body fleet which is a bit smaller than Alitalia was in 2019, when it had 26 wide-bodies. ITA would still be one of the smaller wide-body operators in Europe, reinforcing the need for the support of a bigger group.

Long range narrow-bodies for Rome?

In his interview with Corriere Della Sera, ITA president Antonino Turicchi talked about the plan envisaging “34 long-haul aircraft” by 2027. Since we’ve just seen there are only 24 wide-bodies planned, could this mean that 10 of the new Airbus narrow-bodies be the long-range version of the A321, configured for flying long-haul services? If that’s the case, then the shape of the planned hub at Rome has a bigger skew towards long-haul, with fewer short- and medium-haul services to support it. That would reduce the challenge of deploying narrow-bodies in the highly contested short-haul market out of Rome, but it would also reduce the feed available to support the long-haul flights.

What could be flown with the long range A321? The advertised ranges of the A321-LR and the A321-XLR are 4,000 and 4,700 nautical miles respectively. However, to avoid payload restrictions and allowing for winds and contingency, the practical range is about 20% less than this. Even to get to New York from Rome would require the XLR. I doubt that even the nearest parts of South America are a practical option. So if they are indeed planning to take long-range A321s, I would have thought they’d be mainly intended for Africa, the Middle East and perhaps India. If they take the XLR, that would open up some additional options in the USA and Canada.

A risky strategy

The network logic for LHG of tightening its grip on one of its most important markets is straightforward. As LHG has pointed out, the cash it is committed to laying out should be rapidly recouped by synergy benefits that will be realised elsewhere in the group.

The big risky bet is the huge investment in aircraft and growth that is envisaged in the plan to rebuild the Rome hub. Even if you accept LHG’s argument that ITA is a “fresh start” and carries none of the legacy of Alitalia, then it is still an investment in an unproven business, in a highly competitive environment. The only track record that ITA has at this point is of missing its targets by a wide margin. Granted, LHG will be putting in its own people, but the level of low-cost carrier penetration that we see today in Italy is not something Lufthansa has had to face in its own home markets.

The structure of the deal in theory provides some protection from downside risks. But even as a 41% shareholder, it will be hard for LHG to walk away if the business can’t be made profitable. The fact that Italy is such an important market would make failure even harder to deal with. It is also true that growth could be scaled back if needed - I’m sure that LHG would be able to absorb surplus aircraft elsewhere in the group. But even at its current size, ITA has demonstrated how much cash it can consume in a relatively short period.

As one of the longest running sagas in European aviation, the story of Alitalia and the many attempts to restructure it or replace it with successor airlines may finally be coming to an end. Lufthansa’s shareholders and Italian taxpayers will be hoping that this latest attempt will finish with “and they all lived happily ever after”, and won’t prove to be a fairy tale story that fails to survive a collision with reality.