Lessons from the UK domestic aviation market

What lessons can we learn about the post COVID aviation world from the UK domestic market?

Travel restrictions and government advice to avoid overseas travel are making a mess of international aviation markets at the moment, leaving domestic air travel as the most resilient market during the crisis.

I decided to take a look at what has been going on in the domestic market here in the UK. As a point of detail, I’m defining the market to include the Channel Islands and the Isle of Man, as well as the many small islands in Scotland.

The demise of Flybe

Back in early March, Flybe was one of the first airlines in the world to succumb to the virus. It had many existing problems and was certainly in no shape to survive a crisis of this magnitude.

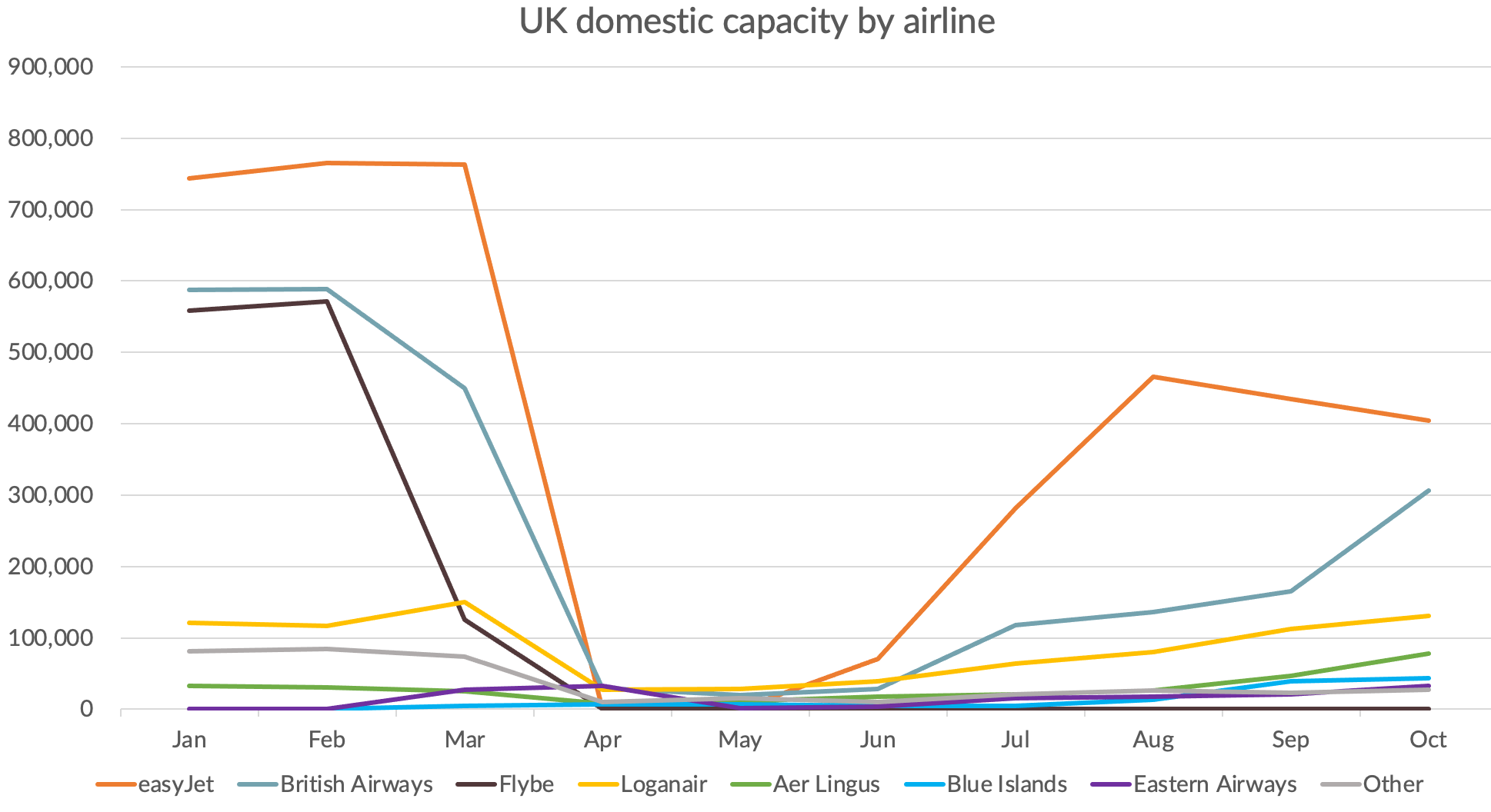

Prior to its collapse, the airline was the third biggest domestic operator, with about 26% of the market as measured by seat capacity. It was only just behind the number two player, British Airways.

Source: OAG, GridPoint analysis

The obvious beneficiaries of Flybe’s demise have been the smaller operators, who have jumped into a number of the smaller niche markets that Flybe used to operate (in many cases supported by government ‘PSO’ subsidies) . Both Loganair and Aer Lingus are now operating more domestic capacity than they were before the crisis. Aer Lingus has launched a number of new routes from Belfast City airport, many of them ex-Flybe routes.

Blue Islands, a small Channel Islands based operator who used to operate as a franchisee of Flybe has taken over a number of ex-Flybe routes, partly thanks to a £10m loan from the government of Jersey. Another Flybe franchisee, Eastern Airways, has done the same. I had a look in more detail at where the Flybe traffic is likely to have gone.

What happened to Flybe’s traffic?

A year ago, Flybe was operating 70 routes, with an average capacity of 160 seats per route, each way. Only 16% of those were competed on an airport pair basis, representing 21% of capacity. However, allowing for substitute airports, 34% of routes were competed, representing 54% of capacity.

Of the roughly 40 routes which weren’t competed, even from substitute airports, only 16 now remain unoccupied. They accounted for less than 10% of Flybe’s seat capacity in 2019.

I’ve done a calculation of who should be the beneficiaries of Flybe’s exit, assuming traffic is redistributed in proportion to the capacity now being offered. easyJet and Loganair are the biggest beneficiaries, with Loganair overlapping quite a bit with Flybe before the collapse and also stepping in to operate 16 additional ex-Flybe routes. Flybe franchisees Blue Islands and Eastern Airways should have retained quite a bit of the traffic they were already carrying, but now doing so under their own brands. IAG should be the other big beneficiary, picking up about 20% of the traffic through British Airways and Aer Lingus.

Source: GridPoint analysis

The contrasting strategies of easyJet and British Airways

Market leader easyJet was much more aggressive than number two player BA in adding back domestic capacity in July and August. They resumed service on virtually all their domestic routes, with only Belfast to the Isle of Man and Edinburgh to Jersey remaining suspended.

Things have swapped around in October, with BA ramping up capacity just as easyJet have been cutting back. Maybe BA will trim some flights from the level they are currently publishing for October, but as things stand BA is publishing capacity at 48% of last year’s level in October, compared to 47% at easyJet.

The demise of Flybe has left IAG unopposed on domestic routes from Heathrow for now. However, the slots that Flybe were using will remain available for anyone wanting to enter the market in the future, as BA is required to make slots available under conditions set by the competition authorities when it acquired bmi back in 2012. Compared to last year, the route from Heathrow to Leeds/Bradford has been dropped but Newquay in Cornwall has been added and Jersey has been moved up from Gatwick. Services from Gatwick to Edinburgh and Glasgow have been dropped as the airline has withdrawn from the airport, at least for now. At London City, BA has resumed services to Edinburgh and Glasgow, dropped the service to the Isle of Man but added Belfast City airport, stepping into the gap left by Flybe.

Heathrow back to number one in October

The differing strategies of BA and easyJet also have consequences for the airports which are their main bases.

Over the years, domestic services have tended to get crowded out at Heathrow due to slot constraints. The revenue and profits that can be generated from flying domestic routes have not compared well to longer range services. For business passengers, London City airport had become increasingly important and for leisure travellers, the low-cost dominated airports of Gatwick, Luton and Stansted had grown and taken share away from Heathrow.

However, with slots no longer a constraint in the short-term and the domestic market holding up better than others, this month sees Heathrow once again back on top as the most important airport for domestic flights, as measured by seat capacity.

Source: OAG, GridPoint analysis

The story is even more compelling if you focus just on domestic flights from the main “London” airports of LHR, LGW, STN, LTN and LCY. London City had become the third most important domestic airport, but with the collapse in business travel and the decision by BA to focus on Heathrow, it has fallen to fifth place. As easyJet has trimmed back capacity and BA has increased, Heathrow has begun to pull away from the other London airports.

Source: OAG, GridPoint analysis

I have one more of these capacity charts. The London picture by airline. That seems to me to show British Airways seeking to reassert its leadership position, partly driven by the resumption of services from London City airport. We will know more in a month how well this works out.

Source: OAG, GridPoint analysis

Impact of the collapse in demand on customer choice

The UK domestic market provides an interesting test case for the impact of a massive reduction in demand on customer choice, whether that is through fewer routes being available at all or a reduction in the number of operators on those routes.

In October 2019, there were 187 domestic routes operated in the UK. That has fallen to 136 today, a reduction of 27%. Almost all of the routes which have been lost were small ones with fewer than 100 seats per day being offered. Of the 105 routes with fewer than 100 seats a day last year, just over half have been lost. The reduction in demand has made these routes unviable for anyone.

For the 81 larger routes with more than 100 seats per day last year, only 5 have been lost, but 17% now have less competition, generally dropping from 2 operators to just one.

The UK market has plenty of airport substitutes and taking that into account the reduction in competitive intensity is smaller. On that basis, 45% of routes had only one operator last year, but that represented only 15% of the seat capacity. 73% of seat capacity was in markets with more than two competitors. That has fallen to 55% today as more routes have become operated by only one or two players.

Lessons for the post COVID world

I believe that the smaller aviation markets brought about by COVID will see a relative strengthening of the position of the best located airports and the strongest and most agile airlines. It will also bring a general reduction in customer choice, whether that is in available routes or how many airlines customers will have to choose between on any routes that remain available.

I think the data from the UK domestic market seems to support those conclusions, so far at least.