Air France - KLM beats IAG and Lufthansa in Q3

Air France - KLM and IAG both reported their Q3 results today. How did they compare?

We got results for two of the big three European network carriers today. IAG had trailed theirs last week, but provided more detail this morning.

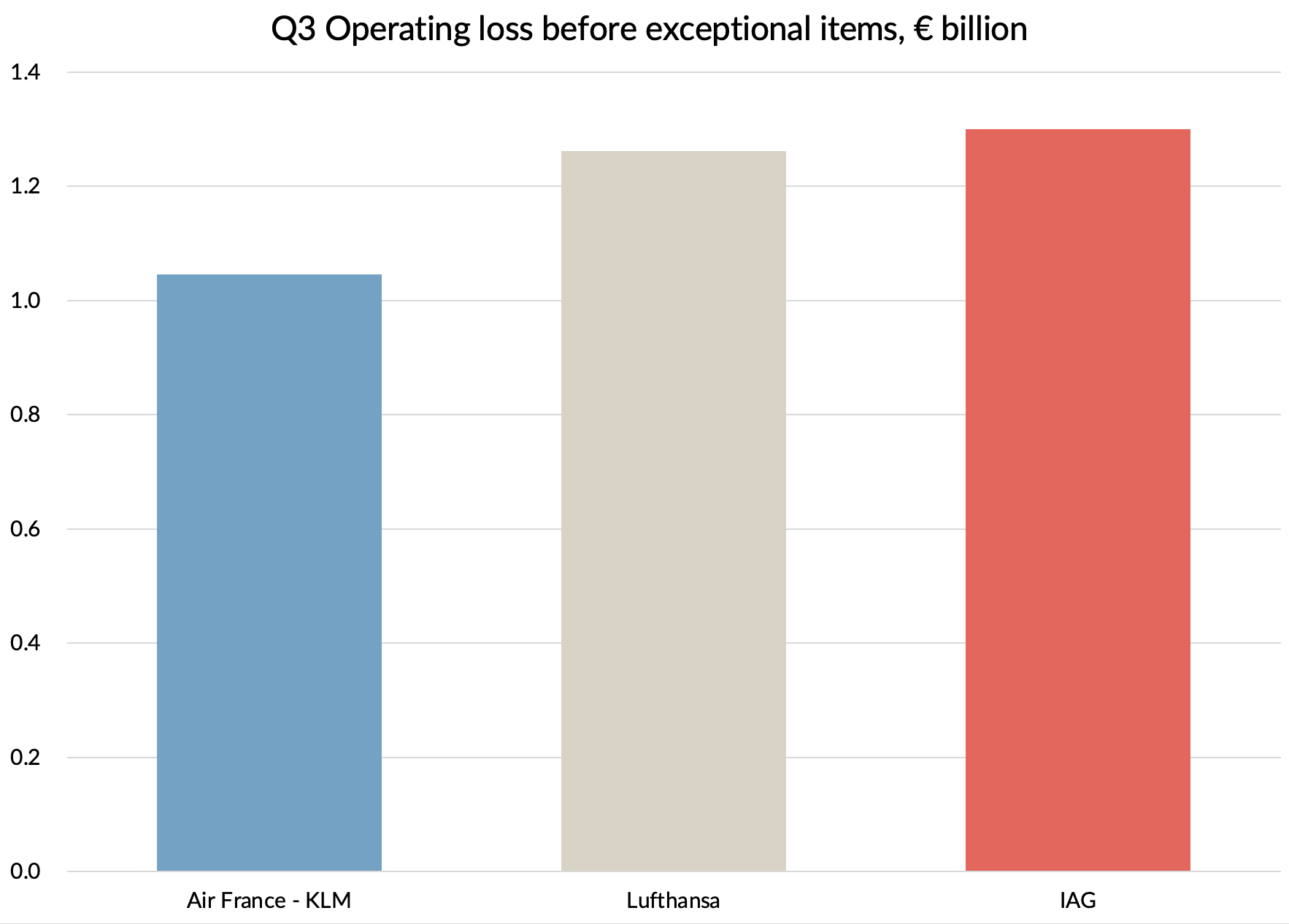

Before exceptional items, the Q3 operating loss for IAG was a suspiciously precise €1,300m. For Air France - KLM, it was €1,046m. Since Lufthansa has already given their headline result of €1,262m, that puts AF-KL at the top of the big 3 profitability (“lossability”?) league table, with IAG dropping to the bottom of the class.

I'm sure that will give the French and the Dutch quite some satisfaction, as the relative picture this time last year was very different.

I thought it would be interesting to compare the performance of AF-KL and IAG in Q3 and see why things have switched around so much.

Source: Company reports

This time last year

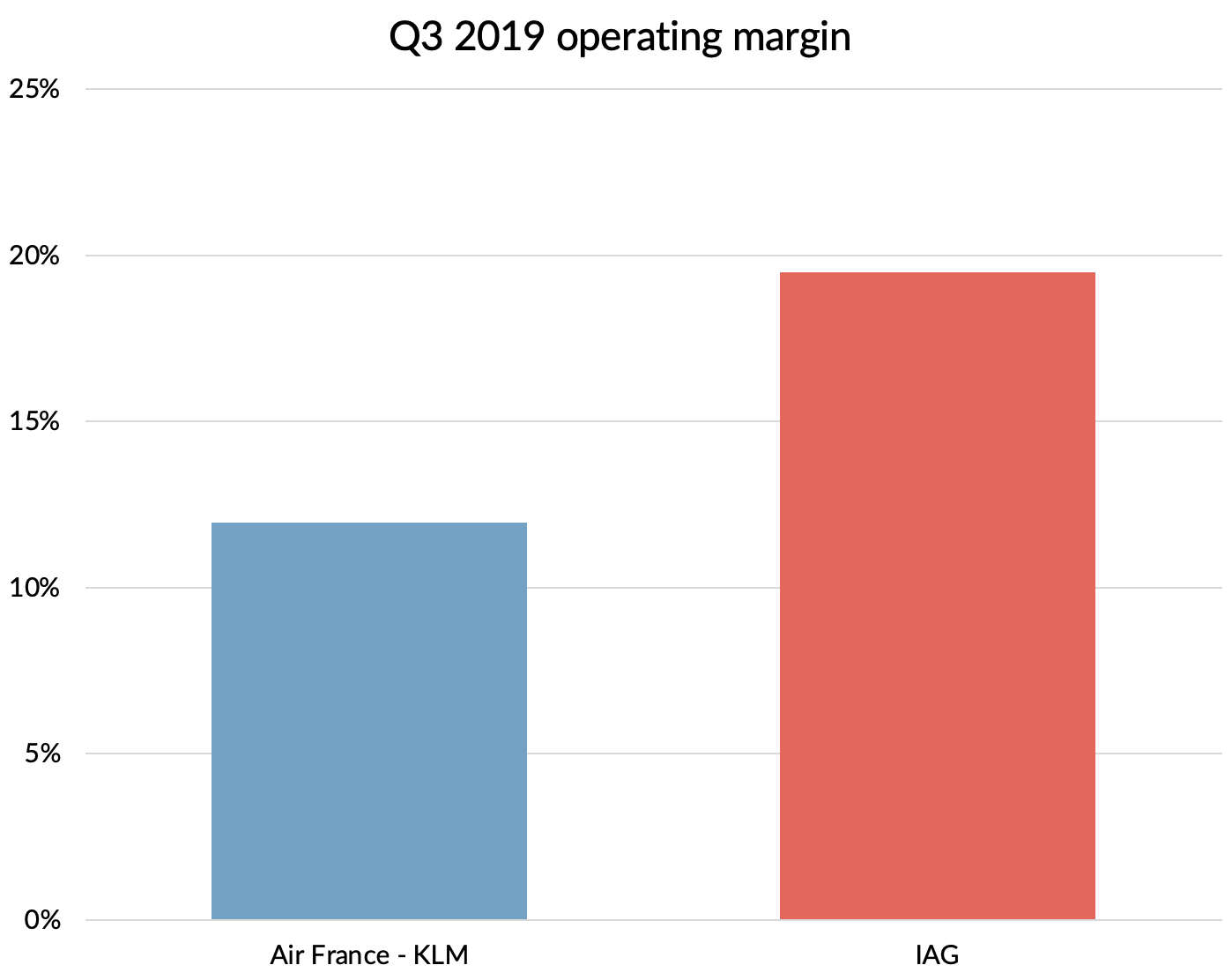

Q3 is normally the best quarter of the year and that was certainly true in 2019. Both companies were profitable, with 12% operating margins at AF-KL. But IAG had a 7.5 point operating margin advantage, delivering 19.5%.

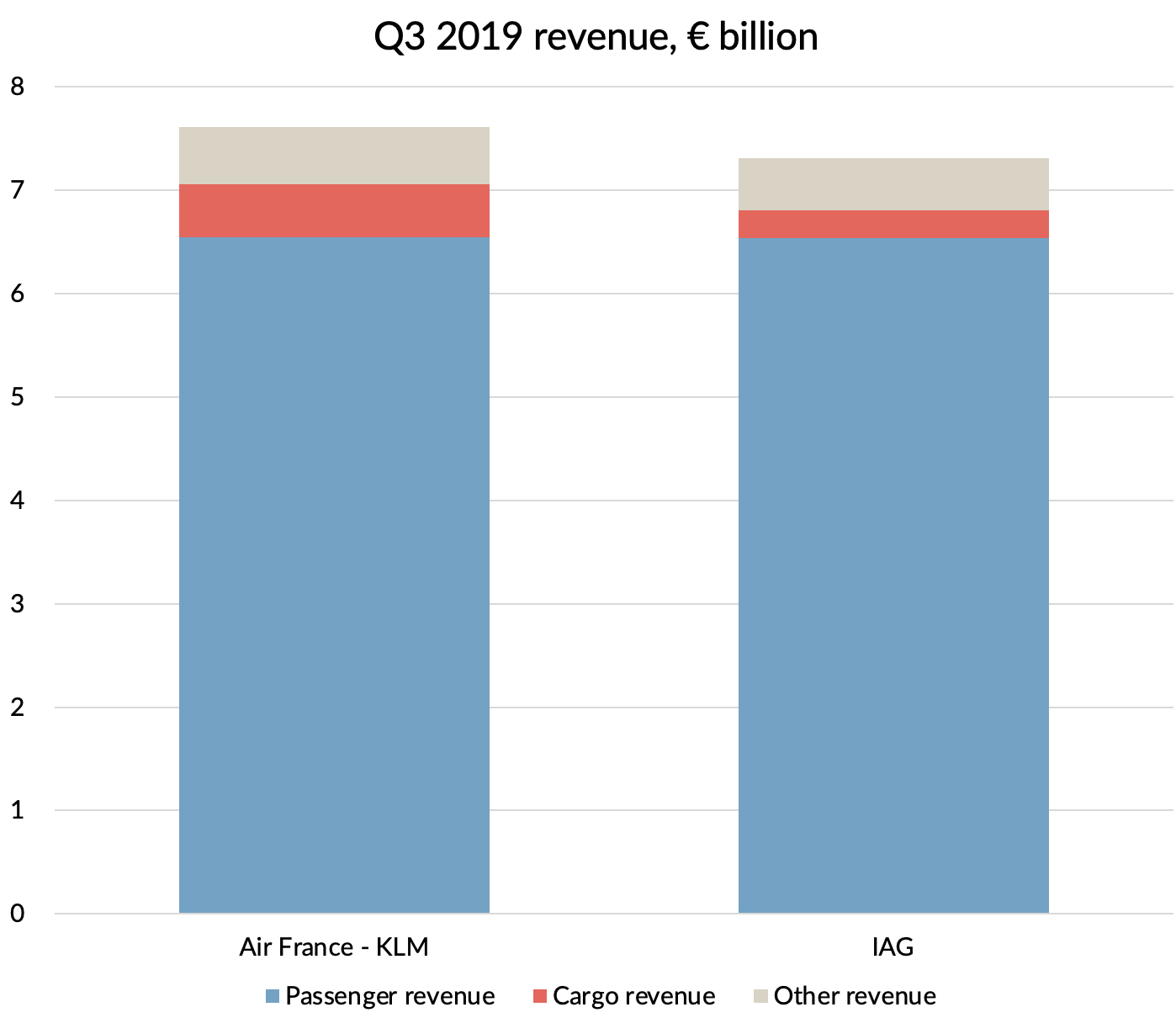

In many ways, the two companies looked remarkably similar. AF-KL was marginally the bigger airline in revenue terms, with total revenue of €7.6 billion, compared to IAG's €7.3 billion. The difference was all down to Cargo revenues, where AF-KL's revenue was almost twice that of IAG. Passenger revenue was virtually identical.

Source: Company reports

AF-KL's average stage length was 19% longer than IAG's, mainly due to I think to IAG's low-cost short-haul operator Vueling being much bigger than Transavia.

Passenger unit revenue, as measured by revenue per ASK was almost identical. Given IAG's shorter stage length, that probably gave AF-KL about a 10% unit revenue advantage on a stage length adjusted basis. IAG's markets are generally more competitive than AF-KL's, so that makes sense to me.

But the biggest difference between the two companies was cost. On a stage length adjusted basis, unit costs at IAG were just over 20% below those at AF-KL.

Source: Company reports, GridPoint analysis

By far the biggest unit cost gap was on employee costs, where IAG came in a whopping 45% lower. Employee cost per head was 21% lower at IAG and it had 23% fewer employees too. 87,160 full time equivalent people at AF-KL compared to 67,407 at IAG, for what we have seen was a very similarly sized company overall.

Although AF-KL had lots of plans to try and close that cost gap, realistically there was only so much they could do given the constraints of State ownership and French labour law. Has the pandemic provided them with a "once in a lifetime" opportunity to tackle the issue?

Employee cost reductions in Q3 and beyond

AF-KL's employee costs fell 36% in the quarter. Most of that came from government support programmes, with Air France getting €228m in the quarter and KLM getting even more at €290m. In total, the group has received €1.4 billion of such support so far, representing 37% of their gross salary cost for Q2 & Q3 combined.

That is much less generous than the US government has been with its carriers, but it is the first area where AF-KL has done better than IAG in the short term. IAG has only received about €560m of such support under government COVID furlough and short time working schemes in total. That’s only 40% of what AF-KL has received.

AF-KL have of course made savings over and above what they received from governments. Excluding that support, Q3 employee cost fell by about 10% versus last year, with manpower numbers down by 5,500 in Q3 compared to the previous year, about 6%. The company disclosed that they had reached agreement with their unions to shed a further 4,500 full time equivalent employees by the end of 2020. That would take them to 10% below where they finished 2019. At Air France, there are additional savings promised for 2021 and 2022 which would add a further 4,500 reductions, taking the total reductions to 14,400, or 16.5% below year end 2019 levels.

Whilst that might sound impressive, the timeline at Air France seems very slow and with medium term capacity likely to be down at least as much, that will do nothing to reduce employee costs on a unit basis.

At IAG, despite the better start point and relative lack of direct financial support from governments, immediate progress on reducing costs has been better. Q3 employee costs were down 42%, about a half of which was thanks to government programmes. Excluding those, the cost reduction was over twice as big a reduction as at AF-KL. Full time equivalent employee numbers fell by 8,500 or 13%, again over twice as much as at AF-KL. Total manpower reductions at British Airways and Aer Lingus have been agreed with unions at 10,000. I'm sure these are not 100% additive to the reductions already achieved using temporary measures, but there will be savings to come in Spain too. Overall, IAG seems to be going for a bigger reduction despite its better start point.

On the basis of this, it doesn't seem that AF-KL is likely to close the gap with IAG, it is more likely that the gap is going to widen.

Of course, the number of employees that will be needed is very dependent on the scale of the medium term capacity reduction that each company is planning. Neither company was giving much away on their thinking there, but they did share what they plan to do in Q4.

Capacity operated and planned for Q4

The biggest difference between IAG and AF-KL in Q3 was the amount of capacity they operated. Capacity at AF-KL was only 42% of last year, but that was double IAG's 21%. Neither carrier managed to fill even that capacity, with load factors languishing at 46% at AF-KL and 49% at IAG. Yields were down too to leave passenger revenue down 77% at AF-KL and 89% at IAG.

Overall, AF-KL recorded over double the passenger revenue in the quarter and their stronger cargo heritage and freighter fleet gave them more than double the cargo revenue too. Overall, AF-KL booked €1.3 billion more revenue in the quarter.

Maybe AF-KL did a better job on capacity planning or selling for the quarter. Certainly KLM seem to have done a particularly good job. But I think a large part of the difference was down to market exposure. IAG is more heavily exposed to the North and South Atlantic markets, which the pandemic has virtually closed to and from Europe. Infection levels in Spain and the UK were worse than France and the Netherlands too for most of the period.

In particular, Air France benefited from the large French domestic market, which was only down 65% in Q3. Ironically, this is the market that the French government has told it to pull back from as a condition of the bailout, in the name of the environment. Also doing relatively well were the French overseas territories - these are long-haul markets in the Caribbean and Indian ocean, but they are also "domestic" and don't have travel restrictions.

That is all about to change though. France has just gone back into a full lock-down and Air France shared that domestic flying would be essentially shut down in November. Their current plans for total capacity in Q4 are for less than 35% of 2019 levels in Air France and about 45% at KLM. IAG continues to ramp up capacity, but have guided for Q4 capacity to be "no more than 30%" of 2019 levels. Whilst I expect IAG still to be lower than AF-KL in Q4, the gap seems to be narrowing.

Cash and net debt

This is another area where the two companies seem remarkably alike. AF-KL reported net debt of €9.3 billion at the end of September, up €1.3 billion on Q2. IAG was a bit higher at €11.1 billion, but it was up only €0.6 billion versus Q2. €830m of cash from loyalty partner American Express is probably the main explanation for the difference in Q3 performance.

In October, IAG received the proceeds of its rights issue, which raised €2.7 billion. So it should have net debt of about €8.4 billion now, slightly better than AF-KL.

Overall comments

AF-KL delivered a terrible set of results in Q3. They were just a bit less terrible than IAG or Lufthansa. After 9/11, British Airways' then CFO John Rishton described the airline's performance as "cream of the crap". For their performance in Q3, Air France - KLM have now earned that accolade amongst the big 3 network players, with KLM in particular being the strongest performer of any European network carrier I have seen.

I never thought that I would congratulate an airline for making a negative operating margin of -20% in what should be the best quarter of the year, which is what KLM achieved.

But these are the crazy times we are living in.