Predicting country classifications for reopening UK travel

The UK government has announced that it will be using a “traffic light” system to classify destinations when it allows outbound leisure travel to reopen. We still don’t know when that will happen, but the earliest date is May 17 with an announcement due in “early May”.

We do know what factors will be taken into consideration. According to the government, there will be four of them:

the percentage of the population that has been vaccinated

the rate of infection

the prevalence of variants of concern

the country’s access to reliable scientific data and genomic sequencing

Nothing has been said about what thresholds will be applied. Maybe we will get that when they announce the classifications, or perhaps they will decline to set hard and fast rules, allowing a more nuanced judgement to be applied.

Being an impatient sort of chap, I thought I’d have a go at guessing the thresholds and doing my own classification based on what has been said so far.

Which countries to focus on?

I’ve prioritised the countries to look at based on their significance for outbound leisure travel, using the number of trips by air taken by UK residents for leisure purposes in the April - September 2019 period. The market size data comes from the UK International Passenger survey and I’ve included every country that is individually covered. That excludes some places like Brazil which is covered under the “Other Central & South America” category. Spoiler alert: if I’d included Brazil, it would be dark red. Clearly the list of markets also excludes domestic destinations like the Channel Islands, which are already open for travel.

Notwithstanding the omissions, this approach gives me quite a long list. I did consider just including the larger markets, to make the charts and data easier to absorb. But as we will see, we are going to need to search the whole haystack if we are to have a chance of finding many green needles.

Let’s get started with the first criterion, progress on vaccinations.

What does “vaccinated” mean, anyway?

The first question we have to look at is what the UK government will consider to be a vaccinated person. Will someone who has only received one dose of a vaccine that needs two be considered to be vaccinated? Or do only fully vaccinated people count?

Unlike most other countries, the UK has pursued a vaccine rollout strategy which prioritises getting people their first dose. That is because the majority of the protection comes from the first dose, with the second dose delivering incremental gains and also believed to be important for longevity of the immunity. So I think they will stick with that thinking and focus on the percentage of people who have received at least one dose. The fact that this is the metric that makes the UK look best is a nice side-benefit, of course.

Another question is whether the UK will consider every vaccine as acceptable for their definition, including for example the Chinese and Russian vaccines that have not been approved for use in the UK. There have been some question marks about their effectiveness and it is possible that countries which have relied on those vaccines might get “down-graded”. Ignoring that issue, the following chart shows the league table of vaccination status.

I’ve coloured the bars based on my guess of how they might get classified on this criterion. Clearly anywhere that is ahead of the UK will qualify, but only Gibraltar and Israel meet that standard. I decided to go with 30% or above as a threshold for “green” status and below 10% as qualifying for red.

Source: Our world in data, plus GridPoint estimates based on half total doses given for China and Gibraltar.

It is actually quite hard to get your head round why the UK might consider vaccination status at all. New Zealand and Australia score very badly on this measure, but they also have no community spread. Why would passengers arriving back from these destinations need to quarantine?

My guess is that vaccination status will only be used in conjunction with other criteria, rather than being a hard filter. I’ll come back to that later when I discuss how the different criteria might be combined to produce an overall classification.

Rate of infection

This seems like a simple one as every country reports case numbers pretty regularly. Last year, the UK used a level of 20 weekly cases per 100,000 people as a threshold for determining which countries did not require quarantine when entering the UK. The most cited metric these days is cases per million of population. As long as you use the 7 day rolling average, this is directly proportional to the old measure. 20 weekly cases per 100,000 equates to a rolling average of 28.6 cases per million.

We know that last summer many cases went unreported due to low rates of testing, so 28.6 reported cases last year probably equates to a higher threshold this year. Less than a week ago, the UK was above last year’s threshold with 47 cases per million. In the last couple of days it has dropped below it, with the most recent figure hitting 23 cases per million. I’ve assumed that a threshold of 50 per million might get set for green status and over 250 would be red. That would put much of the EU into the red category at the moment as the third wave hits Europe (e.g. France is at 496). That seems to match the rhetoric coming out the UK government, who are clearly not wanting to reopen the borders to the EU until case numbers drop back significantly.

Some countries have very low levels of testing and I don’t think you can assume that just because reported numbers are low, that this fully reflects the situation. Where fewer than 1 test per 1,000 people is being carried out, I’ve capped the status at amber, even if reported cases are low. There are a few exceptions, such as New Zealand and Australia which don’t do high volumes of testing because they don’t have community spread. I’ve included China as one of these exceptions, as although some people are suspicious whether China is telling the truth, this isn’t based on any evidence as far as I know.

At the other extreme, Cyprus has been testing its entire population every week, which inflates its reported case numbers, so I’ve rated them as amber, despite a high reported case rate.

The following chart shows the resulting classification on this criterion, using an amalgam of reported cases and testing rates.

Source: Our World in Data, GridPoint analysis and classification

Obviously, this is a metric where a lot can change in 3-4 weeks. Some of the amber countries and even some of the red ones might improve enough to “go green” when the government reveals its classifications. I’ve charted the recent trends in some of the more important leisure markets below.

With case numbers going in the right direction, Ireland and Finland might have a chance of getting into the green category by the time the list is published. Malta seems to have reversed its recent downward trend, perhaps due to cases imported from European tourists over Easter.

The USA is going in the wrong direction at the moment. With great progress on vaccinations, I think we would all hope that this might turn around again soon, but the rising case numbers is the biggest risk to the USA getting classified as green.

There is a big difference between case numbers in different parts of the US, however. In the following chart, getting to “green” on my threshold would mean getting below 71 weekly cases per 100,000. Whilst quite a bit of the US would meet that threshold, it wouldn’t include anywhere on the East Coast, including Florida.

California here we come.

Source: covid.cdc.gov

Variants of concern

Vaccinations and case numbers are relatively easy to measure and monitor. That is less the case for the final two criteria, both of which relate to variants.

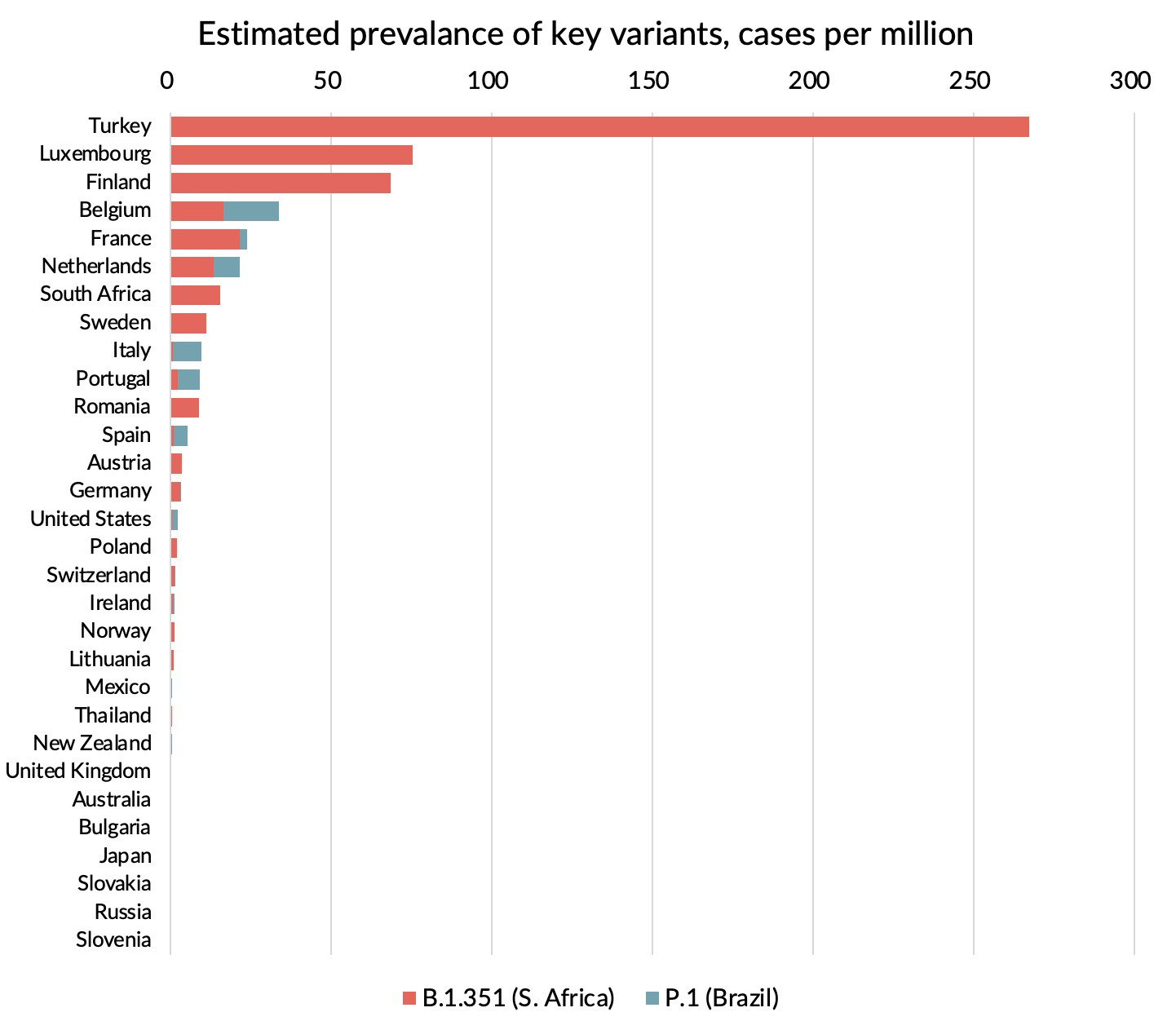

I’ve assumed that there are two main variants that the government is worrying about. B.1.351 (South African variant) and P.1 (Brazilian variant). Such data as is available publicly is posted on the GISAID website.

Not every country in our list has even reported any data on variant prevalence, quite simply because they are not sequencing positive samples. The UK alone accounts for 40.8% of all COVID-19 sequences reported there. The US is second with 22.1%, followed by Denmark with 7.5%. Even where the country has reported data, the sample size is often very low.

Despite these caveats about the reliability of the data, I’ve calculated the estimated prevalence of the two main variants of concern for the countries where we at least have some data on the mix of cases. This gives the following chart.

Source: GridPoint analysis based on variant reports from GISAID and case numbers from Our World in Data

It is hard to know how much of a “zero tolerance” approach the UK government is likely to take here. The rhetoric suggests that this is the single biggest issue that will drive the risk rating. My guess is that they will draw the line at somewhere around the USA, leaving much of the EU “off limits” until case numbers come down considerably. The Netherlands for example probably had as high a case rate last week for these two variants of concern as the UK had in total.

On the other hand, evidence is still coming in about the effectiveness of the current vaccines against the variants based on real world experience. To the extent that this evidence is reassuring, the UK may start to become less concerned about one or more of the variants currently in circulation. But in the meantime, it is likely to take a cautious approach.

As well as existing variants, the UK is also worried about new vaccine-resistant variants which might emerge. They are worried about finding such a variant only after it has already arrived in the UK. Early detection overseas is therefore key. Which brings us to the final criterion.

Sequencing capacity

The last criterion is “the country’s access to reliable scientific data and genomic sequencing”. To some extent this refers to the testing capacity that we discussed earlier. But the bigger issue I think is the amount of genomic sequencing that is being done.

What does good look like here? The EU has set a target of sequencing at least 5% of positive samples, so that might be a good metric for classifying as “green”. But very few countries hit that level, as shown by the following chart which shows the number of COVID-19 sequences submitted to GISAID in the last four weeks. I’ve left off the countries which submitted no sequences at all, which interestingly included Denmark, one of the more prolific contributors in the past.

I’ve calculated what this volume of sequences represents as a percentage of positive tests. I’ve labelled each of the bars with that percentage and also used it to classify the countries (green >=5%, red <1%).

Source: GISAID. Percentage of positive tests sequenced calculated based on positive test volume data from Our World in Data.

If a minimum threshold was set for sequencing 1% of positive samples, key countries like Spain, Greece, Italy, Portugal, France and Turkey would all be ruled out. If the 5% threshold was used, only Ireland, Luxembourg and New Zealand would qualify.

I think perhaps the phrase “access to” might be significant here. As case numbers drop in the UK, there will be significant UK sequencing capacity becoming available. My guess is that the UK might do deals with other countries to help sequence their samples. That might unlock a much longer list of countries than would qualify based purely on their recent sequencing volumes.

Bringing it all together

I think by now you will have realised that very few countries are going to easily clear all the tests. That is certainly the case if each criterion is used as a crude filter.

However, I expect that more judgement will be applied and that the criteria will be used in combination. For example, a country with apparently low case numbers and no known variants of concern, but which scores low on vaccinations, testing and sequencing will not be rated green. Mexico might be an example of this.

On the other hand, a country with relatively higher case numbers, but which has very high levels of vaccination and a good record on testing and sequencing might get rated green. The United States would be a good example of this, especially if the classifications are applied on a State by State basis, rather than needing a single rating for the whole country.

So here is my best guess for the countries that will be classified as green.

Candidates for green rating

The surest case for green must be Gibraltar. It has essentially zero cases of any type and the population is fully vaccinated. It has access to UK sequencing capacity if it needed it at any point. In any event, it is close to being a “domestic” destination from the UK.

Israel must be the next most likely. Again, it has vaccinated close to its entire population and case numbers are below even last year’s threshold. Although it doesn’t seem to have submitted sequencing data to GISAID, nobody would doubt that the country has good access to the technology.

Of course Australia and New Zealand will be green. Neither have community spread but the real issue for those two countries will be whether their borders will be open for UK travellers. In theory the same case could be made for China, but I suspect politics may get in the way. The currently low level of vaccination may be used as the excuse.

Next up I think is Iceland. It has very low case number and is above average on vaccinations. Although we don’t have any sequencing data, the low case rate and physical distance from countries with known variant issues make it very low risk.

Ireland may well be the next most likely candidate. Whilst case numbers are higher than ideal, they have been falling. Vaccination rates are below average but the UK has hinted that given that this is the only country with a land-border with the UK, it would like to help out Ireland’s vaccination programme if it can. The politics of reopening travel would be good, given the history of free travel between the countries and the huge number of residents of both countries with relatives in the other.

The big question in my mind is the USA. The whole country would struggle to qualify for green status unless the case number threshold was set much higher than I expect. But as previously discussed, parts of the USA such as California would qualify. Perhaps also the UK might allow countries which are only “amber” on the case rate to be green if they have very high vaccination rates. That might also bring in Malta and in theory the UAE too. However, the latter’s role as a transit hub where people from countries which have variants of concern mingle may rule it out.

Countries with low case numbers that may fail on other criteria

There is a group of countries with low case numbers and no known issues with variants of concern, but which might fall foul of the “access to reliable scientific data and genomic sequencing” criterion. These are Japan, Thailand, Sri Lanka, Pakistan, Mexico, Egypt and Barbados. All of these have low rates of testing and have not submitted much if any sequencing data. The UK government may have access to better data than I do on this however, so some may make it into the green category. Japan, Barbados and perhaps Thailand have the best chance.

Based on case numbers, both Finland and Portugal could be considered for green status. But I think the prevalence of variants of concern there will probably push them into at least amber and maybe even into red. The same is certainly true of South Africa which is on the UK’s current red list where all travel is banned.

Probably not green for now

Case numbers in the big tourist markets of Spain, Greece, Italy and Cyprus look a bit too high at the moment for them to be rated green from the start. So I expect them to be left on the amber list at the start. Perhaps they will become green later in the year assuming case numbers fall. Last year, the Spanish and Greek islands were given a lower-risk rating than the mainland and that could happen again this year.

Likely reds

Even based purely on case numbers, Turkey looks likely to be rated red to me. It also has high prevalence of the South Africa variant so a double strike there.

The other big tourist destination that risks a red rating is France, based on both high case numbers and existence of variants of concern. The same can be said for all the Benelux countries.

Next, there is Eastern Europe. Poland, Hungary, Bulgaria, Czechia, Slovenia, Croatia and Estonia all have high case numbers. They don’t seem to have any prevalence of variants of concern but they also don’t do much if any sequencing, so there may be a hidden problem.

Finally, we have Sweden. I think that will end up as red based purely on case numbers.

My predictions

So here it is then, my prediction for the classification of the UK’s biggest outbound tourist markets. I’ve shown them on a chart of the number of leisure trips in 2019 to show the relative significance of the markets. Note the truncation of the scale at 4m passengers due to the oversize significance of Spain.

Implications for UK airlines

The big prediction here is that the US will be rated green. If that happens, that would be massively good news for British Airways and Virgin Atlantic.

If my predictions are correct, it is less good news for the short-haul carriers. The classification of all the big European leisure markets as amber or red will I am sure lead to howls of rage from the low-cost airlines.

On a more positive note, there is a reasonable chance that some at least of these countries will move to lower risk categories later in the year. How soon that happens will depend on how quickly Europe can catch up on its vaccination programme and on progress on containing the current wave of infections in Europe.