IAG full year results

Full year 2022 operating profits of €1.2 billion

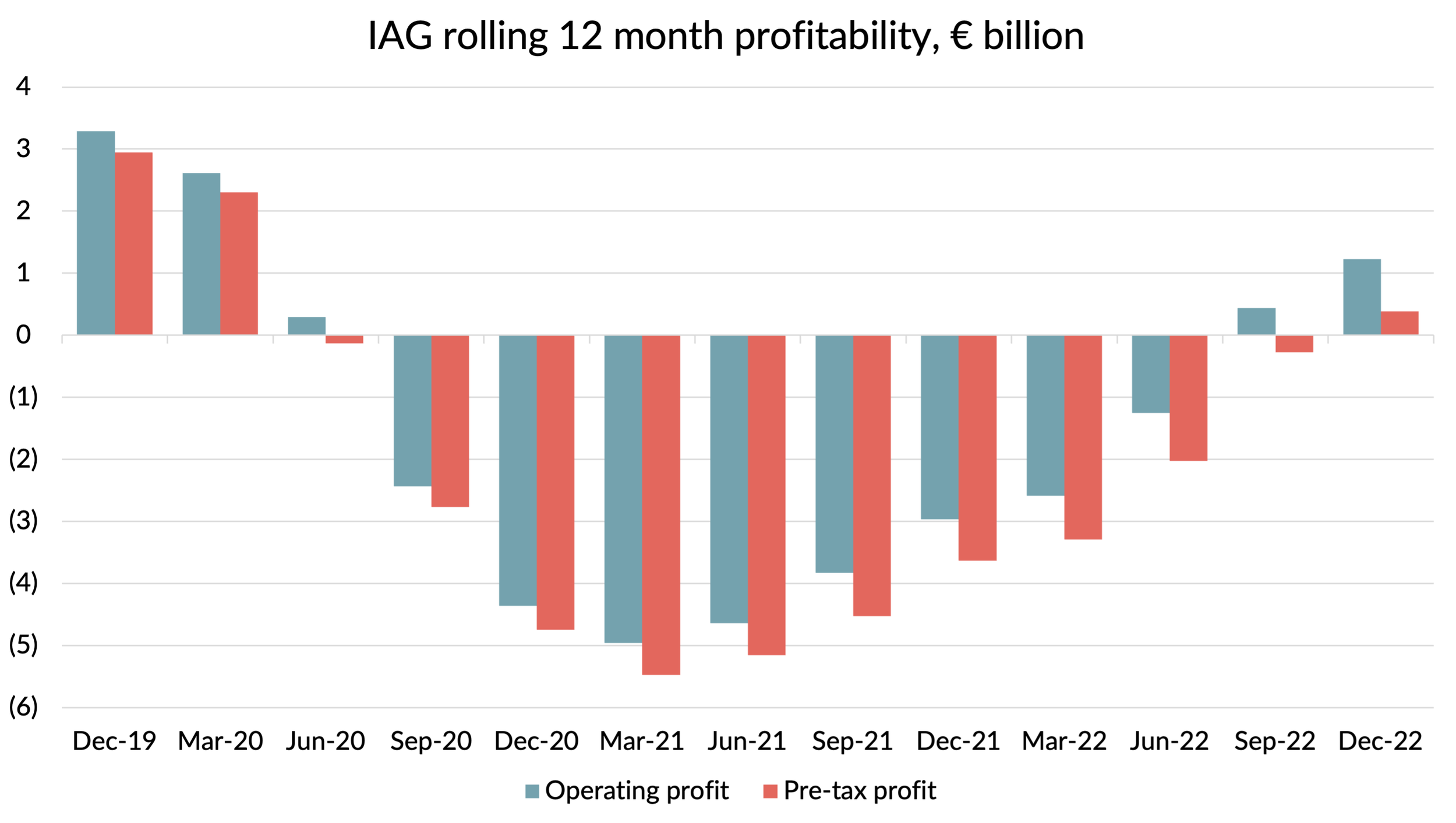

Last week, my old employer IAG published its full year results for 2022. Although this was the first full year profit since 2019, the company still has some way to go to restoring profitability to pre-pandemic levels. The full year profit figures were 63% lower than 2019 at an operating level (€1,256m) and down 87% on 2019 after interest costs (€415m).

The full year figures were rather weighed down by the first quarter numbers, which were still heavily impacted by the pandemic. Excluding Q1, operating profits were “only” down 37%, although at a pre-tax level profits were still 54% lower. Debt taken on during the pandemic continues to pull down the pre-tax results even as operating results improve.

Source: Company reports, GridPoint analysis

Although the company reiterated its commitment to “returning to pre-COVID-19 levels of operating profit”, the timescales remain extremely vague. “Within the next few years” was the best it could offer. It clearly won’t be hitting that milestone in 2023, based the guidance given by management for operating profit next year of €1.8 - €2.3 billion. Even if it achieves the top of that range, that would still be 30% down on 2019 performance.

IAG gave a guide for Q1 2023 operating losses of €200m. That would already take the rolling 12 month operating profit to €1.8 billion. The bottom end of the full year guidance would equate to profits stalling at that level. With IAG being very much a “recovery play” for investors at the moment, suggesting that the profit recovery might already be over went down like a lead balloon and the shares fell 6.5% on the day.

How did the results compare to European peers?

Before the crisis, IAG used to enjoy a significant margin premium to Lufthansa Group and Air France - KLM. Some of that seems to have been restored in 2022, with IAG moving back to the top position of these three in the second half of the year, at least at an operating level. But the margin advantage in the second half was only 2-5 points, about a half the gap in 2019 when it was 7-9 points. Even that performance advantage disappears after financing costs, since IAG has more debt than the other two. For the year as a whole, IAG’s pre-tax margin of 1.7% was only marginally better than AF-KLM’s 1.3% and Lufthansa is likely to beat IAG’s pre-tax profit margin figures when it reports its full year results in a few days time.

Source: Company reports, GridPoint analysis. Lufthansa operating profit based on company guidance, Q4 revenue is estimated.

Further details about the Air Europa acquisition

IAG provided some further details about its on/off acquisition of Madrid-based rival Air Europa.

It has agreed to pay €400m for the 80% of the company it does not already own, with €200m to be paid at completion (half in IAG shares) and a further two €100m cash payments on the first and second anniversaries. If you discount the deferred payments at an annual rate of 10%, that values the company at €467m.

Elsewhere in IAG's accounts, the "fair value" of IAG's 20% equity stake is assessed at €24m, valuing the whole company at €120m. As IAG pointed out, that figure excludes the value of synergies. The difference of €347m represents the value of the synergies that IAG was prepared to "pay away" to the seller as a premium to standalone value. If you turn that value into an annual synergy figure using IAG's 4.8x prospective EV/EBITDA multiple, that would equate to €72m p.a.

However, IAG will need to do better than that to break-even on the total amount it will have cost to acquire Air Europa. Back in 2021, it paid a "termination fee" of €75m to break a pre-COVID agreement to buy the company for €1 billion. It subsequently handed over another €100m by way of a convertible loan in June 2022, which ended up being converted into its current 20% equity stake. Move those figures into "mid 2023" values (again using a 10% discount factor) and that means that it will have cost IAG a total of €574m to buy a company it assesses as being worth €120m on a standalone basis. Paying for this €454m premium will require close to €100m a year of synergies to break even. Adding an allowance for one-off costs and recognising that it will take some time to realise the benefits means the synergies will need to be a bit bigger still, if IAG is to make money out of the whole venture. How achievable is that likely to be?

In 2018, Air Europa had annual revenues of €2.1 billion. Capacity operated in 2023 will be 9% higher than in 2018, so current revenue levels are probably above the 2018 figure. €100m of synergies would equate to circa 5% of Air Europa's 2018 revenue, so that’s about the benchmark it needs to hit. When BA and Iberia merged in 2011, annual synergies of €600m were eventually achieved, equivalent to 13% of the smaller carrier's revenues at the time the deal was done. So by that benchmark, there ought to be plenty of headroom. Iberia and Air Europa share the same home airport, and proximity usually increases synergy potential. However, it also raises the difficulties of getting competition clearance and the cost of the remedies that will be imposed by the EU Commission will reduce the net synergy potential. Whether there is a remedy package that will satisfy the Commission without making the deal financially non-viable is still an open question, and of course it is possible the EU could block the deal outright if it doesn't feel the competition issues can be adequately remedied.

The whacky world of pensions accounting

Another interesting item revealed in IAG's accounts was the damage done to the assets of BA’s pension plans by the downturn in equity and bond markets in 2022. At the start of the year, plan assets stood at €34.4 billion. That had fallen to only €23.7 billion by the end of the year. These pension plans have been closed for some time now and with no material contributions coming in from either employees or the company, the €1.3 bilion of benefit payments made during the year could only be met from investment returns or selling assets. In 2021, the funds made investment profits of €2.1 billion, but in 2022 they made a thumping loss of €8.7 billion in 2022, a 25% hit.

The actuaries will of course point out that the fall in markets also increases expected future investment returns. So the amount of money you need today to pay for future benefit payments goes down. You can see that in IAG's accounts, where the present value of scheme liabilities fell by 36% from €31.6 billion to €20.2 billion.

All of which led to the somewhat counter-intuitive outcome that the net value of pension assets and liabilities in IAG's books actually improved in the year by over €600m.

Vouchers

When airlines were forced to cancel huge numbers of flights due to the pandemic, they encouraged customers to accept vouchers for future travel, rather than issue refunds. We got a bit more information in IAG’s accounts about what has been happening to those vouchers, now that flights are operating again.

At the end of 2022, IAG had vouchers worth €911m in its balance sheet, down from €1,400m a year earlier, a reduction of €489m (35%). Since there was plenty of opportunity for customers to redeem their vouchers during 2022 and only 35% did so, it does beg the question how many of these vouchers will ever be redeemed. The company itself is not yet ready to try and forecast that. In a note to the accounts it said:

"During 2022, while the recovery from COVID-19 has seen much lower levels of voucher issuance and high levels of voucher redemption, the Group’s operating companies’ voucher programmes have had limited voucher expiry in 2022, with the majority not expected until 2023 at the earliest. Accordingly, the Group has had insufficient historical expiry experience relating to vouchers issued during the pandemic and therefore has not applied any breakage to existing voucher liabilities as it cannot confirm that there would not be a subsequent significant reversal of revenue if it were to do so."

It seems to me that there is a likelihood of a significant release to profits once the extent of vouchers expiring unused becomes clear. Perhaps the rate of voucher use will increase as the expiry date approaches, but if even 20% of the original €1.4 billion of vouchers expire unused, that would be a €280m release to profit. In some senses, this would be a non-cash windfall. The money has already been collected after all. However, if the vouchers are never used, IAG will have extra seats available to sell. Given what has happened to ticket prices since the pandemic, the cash value of those seats will be even bigger than the reported voucher values.

Given how controversial the voucher schemes were with consumer watchdogs and the media, it is perhaps no surprise that the company is not drawing attention to this potential windfall. I'm sure they will do everything in their power to release the profits little by little over the next few quarters and hope that the media won't notice. The bigger those profits turn out to be, the harder that will be to pull off.

Employee numbers

Now that all the temporary furlough arrangements have been unwound, I thought it would be interesting to look at how employment numbers compare to before the pandemic. Overall employee numbers at IAG fell by 6,224 from December 2019 to December 2022, a reduction of 8.6%. Capacity at IAG was still down 13% on 2019 in Q4 and full restoration of capacity won’t happen until the end of 2023, so a reduction in employment numbers is unsurprising. But what is rather more odd is the pattern of changes by employee type.

The chart below shows the year end employee numbers and how they have changed since 2019. The biggest reductions have been at airports, with numbers falling by over 20%. Whether this has been driven by efficiency gains or reflects ongoing manpower shortages is not clear. Also striking is that the number of senior executives is up 11.6%, and the number employed in “corporate” roles has increased by an alarming 16.6%. Between the two categories, that’s almost 2,000 more “pen-pushers” (although I suppose these days they should be called “email-senders”). The figures are for headcount, so part-time workers will count the same as full-time. Perhaps post-pandemic there has been a shift to part-time work and the “full time equivalent” position doesn’t look as bad. But it is not a good look.

Source: Company reports, GridPoint analysis

Included in the “corporate” employment numbers will be IT workers and the increase could be a sign of increased investment following a string of high profile IT failures, together with the constant rise in the importance of automation and digital innovation. Most IT work is outsourced to contractors these days at IAG, but I guess this could be part of the explanation.

Emission costs

The next item that attracted my interest in IAG’s full year report was the cost of purchasing Emissions Trading credits under Europe’s Emissions Trading Scheme (ETS). Flights operating between airports in the European Economic Area are required to purchase credits for their carbon emissions. Post Brexit, the UK is no longer part of this, but the UK has set up a parallel scheme, so to a good approximation the same rules and costs apply. Airlines receive free allowances each year based on a historical baseline of emissions. However, the number of free allowances declines each year and there is a likelihood that they will be phased out completely over time. The price of buying credits has also been rising and from a low of €20/tonne in early 2020, the price recently hit €100. If you want to see the latest prices, there’s a good tracker here.

In any event, as flight volumes have recovered, the cost of buying emissions credits has been growing rapidly for European airlines. IAG disclosed a cost in 2022 of €132m, quite similar to the €137m spent by Air France-KLM. Those costs are set to rise significantly in 2023. I estimate that IAG’s ETS costs will rise to €370m in 2023 and Air France-KLM’s bill should be similar. That’s quite a big increase in costs and is one of the factors pushing up airline ticket prices in Europe.

IAG also gave a figure of €407m for the stock of emissions credits it had pre-purchased for future years, which it said represented sufficient allowances to settle its forecast obligations through to at least the end of 2023. That statement ties in fairly well with my estimate for costs in 2023. Air France-KLM disclosed a balance at the end of 2022 for pre-purchased ETS credits of €208m, which suggests they are not pre-purchasing as far forward as IAG. I don’t know whether that is driven by a difference of view on policy, or just reflects tighter cash constraints. In any case, it highlights how airline policies on pre-purchasing of ETS credits are already becoming significant in judging the comparative health of company cash positions. The size of the numbers is only going to rise in future as free credits are phased out.

Performance by operating company

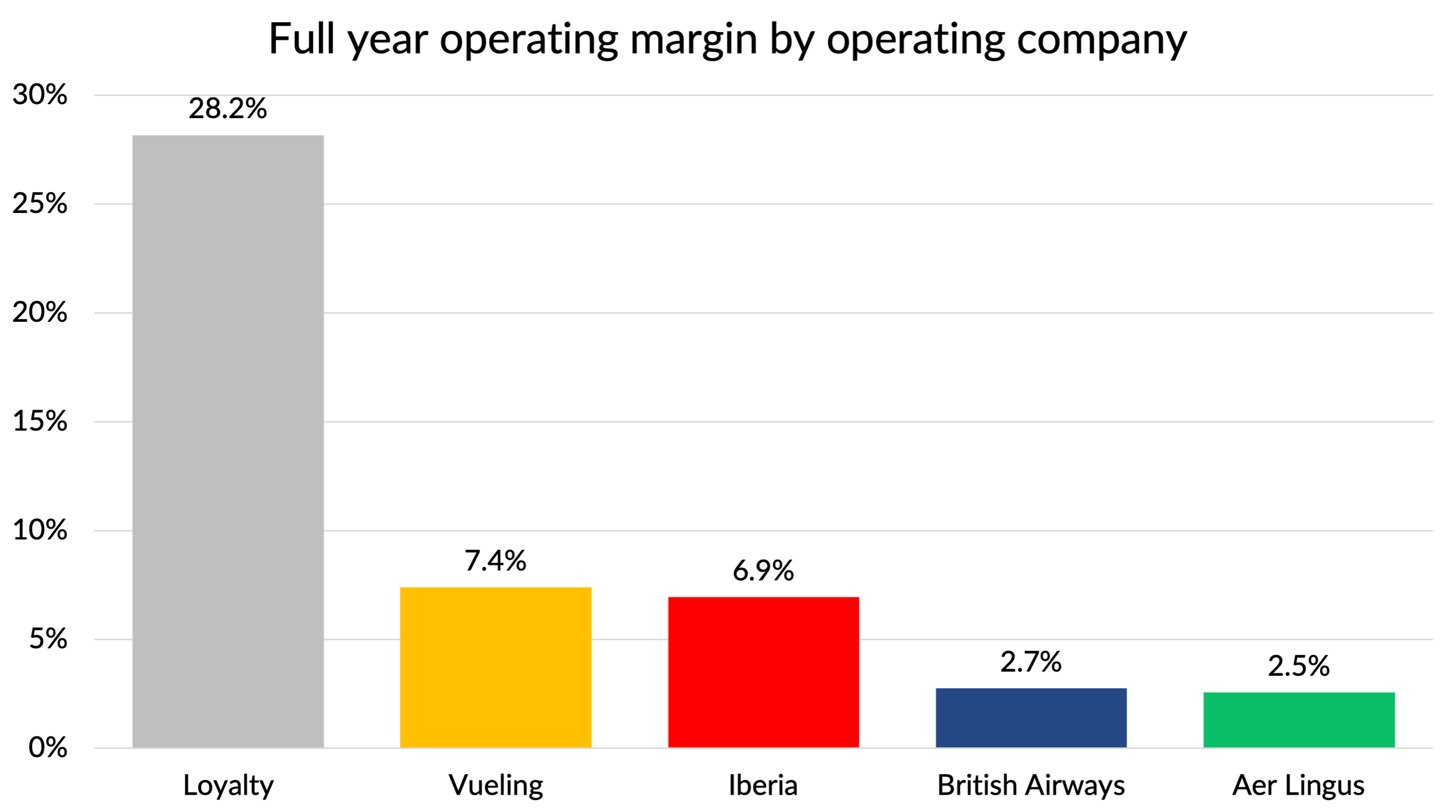

When it comes to assessing which airline within IAG is performing the best, it is a bit hard to compare the quarterly figures because of seasonality differences in the operations.

All the airlines were affected by Omicron related travel restrictions in Q1, but BA and Aer Lingus were probably the most impacted. Performance converged in Q2, whilst Vueling and Aer Lingus did the best in the summer peak, but with both airlines having a highly seasonal profile, they fell back in the fourth quarter.

Source: Company reports, GridPoint analysis

Judged on overall operating margin for the year as a whole, amongst the airlines the winner was Vueling, marginally ahead of Iberia.

But in fact the out and out winner in terms of margins was IAG’s Loyalty division, which operates Avios, the group’s loyalty currency. IAG disclosed its profits for the first time, rather than lumping it in with “other group revenues and costs”. When judging the performance of the airline brands, it would be fair to point out that British Airways is the core driver of the profitability of the Loyalty business.

IAG doesn’t split out the profits of its Cargo business - the figures are embedded in the profits of the airlines. If it did, the division might have challenged Loyalty for first position, given the continued strength of cargo yields in 2022.

Source: Company reports, GridPoint analysis

Final thoughts

There is a lot more that could be said on the comparative performance of Europe’s airlines in 2022, but I will hold off on that until all the European airlines have reported their results.

IAG is back into profits and performance is similar to other network carrier groups in Europe, but much of the profitability advantage it used to enjoy compared to its European peers seems to have gone missing during the pandemic. Brexit happened at the same time of course, and the toll that has taken on the UK economy and London’s position as a financial centre may also be partly responsible. IAG would probably also argue that they got less government assistance and that contributed to the relative erosion of its balance sheet strength.

Whether the company can get back on top may depend on whether the corporate travel market continues to recover, or “gets stuck” at current levels, and whether the UK can bounce back from its post Brexit difficulties. IAG is a comparatively small player in Cargo markets, so as that market normalises it will be relatively less affected. On the other hand, it has less to gain from a recovery in Asia. In addition to the Air Europa situation, there are a small number of other M&A moves in Europe left to play out. Which deals get done and how well they are executed will also influence the relative strength of the three network players going forward.

I don’t think I’ll be running out of things to write about in 2023.